![]() Barkerville Gold Mines {TSX.V: BGM}

Barkerville Gold Mines {TSX.V: BGM}

Released positive results from the independent preliminary economic assessment (PEA) prepared in accordance with National Instrument 43-101 at its 100-per-cent-owned Cariboo gold project, located in the historic Wells-Barkerville mining camp, British Columbia.

.

.

.

Mr. Chris Lodder reports

BARKERVILLE GOLD MINES DELIVERS POSITIVE PEA FOR CARIBOO GOLD PROJECT

.

Barkerville Gold Mines Ltd. has released positive results from the independent preliminary economic assessment (PEA) prepared in accordance with National Instrument 43-101 at its 100-per-cent-owned Cariboo gold project, located in the historic Wells-Barkerville mining camp, British Columbia. The preliminary economic assessment provides a base case assessment of developing the project as an underground ramp access mine with a gold pre-concentration plant in Wells and gold processing in its existing upgraded Quesnel River mill. The preliminary economic assessment will be filed on SEDAR under the company’s profile within 45 days of the date of this news release.

,

PEA HIGHLIGHTS

IRR after taxes and mining duties 28.1%

NPV after taxes and mining duties $402.2-million

Preproduction construction costs (including $30-million contingency) $305.5-million

After-tax payback period (after start of operations) 3.1 years

Peak-year payable production 206,000 oz

Average LOM payable production 185,000 oz

Metallurgical gold recovery 92.1%

Average diluted gold grade 4.5 g/t Au

PEA life of mine (LOM) 11 years

Total mineralized material mined 14,683,000 tonnes

Contained gold in mined resource 2,133,000 oz

Payable gold LOM 1,966,000 oz

All-in sustaining costs net of byproduct credits and royalties over LOM $796 (U.S.)/oz

Estimated all-in cost (capex plus opex) $912 (U.S.)/oz

Total unit operating cost $105.13/tonne mined

Gross revenue $3.39-billion

Operating cash flow $1.54-billion

Mine construction commencement Mid-2021

NPV before taxes and mining duties $632.7-million

IRR before taxes and mining duties 34.9%

.

.

Chris Lodder, president and chief executive officer, commented: “Today’s PEA results for our Cariboo gold project provide a robust after-tax internal rate of return of 28 per cent and after-tax net present value of $402-million with a capex [capital expenditure] of $306-million, using only about 50 per cent of our present mineral resource estimate. This is a very strong start to a project that is growing as new resources are being delineated by our ongoing successful exploration at depth and on strike of the present resources and throughout the 2,000-square-kilometre prospective land package. The PEA envisions mining up to 4,000 tonne per day utilizing a long-hole mining approach, focused on extracting large panels with minimum widths of 3.7 metres and minimum height of 30 metres. A key outcome of our extensive mining and processing testwork is the ability to produce a high-quality concentrate averaging 20.5 gold g/t [grams per tonne] at the mine site and continued use of our upgraded Quesnel River mill for final processing. This, along with optimization of the mining method, allows us to include lower-grade resources in the mine plan. In summary, the PEA outlines a solid base case for significant and profitable gold production with low capital costs in an extensive brownfields district with superb production expansion potential. BGM’s vision of building a long-life, high-economic-margin, low-environmental-impact mine in one of Canada’s great historic mining camps is now entering the permitting and advanced engineering stage.”

,

The study was prepared by BBA Inc. under the supervision of Osisko Group’s project manager, Kim-Quyen Nguyen, PEng, MBA, and the Osisko Group technical team. The study included contributions from the geological and engineering teams at Allnorth Consultants Ltd., BBA, InnovExplo Inc., Golder Associates Ltd., Mining Plus Canada Consulting Ltd., SRK Consulting (Canada) Inc. and WSP Canada Inc.

This preliminary economic assessment foresees a project that would have a significant economic impact and minimal environmental impact for the Cariboo region of British Columbia, with the potential of generating over $3.39-billion of gross revenue and contributing approximately 320 permanent, well-remunerated jobs during the production phase, as well as an additional 120 during the construction phase.

.

