![]() O3 Mining Inc. (TSX.V: OIII)

O3 Mining Inc. (TSX.V: OIII)

03 Mining announced its plan to execute a 250,000-metre drilling program during 2021 and 2022 at its Malartic and Alpha properties in Val-d’Or, Québec, Canada.

It is seeking to convert, expand and discover new gold resources.

| 03 Mining | TSX.V: OIII |

| Stage | Exploration |

| Metal | Gold |

| Market Cap | C$175 m @ $2.58 |

| Location | Quebec + Ontario |

O3 Mining To Drill 250,000 Metres At Marban and Alpha in 2021-2022

Toronto, March 2, 2021 – O3 Mining Inc. (TSX.V: OIII; OTCQX: OIIIF)(“O3 Mining” or the “Corporation”) is pleased to announce its plan to execute a 250,000-metre drilling program during 2021 and 2022 at its Malartic and Alpha properties in Val-d’Or, Québec, Canada as it seeks to convert, expand and discover new gold resources.

O3 Mining drilled 86,000 metres during 2019 and 2020 on its Malartic and Alpha properties to build on its mineral inventory in Québec of 3.9 million ounces of gold (total measured and indicated resource of 2.4 million ounces gold contained within 62.0 Mt @ 1.22 g/t Au and 1.5 million ounces gold contained within 20.2 Mt @ 2.27 g/t Au in the Inferred category).

The exploration success to date, as well as a recently completed CDN $35.0 million bought deal financing which brought its total cash and investments to CDN $145.9 million, gives O3 Mining the confidence to expand the drilling program as it executes its triple exploration strategy to convert, expand and discover resources through the second-largest drilling program in Québec behind its sister company Osisko Mining. The completion of the additional 250,000 metres will bring the total program to approximately 350,000 metres on the properties since it started drilling in September 2019.

The exploration budget for 2021-2022 is CDN $49.3 million with 125,000 metres budgeted for Malartic and 125,000 metres for Alpha. After the winter season ends in April, the Corporation will continue drilling year-round, with six drill rigs.

O3 Mining Strategy

Convert:

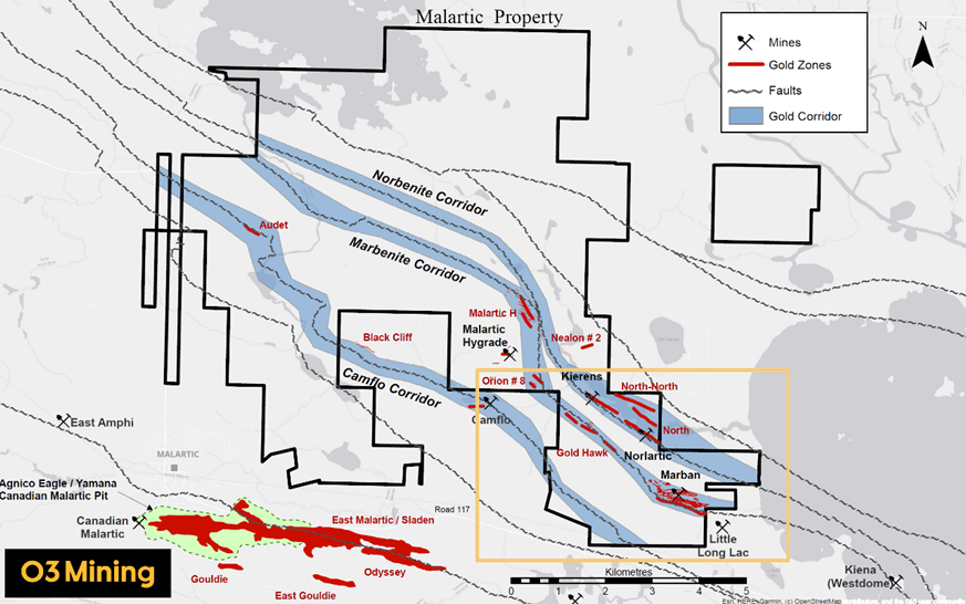

At the Marban project on the Malartic property, the Corporation is undertaking infill drilling to convert Inferred mineral resources to the Measured and Indicated categories as it moves towards completing a Pre-Feasibility Study, planned for 2022. Marban has aPreliminary Economic Assessment (“PEA”) announced on September 8, 2020 which outlined open-pit production of 115,000 ounces a year for 15 years.

Expand:

O3 Mining will continue with step-out drilling and testing new areas within 5 kilometres of the proposed plant site at Malartic with the aim of identifying new mineral resources that can be brought within the mine plan, a strategy the Corporation successfully executed in 2020 (see Press ReleasesNovember 24, 2020andNovember 3, 2020). The Marban PEA was based on a measured and indicated resource of 1.9 million ounces gold contained within 54.2 Mt @ 1.10 g/t Au and a total of 0.6 million ounces gold contained within 13.2 Mt @ 1.44 g/t Au in the Inferred category.

