Stocks to Watch in 2026 – Colonial Coal

Stocks to Watch in 2026 – Colonial Coal

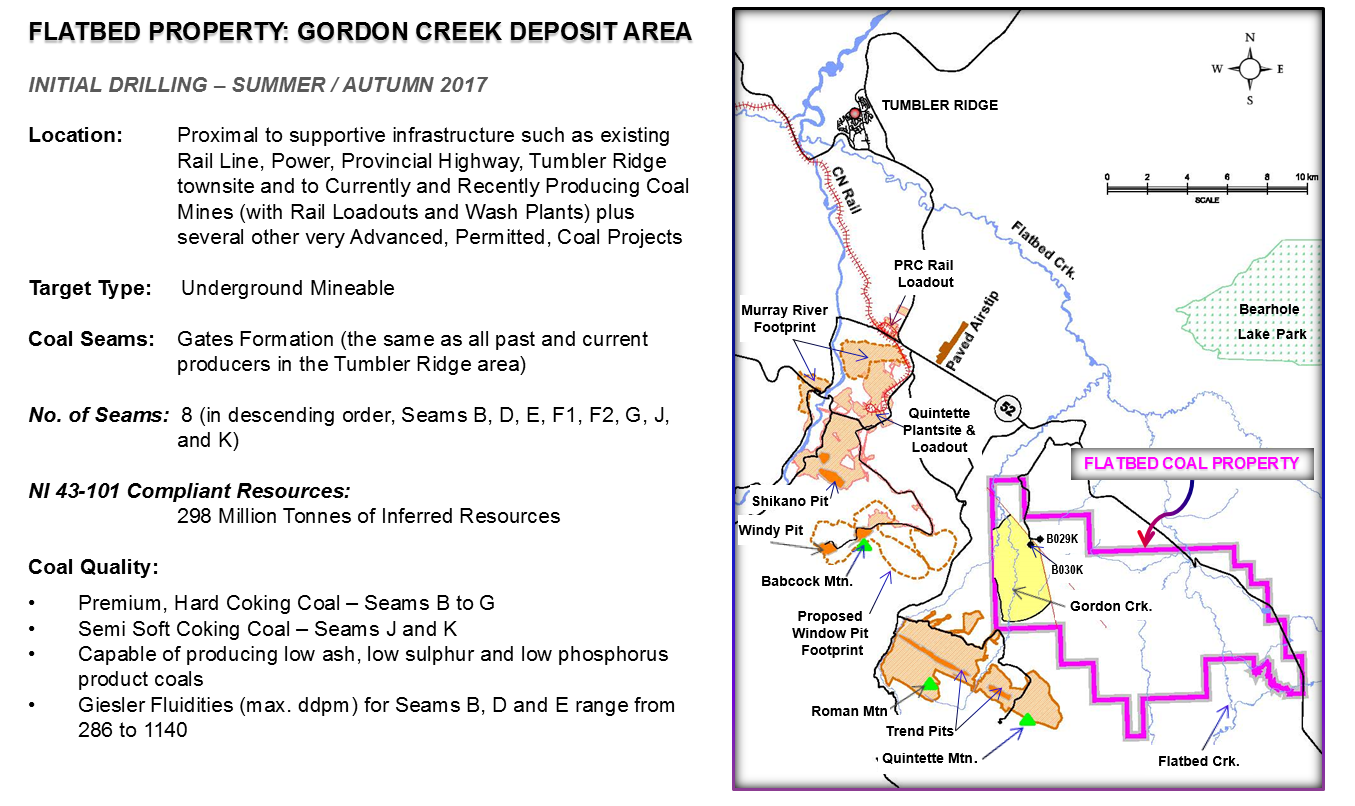

Colonial is a coal exploration and development company based in the prolific Peace River area of British Columbia.

The company has a large metallurgical (steelmaking) coal asset surrounded by larger players. The company are looking to complete a corporate transaction in the near future.

.

.

| Colonial Coal | TSX.v : CAD | |

| Stage | Exploration | |

| Metals | Metallurgical coal | |

| Market cap | C$443 m @ C$2.43 | |

| Location | British Columbia, Canada | |

| Website | www.ccoal.ca |

,

City Investors Circle – Stocks to Watch in 2026 – Colonial Coal

Colonial is a coal exploration and development company based in the prolific Peace River area of British Columbia.

The company has a large metallurgical (steelmaking) coal asset surrounded by larger players. The company is looking to complete a corporate transaction in the near future.

Highlights

The company focuses on acquiring, exploring, and advancing high-quality metallurgical coal projects in Canada.

There is no current production as the company focus on its strengths, exploration and development, and has a pipeline aimed at supplying premium steelmaking coal, particularly for Asian markets.

There is a direct rail link from a line nearby direct to a port where the coal can be shipped to Asian markets in a shorter route than from Australia or southern Canadian ports, saving both time and money.

.

Next steps

The company recently announced a news release stating that it is in discussion with various entities about a potential corporate action, see here.

One can only hope that with the coking coal price moving upwards slowly, that the near future will see a corporate action that enhances shareholder value.

CEO David Austin has overseen two major coal deals before , both in British Columbia, so has the experience required to negotiate to create shareholder value.

.

Conclusion

Colonial is a company looking to either sell one or both of its assets, or potentially become part of a greater entity, all options are currently open.

Given the success David Austin has delivered previously, there’s certainly a reason for cautious optimism amongst shareholders, of which I’m one.

.

——-

To view Colonial Coal’s latest share price and chart, please click HERE

.

Live metal prices can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Colonial Coal.

.