PEA SUMMARY Total mineralized material mined (tonnes) 14,683,000 Average diluted gold grade (g/t Au) 4.52 Total gold contained (oz) 2,133,000 Total gold payable (oz) 1,966,000 Gold recovery (including payable) (%) 92.1 Average annual gold produced (gold oz per year) 185,000 Total initial capital cost ($M) 305.5 Sustaining capital ($M) 327.4 Closure cost ($M) 15.1 Unit operating cost (per tonne mined) Mining ($) 65.39 Processing (including paste backfill) ($) 18.88 Transportation ($) 5.60 Tailings, waste and water management ($) 4.18 General and administration ($) 11.07 Total unit operating costs (per tonne mined) ($) 105.13

.

.

Opportunities to enhance value

Cariboo has very high potential for mineral resource expansion, as the Shaft Cow, Valley and Mosquito deposits are open along strike and down dip, and new zones are still being discovered within the larger highly prospective land package. Much of the sustaining capital is related to underground development, but it also allows access to much of the remaining defined resource not used in the present preliminary economic assessment to allow cost-efficient resource delineation and conversion. Future mine modelling using more selective mining methods represents opportunity to capture additional resources potentially minable in mineralised zones, and metallurgical testwork is planned to optimize the processing.

,

Trade-off studies will also be performed to determine the best overall economic processing and water management methods. Geotechnical work, combined with an improved mining sequence/development schedule and trade-off studies on material handling, and mine infrastructures will further optimize the design of the project.

,

.

.

Preliminary economic assessment details

The independent preliminary economic assessment was prepared through the collaboration of the following firms: Allnorth Consultants (Vancouver, B.C.); BBA (Vancouver, B.C.); InnovExplo (Val d’Or, Que.); Golder Associates; Mining Plus Canada Consulting (Vancouver, B.C.); SRK Consulting (Vancouver, B.C.); and WSP Canada (Val d’Or, Que.). These firms provided mineral resource estimates, design parameters and cost estimates for mine operations, process facilities, major equipment selection, waste rock and tailings storage, reclamation, permitting, and operating and capital expenditures. The attached table summarizes the contributors and their areas of responsibility.

.

Resource estimate

The preliminary economic assessment is based on an indicated and inferred mineral resource estimate completed by independent qualified persons Christine Beausoleil (PGeo) and Carl Pelletier (PGeo) of InnovExplo for the Cariboo gold project. This estimate consists of an indicated resource and an inferred resource using a base cut-off of 3.0 grams per tonne gold.

,

CARIBOO GOLD PROJECT MINERAL RESOURCE ESTIMATE

Deposit Indicated Inferred

Tonnes (000s) Grade (g/t) Au (000s oz) Tonnes (000s) Grade (g/t) Au (000s oz)

Mosquito 542 7.1 124 690 6.5 144

Shaft 7,200 5.6 1,300 5,817 5.0 941

Valley 1,212 5.3 208 3,475 4.9 545

Cow 3,578 5.5 637 1,867 4.7 282

Total 12,532 5.6 2,269 11,849 5.0 1,912

/

Mineral resources that are not mineral reserves do not have demonstrated economic viability. For further details, mineral resource estimate notes and resource modelling notes, please see the NI 43-101-compliant resource report titled, “NI 43-101 Technical Report and Mineral Resource Estimate Update for the Cariboo Gold Project, British Columbia, Canada,” dated effective May 29, 2019, and filed on SEDAR on July 11, 2019, under the company profile.

,

Capital and operating cost summaries

CAPITAL COST SUMMARY

(in millions)

Capital costs Preproduction Sustaining Total

Mining 59.1 303.0 362.1

Infrastructure (including process plant, paste backfill

and tailings, waste and water management) 152.1 21.0 173.1

Indirect (including owner's costs) 64.4 - 64.4

Closure cost - 15.1 15.1

Contingency 30.0 3.4 33.4

Total capital costs 305.5 342.5 648.0

OPERATING COST SUMMARY Operating costs $/t mined Mining 65.39 Transportation 5.60 Processing (including paste backfill) 18.88 Tailings, waste and water management 4.18 General and administration 11.07 Total 105.13

COSTS PER OUNCE

(US$/oz)

Capex 249.90

Opex 661.90

All-in cost 911.80

.

.

Mining

The Cariboo gold project will consist of the extraction of four separate deposits: Cow, Valley, Shaft and Mosquito. The overall strategy is to simultaneously mine two or three deposits to achieve a total production rate of 4,000 tonnes per day.

