Wesdome Gold Mines Ltd. (TSX: WDO)

Wesdome Gold Mines Ltd. (TSX: WDO)

Announced Q3 2020 financial results.

Mr. Duncan Middlemiss, President and CEO commented, “During Q3, Wesdome generated operating cash flow of C$25.5 million or C$0.18 per share and free cash flow of C$3.2 million, (net of an investment of $13.9 million in Kiena), or C$0.02 per share, ending the quarter with a cash position of C$73.5 million.

.

.

.

.

Wesdome Q3 results in accordance with guidance

.

.

TORONTO, Nov. 03, 2020 – Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces third quarter (“Q3 2020”) financial results.

(All figures are stated in Canadian dollars unless otherwise noted.)

.

Mr. Duncan Middlemiss, President and CEO commented, “During Q3, Wesdome generated operating cash flow of $25.5 million or $0.18 per share and free cash flow of $3.2 million, (net of an investment of $13.9 million in Kiena), or $0.02 per share, ending the quarter with a cash position of $73.5 million (Q2 2020: $66.7 million).

Cash costs for the quarter were C$1,052 per ounce (US: $790) and All-in sustaining costs were $1,395 per ounce (US $1,047). Both of these unit costs are currently above the high end of our full year guidance, however we believe the AISC will decrease to the upper end of full year guidance ($1350/ounce). Free cash flow was impacted by investments in the tailings, hoist and ventilation upgrades at Eagle River.

A total of $2.8 million was spent on these projects during the quarter in order to advance future underground production to over 600 tonnes per day. In particular the hoist upgrade was longer in duration than originally planned thereby causing significant hoisting delays within the quarter.

The upgraded hoist has since been successfully commissioned and is performing well. The ventilation upgrade construction work will continue into Q4 with the installation of a second fresh air fan on surface that will provide additional haulage capacity underground. The fan will be commissioned early in Q1 2021. During Q3 the company was able to significantly invest in Eagle upgrades and the advancement of Kiena, compared to Q2 which was much more affected by the pandemic.

With YTD 2020 total gold production of 70,272 ounces at an average grade of 15.1 grams per tonne (“g/t Au”) at the Eagle River Underground Mine, the Company is well-positioned to achieve its full year guidance range of 90,000 – 100,000 ounces at an average grade of 15 – 16.7 g/t Au.

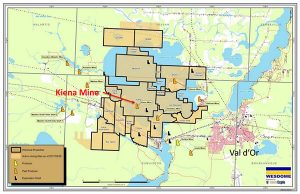

At Kiena, full drilling and development capacity resumed in June. We are now currently operating seven underground drills, with the focus on converting inferred resources to the indicated category. We expect to publish an updated resource estimate in Q4 2020. We are also advancing development on the 111 metre level in order to position the Company to take a bulk sample. Future bulk sampling on the A Zone will provide an opportunity to assess the geological block model and rock quality characteristics and will provide additional information to complete the ongoing Prefeasibility Study (“PFS”), expected to be completed by H1 2021.”

.

Key operating and financial highlights of the Q3 2020 results include:

- Gold production of 20,008 ounces from the Eagle River Complex, a 30.8% decrease over the same period in the previous year (Q3 2019: 28,910 ounces) due to lower grades and the impact of COVID-19:

- Eagle River Underground 44,667 tonnes at a head grade of 13.8 g/t Au for 19,319 ounces produced, 33.1% decrease over the previous year (Q3 2019: 28,894 ounces).

- Mishi Open Pit 11,533 tonnes at a head grade of 2.5 g/t Au for 689 ounces produced (Q3 2019: 15 ounces).

- Revenue of $55.0 million, a 19.7% increase over Q3 2019 (Q3 2019: $45.9 million).

- Ounces sold 21,700 at an average sales price of $2,532/oz (Q3 2019: 23,450 ounces at an average price of $1,957/oz).

- Earned mine profit1 of $32.1 million, a 20.0% increase over Q3 2019 (Q3 2019 – $26.8 million).

- Cash costs 1 of $1,052 (US$790) per ounce of gold sold (Q3 2019 of $815 (US$618) due to less ounces sold and the impact of COVID-19.

- All-in sustaining costs (“AISC”) 1 of $1,395/oz or US$1,047/oz, a 3.8% increase over the same period in 2019 (Q3 2019: $1,344/oz or US$1,018/oz), due to lower ounces sold; partially offset by lower sustaining capital expenditures.

- Operating cash flow of $25.5 million or $0.18 per share1 as compared to $27.3 million or $0.20 per share for the same period in 2019.

- Free cash flow of $3.2 million, net of an investment of $13.9 million in Kiena, or $0.02 per share1 (Q3 2019: free cash flow of $9.2 million or $0.07 per share.

- Net income of $14.6 million or $0.10 per share (Q3 2019: $12.4 million or $0.09 per share) and Net income (adjusted)1 of $15.5 million or $0.11 per share (Q3 2019: $12.4 million or $0.09 per share).

- Cash position increased to $73.5 million compared to $66.7 million in the previous quarter.

To read the full news release, please click HERE

..

=======

City Investors Circle is based in the financial district in the City of London.

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email: andrew@city-investors-circle.com for information.

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

These are not recommendations in any form, always consult an investment professional.