Uranium Energy Corp. (NYSE: UEC)

Has been featured in a recommendation by Sprott Research.

Sprott say UEC is “supplanting Cameco as the go to Uranium stock”.

.

.

.

.

.

.

| NYSE: UEC |

| Production + development |

| Uranium |

| US $1.16 Billion @ $3.17 |

| Texas, Wyoming, USA, Paraguay |

.

.

.

Comment

Please note, the following is a Sprott Research recommendation for information purposes only.

The opinions expressed are theirs, and not of this website, we are merely reporting their comments and recommendation.

.

The research note follows:

Uranium Energy Corp (UEC US) Initiation: Supplanting Cameco as the go-to uranium stock

Initiation: Supplanting Cameco as the go-to uranium stock

RECOMMENDATION: BUY PRICE TARGET: US$7.00/share RISK RATING: HIGH

.

North America’s largest pure play uranium inventory

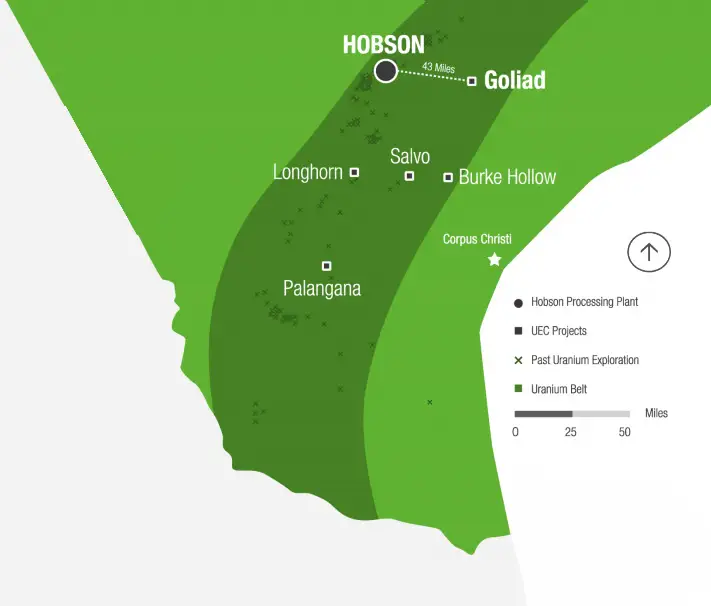

Since the mid-2000s, Uranium Energy Corp (UEC) has been one of the leading uranium developers and producers, initially focused on its Texas ISR assets.

Recent years have seen transformational M&A which has seen UEC diversify to Wyoming and Saskatchewan, with a ~266Mlb resource base (excluding its minority stakes in Canadian assets) that includes fully permitted US ISR assets in WY and TX capable of producing up to 6.5Mlbs, and a >3,000km^2 land position and 146Mlb resource base in the world class Athabasca basin.

.

Targeting Cameco’s vacated role as the go-to uranium pure play

With long time bell weather Cameco now diversified into downstream services, we think UEC is well poised to replace Cameco as the go-to uranium pure play for large institutions. Key attractions include its US listing, diversification with US ISR and high grade Athabasca projects, permitted assets in safe jurisdictions, physical uranium on balance sheet, and >US$45m per day trading liquidity. While some investors may prefer either permitted production or big, high grade Athabasca projects, UEC’s has the broadest appeal, which results in sector leading liquidity, making it an institutional hub for uranium investors.

.

US domestic production potential with permitted TX and WY assets

UEC has the best domestic US ISR portfolio in our view, with permitted assets in Wyoming (89Mlbs) and Texas (19Mlbs), and hard rock assets in NM and AZ. Both the WY and TX hub and spoke projects have existing processing plants, permitted wellfields and operating permits for a combined 6.5Mlbs per year (~14-16% of US domestic demand). With US$93m of cash and liquid assets (incl 0.8Mlbs of U[3]O[8]), UEC is permitted and well-funded with a further 3.1Mlbs at US$42/lb of committed purchases to add to its exposure.

.

Athabasca portfolio brings UEC’s aggressive approach to the basin

In addition to permitted domestic US assets, UEC has one of the largest portfolios in Saskatchewan’s Athabasca basin, home the world’s largest and highest grade uranium deposits. This includes the Roughrider project (historic 58Mlbs at 4.7% U[3]O[8]), which Rio Tinto acquired for US$640m in 2011 (beating out Cameco), 49% of the 95Mlb at 1.3% U[3]O[8 ]Shea Creek project, and a 15% share of Cameco’s 105Mlb at 2.6% U[3]O[8] Millennium project. In addition, UEC has >3,000km^2 of exploration holdings in prolific exploration areas. We think UEC can bring greater value out of these assets with its strong balance sheet and aggressive approach.

.

Initiate with Buy rating and US$7.00/sh 1.2xNAV[7% ]price target

We value UEC using a combination of SOTP DCF and EV/in-situ valuation. We value the Texas and Wyoming ISR assets using NPV[7%-60/lb], and the other assets at US$2.0-6.0/lb. Adding in cash and liquid assets, we generate a US$2,280m NAV and US$5.74/sh FD/FF NAVPS estimate to which we apply a 1.2x NAV multiple for US premium, liquidity premium, and management.

Sprott Capital Partners produces this publication and it does not constitute a research report. This commentary is for information purposes only and does not contain investment advice. Sprott makes no representations or warranties with respect to the accuracy, correctness or completeness of such information and they should not be relied upon as such. Please refer to the attached report for addition disclosures and disclaimers.

Sprott

RESEARCH DEPARTMENT

Sprott Capital Partners LP

Royal Bank Plaza, South Tower

200 Bay Street, Suite 2600

Toronto ON, M5J 2J1

Please note that the statements and opinions contained in this third-party report are being provided for informational purposes only and are not adopted by UEC.

.

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in the companies mentioned.

.

.