,

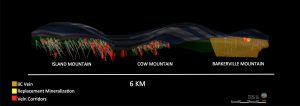

The Cariboo gold mine site is located near Wells, B.C., 83 kilometres east of Quesnel, B.C. The underground mine complex is located beneath Island Mountain, Cow Mountain and the valley between the two mountains. The mineral resources used in the mine plan are contained in four deposits (Shaft, Cow, Valley and Mosquito) over a length of 3.7 kilometres and span from surface down to a depth of approximately 640 metres. Each deposit is characterized by multiple vein corridors that trend east-northeast and dip vertically to subvertically (see May 29, 2019, press release for a more detailed description of vein corridors and the controls on gold mineralization). The mining method selected is long hole with longitudinal retreat on panels with sublevels every 30 metres and strike lengths between eight to 20 metres, depending on rock quality, and minimum thicknesses of 3.7 metres. Mineralized material will be extracted by ramp using a fleet of 10-tonne and 14-tonne load-haul dumps (LHDs) and 50-tonne haul trucks at a total mine production rate of 4,000 tonnes per day.

.

Mineralised material mined underground will feed an underground crushing facility, while the waste rock from development will mostly remain underground and be used as backfill, except for during pre-production, where the development waste rock will be transported to the waste rock storage facilities (WRSF) on a historic mine impacted site on Barkerville Mountain. Cemented and uncemented rock will both be used to backfill excavated stope voids to progress the mining sequence. Cemented paste backfill will be produced with tailings from the flotation circuit at surface and returned underground to be used in the backfill strategy to fill excavated stopes and old underground workings, where required. All tailings will be returned underground and no tails will be disposed on surface.

n

Processing

The mineralised material will be crushed underground, transported to surface by a vertical conveyor and stored in a silo at the surface concentrator. The first concentration step will be completed using mineral sorters. The surface silo will feed a screen where coarser particles (greater than 12 millimetres) will be separated, washed and fed to the mineral sorters. Mineral sorter product (sulphide-bearing and gold-bearing material) will be further crushed using a secondary cone crusher, for which the secondary crusher product will feed either the milling and flotation circuit for further concentration or the final mineralised material silo for transport to the QR mill. Mineral sorter waste will be sent to a waste silo for placement in the waste rock storage facilities.

A proportion (limited by the Wells mill design throughput) of the mineral sorter concentrate, as well as particles finer than 12 mm passing through the screens, will feed the flotation concentration circuit. The mineralised material will feed a ball mill closed by a cyclone cluster, where the ball mill product will feed a pyrite flotation circuit. The mineralised material will be further separated into a pyrite flotation concentrate and flotation tailings. Both the flotation concentrate and the flotation tailings will be thickened and filtered. The flotation concentrate will then be combined with a proportion of the mineral sorter product in the final mineralised material bin and stored for transport to the existing QR mill, while the flotation tailings will be used for producing paste backfill.

At the QR mill, processing will consist of grinding to a P80 of 45 microns, including a gravity circuit and a carbon-in-pulp (CIP) circuit, followed by cyanide destruction, thickening, filtration and tailings disposal. An adsorption-desorption-recovery (ADR) circuit and gold room recover the gold and produce dore bars. The plant includes a reagent preparation area and process water circuit to service the entire plant. The overall payable gold recovery is estimated to average 92.1 per cent over the life of mine.

The pre-concentration plant at the mine site would also include a wet laboratory, mill, mine and maintenance shop. There is an existing laboratory at the QR mill site.

,

Surface infrastructure and construction indirect

The Cariboo gold project comprises one mine site, one WRSF site and one plant site, including filtered tailings stack. Crushed mineralised material from underground will be conveyed to the surface pre=concentration plant at the mine site. The concentrated material will be transported by trucks to the QR mill site for processing (plant site). A proportion of the waste rock generated by the mine development will be stored at the mine site WRSF.

m

The Cariboo gold project mine site is located 50 kilometres northeast, or 115 kilometres by road, of the QR mill site; the Bonanza Ledge site is located five kilometres from the mine site.

m

The Cariboo gold project envisions construction of the following key infrastructure: Cariboo gold mine; pre-concentration plant at the mine site; onsite control gate and parking area; overhead transmission line from BC Hydro’s Barlow substation near Quesnel to the mine site; 69 kVA (kilovolt-ampere) mine site substation fed from the BC Hydro grid; pre-concentration plant; maintenance shop; mine warehouses; Willow River bridge; fire water pump station; mine onsite roads; waste water treatment at mine site; WRSF at mine and Bonanza Ledge sites; mine camp complex (comprising the mine dry, offices, cafeteria, fitness room and dormitory); mine and QR mill sites; water treatment plants at mine and QR mill sites; QR mill filtered tailings stack; and associated water management infrastructure.