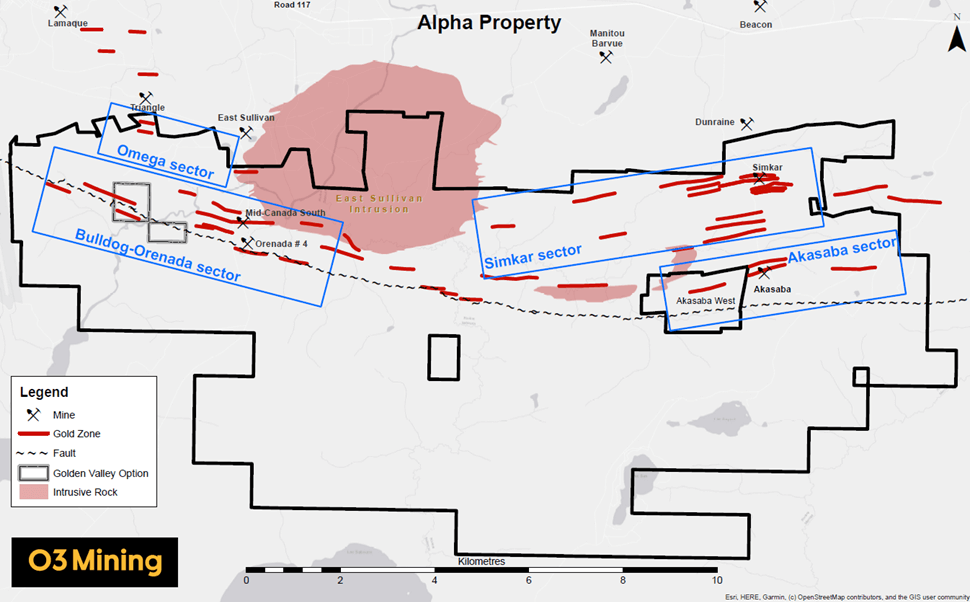

O3 Mining also aims to continue to expand the mineral resource footprint in the Orenada-Bulldog and Akasaba sectors at Alpha where it has an option on the nearby Aurbel mill. Alpha hosts 1.2 million ounces of gold (total Measured and Indicated resource of 500,000 ounces gold contained within 7.7 Mt @ 2.00 g/t Au and 700,000 ounces gold contained within 5.9 Mt @ 3.80 g/t Au in the Inferred category).

Discover:

O3 Mining aims to continue to discover new mineralized zones at the Simkar and Omega sectors at Alpha and to test targets generated by its exploration team and verified using artificial intelligence (“AI”) by Mira Geoscience Ltd. incorporating drilling and mapping databases, geochemical samples, Induced Polarization (IP), Electromagnetic (EM), magnetic and gravity datasets (see Press Release August 6, 2020, please click HERE).

03 Mining Management comments

“We see the market looking for large, economic gold deposits in mining-friendly jurisdictions and that is exactly what O3 Mining is in the process of delivering.

We have secured the financial resources to increase the planned scope of our 2021 and 2022 exploration programs to convert, expand and discover and keep building ounces around our two potential production sites in Val-d’Or.

2021 will be an exciting year for O3 Mining as this exploration program further advances the production potential of Malartic and Alpha,”

03 Mining President and CEO Jose Vizquerra

Highlights

Drilling at the Malartic property will test extensions of the ore deposits included in the September 2020 PEA (See press release September 8, 2020) to grow the mineral resource base, specifically focused on the Norlartic–Kierens, North-North, North Shear, Marban, and the Gold Hawk deposits.

Other drilling targets include Orion #8, Golden Bridge, MK, Malartic H, Marban NE, and Camflo deep, including extensions of historical mineralized zones within three kilometres of the PEA pit shells, which offer additional potential to increase resources within the Marban mining project area.

Drilling at Alpha will aim to expand the known deposits at Bulldog, Orenada, Simkar, and Akasaba, and the Corporation will proceed to a resource estimate when it feels there are enough resources to generate an economic production scenario. Drilling will follow-up on significant drill intercepts to prove-up the continuity of grades and widths to turn these into new deposits as well as make new discoveries within the Bulldog-Orenada, Akasaba, Simkar, and Omega sectors.

Figure 1: Alpha Property Map

Figure 2: Malartic Property Map

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About O3 Mining Inc.

O3 Mining Inc., an Osisko Group company, is a gold explorer and mine developer ready to produce from its highly prospective gold camps in Québec, Canada. O3 Mining benefits from the support, previous mine-building success, and expertise of the Osisko team as it grows towards being a gold producer with several multi-million ounce deposits in Québec.

O3 Mining is well-capitalized and owns a 100% interest in all its properties (137,000 hectares) in Québec. O3 Mining trades on the TSX Venture Exchange (TSX.V: OIII) and OTC Markets (OTCQX: OIIIF). The company is focused on delivering superior returns to its shareholders and long-term benefits to its stakeholders.

To read the full news release, with disclosures, please click HERE

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com for information.

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and information purposes only, and are not recommendations in any form. Always consult an investment professional.

=======