Ascot Resources Ltd. (TSX: AOT)

Provided an update on the Premier Gold Project located in the Golden Triangle of northwestern British Columbia with respect to progress to date and development plans in 2022.

The company also highlighted a funding shortfall which will have to be addressed in order to complete mine construction.

.

| Ascot Resources |

TSX : AOT |

| Stage |

Development |

| Metals |

Gold |

| Market cap |

C$394 m @ $1.05 |

| Location |

Golden Triangle, British Columbia |

.

.

Ascot Gold Premier Mine mill

/

Ascot Provides Update on Premier Gold Project Progress to Date and Plans for 2022

.

Vancouver, B.C. January 25, 2022 — Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) provides an update on the Premier Gold Project (“PGP” or the “project”) located in the Golden Triangle of northwestern British Columbia with respect to progress to date and development plans in 2022.

This release includes a detailed project schedule and an updated capital cost estimate for the project. Building on the success of the Early Works program in 2021, Ascot remains on track to commence full-scale construction activities and underground development in April 2022, with first gold pour targeted for the first quarter of 2023.

The Company is also pleased to announce the receipt of the Environmental Management Act Permit, completing the JPAA (Joint Permit Application Amendment) for the project.

All financial metrics herein are in Canadian dollars, denoted as C$, unless otherwise stated.

.

Ascot Gold management comments

“The Company made considerable progress on pre-construction and Early Works activities in 2021 and is now pleased to have received the final operating permit for the Premier Gold Project.

“Despite facing various challenges last year, including the loss of key equipment at sea due to weather events, the Ascot team stepped up in meaningful ways and adapted to stay the course towards production, positioning us to execute on the project in 2022.

“We are excited to get the Premier mill restarted with first gold pour anticipated around this time next year.

“The Golden Triangle of northwestern B.C. has been a focal point for Canadian mining mergers and acquisitions in recent years, and Ascot has one of only three mills in the entire region.

“Notwithstanding project delays and cost pressures, we are confident in our ability to execute on the remainder of project construction during 2022, on the path to becoming Canada’s next gold producer.”

Derek White, President and CEO of Ascot Resources

Project Progress to Date

Before the Mines Act Permit issuance in December (see News Release dated December 7, 2021), Ascot was able to advance many project pre-construction activities as a part of the Early Works program. The focus of the program was preparing for the delivery of the Ball and SAG mills and their subsequent installation inside the mill building (see Figure 1). This was a major success for the project and was on time and on budget, such that the construction activities inside the process plant are not currently on the critical path schedule. Other major areas of Early Works progress included initial earthworks activities for the new water treatment plant, the Cascade Creek diversion channel, and the Dago Pit liner for temporary waste and water collection. The temporary construction camp with total capacity of approximately 170 people was also installed adjacent to the mill building.

Figure 1 – Interior of mill building showing SAG (left) and Ball (right) mills installed

Concurrent with project activities on site, detailed engineering has been advanced to 70% complete. Designs for these areas are substantially complete: Site roads, power supply, water treatment plant, tailings facility, Cascade Creek diversion channel, and several areas inside the mill. Remaining areas to be engineered are the process plant piping, electrical, and instrumentation. We anticipate substantial completion of detailed engineering by approximately April 2022.

Project procurement has progressed well so far despite numerous challenges in global shipping and transportation. While there are increasing pressures related to supply chain and inflation across the entire mining industry, the project is not wholly exposed to these risks given the existing infrastructure and the procurement completed to date. The Ball and SAG mills were ordered in 2020, arrived on site in 2021 and were installed. Ascot has ordered approximately 87% of the remaining fixed equipment for the project.

Key orders remaining in the plant relate mostly to piping, instrumentation, and bulk consumables. Outside of the plant construction, the major pieces of equipment yet to be received are the replacement water treatment plant clarifier and tailings thickener (see News Release dated December 7, 2021). Upon learning of the loss of those items, Ascot quickly arranged the re-fabrication orders for these items. The fabrication of the clarifier and thickener are progressing well and Ascot anticipates completion by the end of February 2022, followed by delivery scheduled in April 2022.

Ascot is in the final stages of selecting a supplier for our underground equipment fleet, which we currently anticipate requiring on site in three tranches: the first in September 2022, a second in January 2023, and the remainder in August 2023 as the mining area expands. This is in addition to and after the mobilization of the underground development mining contractor in April 2022.

Ascot estimates construction of the Premier Gold Project is approximately 23% complete as of year-end 2021. Major areas of focus for the project in 2022 will be the underground development and early access to initial mining areas, the delivery and installation of the new water treatment plant, the completion of the Cascade Creek diversion channel, the tailings facility earthworks, and the completion of the process plant circuit. These activities all lead towards starting mill commissioning later in 2022 ahead of initial gold pour anticipated in Q1 2023.

As anticipated in Ascot’s News Release dated December 7, 2021, the B.C. Ministry of Environment and Climate Change Strategy has issued to Ascot the Environmental Management Act Permit PE-8044. This permit amendment is primarily related to water discharge requirements during the production phase at PGP and solidifies Ascot’s fully-permitted status. The receipt of this permit is another key condition to draw down the remaining US$75M under the Company’s project finance facility with Sprott Private Resource Lending Corp. and Beedie Capital.

.

Project Schedule

As previously announced (see News Release dated December 7, 2021), most outdoor construction activities have been paused for the winter and underground development has been delayed until approximately April 2022. An overview of the project schedule is shown in Figure 2. During Q1 2022, work will be progressed inside the mill building, and detailed engineering and the remaining procurement will be concurrently advanced.

.