.

Indirect costs, including owner’s costs, engineering, procurement and construction management, temporary facilities for construction and other related items are estimated at $64.4-million. An additional $30.0-million have been budgeted as contingency.

n

Environment and reclamation

The Cariboo gold project is subject to both the provincial and federal environmental assessment (EA) processes. The project facilities are within the jurisdictions of the Cariboo regional district and the district of Wells. These jurisdictions have existing bylaws that may pertain to project activities/operations and property ownership or business operations.

j

Environmental baseline data collection has been initiated for the mine site areas. All the collected baseline data will inform the environmental impact assessment study, which is currently under way. The environmental baseline studies will also support the continuing permitting process and the future permit applications, once the environmental impact assessment study has been approved and the EA certificates have been received.

n

In addition to provincial and federal EA approvals, the project will require several permits, approvals and authorizations prior to start-up and throughout all stages of the project. Application for these permits, approvals and authorizations will be initiated following the receipt of the EA certificates. The project must also comply with any other terms and conditions associated with the EA certificates.

,

A reclamation and closure plan for the mine and QR mill sites has been developed, in accordance with the Mining Act of British Columbia. Sites reclamation costs were estimated at $15.1-million. The sites reclamation cost estimate for the Cariboo gold project is based on returning the sites to a satisfactory state that mainly includes: eliminating all unacceptable risks to human health and safety; dismantling of the buildings and infrastructure associated with the mine and mining activities; a pre-concentration and processing plant; the reclamation of the filtered tailings stack; and WRSFs. This cost estimate includes the cost of site reclamation as well as post-closure monitoring. In accordance with the regulations, the corporation intends to post a bond as a guarantee for the site closure cost.

,

Indigenous and stakeholder engagement

Barkerville Gold Mines has taken a pro-active and transparent approach with indigenous and stakeholder engagement, sharing project information, seeking input and involving communities and individuals in the project on a continuing basis since 2015.

Consultation on the project with indigenous and non-indigenous communities was initiated in 2015 and has continued with frequent engagement and information sharing on project activities, employment and contracting opportunities through meetings and open-house presentations.

,,

Concerns raised by communities include: land disturbance; water quality; impacts to wildlife; and the cumulative effects of all projects in the area. Barkerville Gold Mines is committed to continuing dialogue with potentially affected communities through the environmental assessment process.

.

Both the indigenous and non-indigenous communities have expressed strong support for the project. Their interest in the project is to maximise the economic benefits for local communities — specifically with a focus on employment and entrepreneurial opportunities throughout the phases of the project.

.

Royalties

A 4-per-cent net smelter return royalty on all metals produced from the Cariboo gold project has been applied.

m

Independent qualified persons

This preliminary economic assessment was prepared for Barkerville Gold Mines by BBA and other industry consultants, all qualified persons under NI 43-101. The qualified persons have reviewed and approved the content of this press release. The independent qualified persons that contributed to the preliminary economic assessment include:

- Grant Morgan (Allnorth Consultants);

- Colin Hardie and Alain Dorval (BBA);

- Evan Jones, Mike Tremblay and Michael Bratty (Golder Associates);

- Christine Beausoleil and Carl Pelletier (InnovExplo);

- Zach Allwright (Mining Plus Canada Consulting);

- Tim Coleman (SRK);

- Mathieu Belisle and Andreanne Hamel (WSP).

.

About Barkerville Gold Mines Ltd.

Barkerville Gold Mines is focused on developing its extensive mineral rights package, located in the historical Cariboo mining district of central British Columbia. Barkerville Gold Mines’ Cariboo gold project mineral tenures cover 1,950 square kilometres, along a strike length of 67 kilometres, which includes several past-producing placer and hard rock mines, making it one of the most well-endowed land packages in British Columbia. Since the management change in mid-2015, the company has unlocked the fundamental structural controls of gold mineralisation.

We seek Safe Harbor.