Auteco (ASX: AUT)

Has struck a A$65-million deal to acquire the Green Bay copper and gold mine, previously operated by the former AIM listed Rambler Metals, in Newfoundland, Canada.

This looks to be a shrewd purchase of a producing mine that could increase tonnage significantly.

.

.

.

| Auteco Minerals | ASX : AUT |

| Stage | Exploration / development |

| Metals | Copper / Gold |

| Market cap | A$65 m @ 28c |

| Location | Newfoundland, Canada |

.

Comment

This looks like a very shrewd deal for Auteco, and we have promoted them to the second tier of our watchlist as a result.

Managament have achieved before, and can clearly see another winner in this deal. Management took A$5 million in the placing, which is good to see them backing themselves to create shareholder value.

They are not going straight back into production, they are going to drill out a much larger resource here before restarting mining.

I have a feeling they will significantly expand the resource here.

/

Auteco Closes The deal on the Former Rambler Metals Mine in Newfoundland

.

Auteco Minerals (ASX: AUT) Minerals has struck a A$65-million deal to acquire the Green Bay copper and gold mine, previously operated by the former AIM listed Rambler Metals, in Newfoundland, Canada.

AuTECO submitted a bid under the sale and investment solicitation process for Canadian company Rambler Group, which was ordered by the Supreme Court of Newfoundland and Labrador in March this year, as part of the restructuring proceedings of Rambler Group.

AuTECO’s bid involved the offer to purchase the assets by way of the cancellation of all outstanding issued capital in the Rambler Group, and the issuance of new shares in the company, and a reverse vesting order (RVO).

Under the terms of the acquisition, AuTECO will provide A$35-million in cash on completion of the transaction, as well as A$15-million worth of shares in the company, amounting to around 600-million shares.

A further A$15-million will be payable no later than 18 months following the completion of the transaction, of which A$7.5 million will be payable in cash and a further A$7.5 million in shares. A deposit of A$3.5 million has been paid, which will be deducted from the Stage 1 payments on completion of the transaction.

.

Incoming AuTECO MD Steve Parsons stated,

“Green Bay is an exceptional acquisition opportunity and we were extremely fortunate to be given the opportunity to acquire this asset via the administration process.

“It is very rare for a copper asset of this size and grade, with a resource of this magnitude, and such immense growth potential, to come up anywhere in the world, let alone in a tier-one location like the province of Newfoundland and Labrador.

“The potential to grow the mineral resource quickly is abundantly clear, with extensive high-grade mineralisation intersected down-plunge and highly promising exploration upside in positions parallel and along strike from the existing resource.”

.

The project currently hosts a 39.2-million-tonne resource, at 2.1% copper for 812,000 t of Cu equivalent, of which 68% is in the measured and indicated category.

The mine last produced copper in early 2023, mined by Rambler Metals, and has been on care and maintenance since then, as a result of Rambler’s cash crisis.

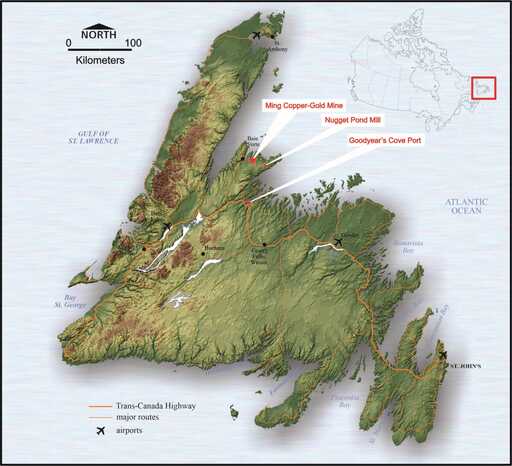

The acquisition includes the Ming mine and Nugget Pond processing facility, with the infrastructure valued at around A$250-million.

The transaction will be funded by a minimum A$50-million two-tranche placement, with Parsons saying the capital raising will enable AuTECO to immediately establish an exploration decline with the aim of rapidly growing the resources around historical intersections such as 102 m at 1.7%copper . This intersection is 460 m down plunge of the current resource boundary.

The first tranche of the capital raise will consist of some 347-million shares, at a price of 2.5c each, raising an initial A$8.7-million under the company’s existing placement capacity.

The second tranche will entail the placement of a further 1.65-billion shares, raising a further A$41.3-million.

.

To read the full news release, please click HERE

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Auteco

..