Mining Review 16th June 2024

Mining Review 16th June 2024

A mildly positive week for gold and precious metals as the long running saga of when will the US cut rates this year continues, with an immediate cut looking out of the question currently.

New from our watchlist was dominated by G Mining Ventures and West Red Lake Gold Mines, with two news items each, but others stole the show.

.

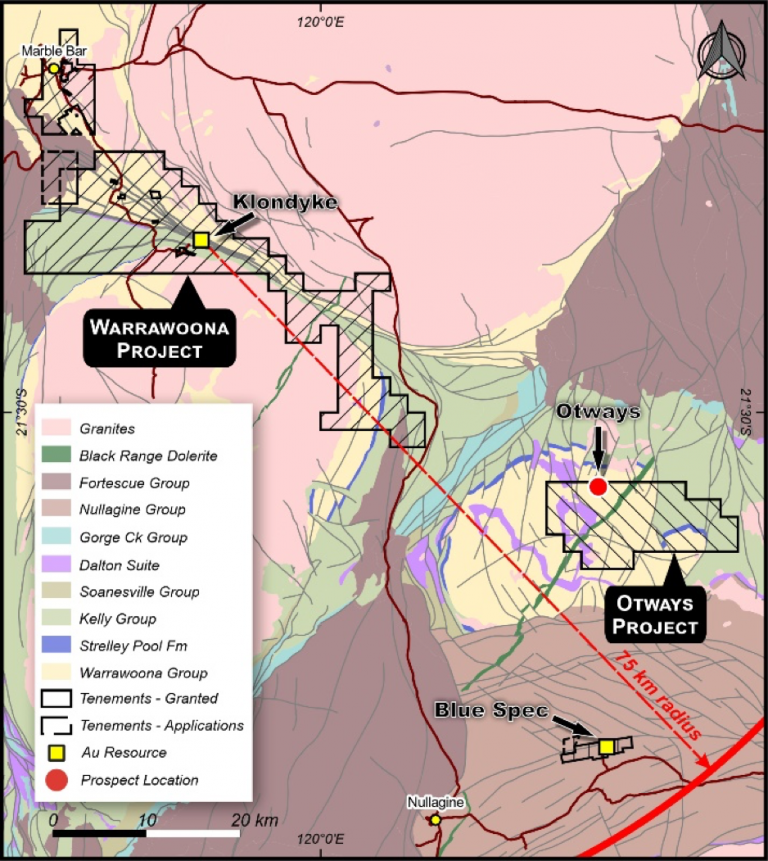

Calidus’ Nullagine gold project, Pilbara, WA.

.

City Investors Circle Mining Review 16th June 2024

A mildly positive week for gold and precious metals as the long running saga of when will the US cut rates this year continues, with an immediate cut looking out of the question currently.

New from our watchlist was dominated by G Mining Ventures and West Red Lake Gold Mines, with two news items a piece, but others stole the show.

—

The first was American Creek Resources, who received a non binding Letter Of Intent from privateley owned Cunningham Mining that it, or one of its Subsidiaries, would acquire all the shares in American Creek, subject to due dilligence .

The consideration offered is 43 cents per share, a 274% premium to the share price on the day of announcement, and seems very generous, given premiums in other recent mining deals.

We have to remember though that AMK’s share of the Treaty Creek project is 20% of around 27 million ounces of gold currently, so quite a large resource, in a rising gold market, in a tier one jurisdiction.

The puzzling aspect to this is the market reaction, with a near doubling of the price on the day, but still to only around half of the bid price, and then a slow drift back afterwards, to around the 18 cent mark, which is nowhere near the offer price.

I am surprised that people aren’t buying this up to at least the mid 30 cent range for what seems like an easy win. I guess the reason will become apparent in the fulllness of time.

—

G Mining Ventures commenced processing at their TZ project in Brazil, which pepped the share price a bit. The project remains on track and if commissioning goes well I expact a positive reaction share price wise, especially if the price if gold holds at the current levels.

—

To read the full stories from our watchlist companies this week, please click the links below.

Calidus Resources Announced a Maiden Resource for Nullagine Restart

West Red Lake Gold Mines Poured a Gold Bar From Madsen Mill Cleanup

G Mining Ventures Directors Recommend a Vote FOR the Arrangement

G Mining Ventures Commenced Processing Ore at Tocantinzinho

West Red Lake Gold Mines Intersected 16.69 g/t Au over 8m

American Creek Resources Non-Binding LOI and Exclusivity With Cunningham

Click here to view all historical archive reports

—

Market Data

Weekly Price changes

(US$ unless stated)

.

| Metal Prices | Price | Weekly % Change |

| Gold price in UK £ | 1843 | 2.05% |

| Gold | 2334 | 1.74% |

| Silver | 29.6 | 1.40% |

| Palladium | 895 | -2.51% |

| Platinum | 970 | -0.31% |

| Rhodium | 4560 | -2.98% |

| Copper | 4.41 | -2.00% |

| Nickel | 7.95 | -3.28% |

| Zinc | 1.27 | -1.55% |

| Tin | 15.03 | 3.94% |

| Cobalt | 12.06 | -0.08% |

| Manganese | 5.55 | 1.65% |

| Lithium | 13162 | -3.19% |

| Uranium | 86 | -1.38% |

| Iron Ore | 106.7 | -1.93% |

| Coking Coal | 326 | 0.00% |

| Thermal coal | 136 | 1.12% |

| Metal ETFs | Price | Weekly % Change |

| GLD | 215.73 | 1.95% |

| GDX | 33.41 | -0.39% |

| GDXJ | 41.85 | -0.26% |

| Sil | 31.58 | -0.41% |

| SILJ | 11.39 | -0.87% |

| GOEX (PCX) | 27.52 | -0.65% |

| URA | 29.56 | -1.34% |

| COPX | 44.32 | -2.51% |

| HUI | 262.06 | -0.40% |

| Gold / Silver ratio | 78.85 | 0.33% |

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.