Figure 2 – Overview schedule of activities for PGP

Ascot is planning to ramp-up full-scale construction activities in April 2022. Critical work areas include the construction and installation of the new water treatment plant, the excavation of the Cascade Creek diversion channel, the tailings facility earthworks, process plant piping and instrumentation, and initial underground mining development.

The replacement clarifier and thickener are scheduled to be delivered to site in April 2022, which includes approximately one month of contingency for shipment to account for ongoing global supply chain pressures. Installation of the new water treatment plant, the foundation for which has already been excavated, is anticipated to be complete by November 2022, allowing the commencement of process plant commissioning.

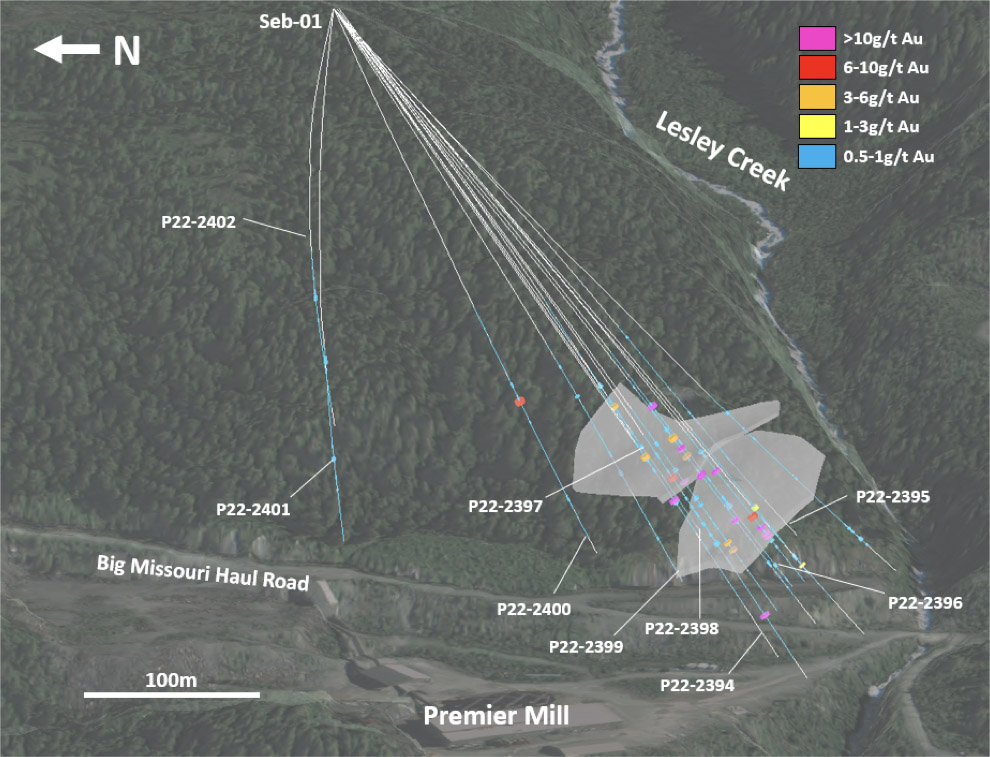

Concurrently, underground development is scheduled to begin in late April 2022 starting from the S1 Portal at the Big Missouri deposit. Initial development and stoping ore is anticipated to be accessed by October 2022, which will enable process plant commissioning to begin by year-end 2022, followed by the first gold pour early in 2023. In order to hedge against mining and grade variability, three initial Big Missouri stoping areas are planned to be accessed in 2022, concurrent with primary development towards the Silver Coin deposit.

.

Capital Forecast

In March of 2021, before starting pre-construction activities including Early Works, Ascot announced an updated project capital cost estimate of C$176M (see News Release dated March 18, 2021). Now with the Mines Act Permit in hand and a more definitive project schedule, Ascot is reporting an updated project capital estimate of C$224M, reflecting an increase of 27% over the March 2021 figure.

At a high level, the factors that have caused cost increases to the project, in order of influence, are: fixed indirect costs caused by schedule delays, weather impacts, piping and instrumentation labour productivity, indirect cost inflation, supply chain pressures, and COVID-19 protocols.

- Process Plant +C$8M: Lower labour productivity has been used for the piping and instrumentation activities going forward. Cost for systems and instrumentation for electrical equipment in the mill have increased due to supply chain pressures and inflation.

.

As at year-end 2021, Ascot had incurred a total of C$60M on the project. Based on the updated capital cost estimate, there remains C$164M left to spend on the project, including a C$15M contingency, representing a buffer of 11.3% on the project costs going forward less mining costs.

Varying levels of contingency were assigned to different project areas based on risk assessment. Of the remaining C$164M in costs yet to be spent, approximately C$103M has been committed under purchase orders as of year-end 2021.

Ascot has a higher degree of confidence in the updated capital estimate as it is based on real-world costing through the Early Works program, and because the Company has now ordered most of the remaining key equipment and materials to complete the project. The only remaining items that have yet to be ordered are process plant piping, control systems, and limited amounts of steel works – all of which have been assigned higher levels of contingency.

Ascot ended 2021 with a cash balance of approximately C$59M (unaudited), and there remains US$75M (~C$94M) undrawn on the project finance facility, bringing total available liquidity to approximately C$153M. This is less than C$164M left to spend, which does not include various corporate costs including but not limited to exploration drilling, corporate G&A, working capital and minimum cash balance requirements, security deposits, and permit maintenance costs.

As a result, Ascot will be pursuing additional funding options in the near future to address capital requirements arising from the aforementioned project delays.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Ascot Resources, bought in the market at the prevailing price on the day of purchase.

.

.