Calibre Mining (TSX: CXB)

Announced the results of the Company’s updated Mineral Resources and Mineral Reserves for its Nicaragua and Nevada properties as of December 31, 2023.

Reserves have grown in both jurisdictions net of depletion since acquisition of each asset.

.

.

| Calibre Mining | TSX: CXB |

| Stage | Production, development, exploration |

| Metals | Gold |

| Market cap | C$1.3 Billion @ C$1.81 |

| Location | Canada, Nicaragua, USA |

/

CALIBRE DELIVERS FOURTH CONSECUTIVE YEAR OF MINERAL RESERVE

GROWTH

Vancouver, B.C. – March 12, 2024: Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (the “Company” or “Calibre”) is pleased to announce the results of the Company’s updated Mineral Resources (“Resources”) and Mineral Reserves (“Reserves”) for its Nicaragua and Nevada properties as of December 31, 2023.

Reserves have grown in both jurisdictions net of depletion since acquisition of each asset.

As demonstrated by the team’s track record, Calibre continues to efficiently make new discoveries and convert discoveries into Reserves as evidenced at the VTEM gold corridor within the Limon Mine Complex which has seen year over year Reserve growth of 36%.

The VTEM corridor now contains 1.25 Mt averaging 8.25 g/t Au for 332 koz in Reserves with multiple kilometres of strike potential and an ongoing 50,000 m drill program.

.

Nicaragua Mineral Reserves (December 31, 2023)

Nicaragua Mineral Reserves (December 31, 2023)

Highlights

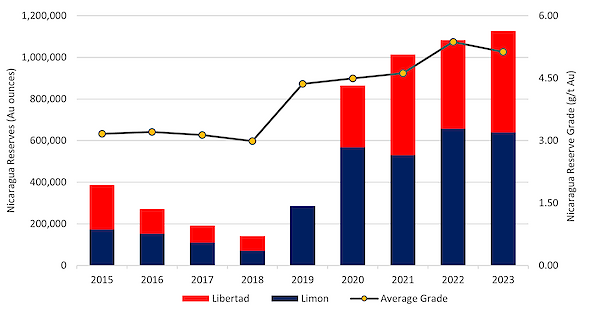

- Nicaragua: Increase in Reserves net of production depletion of 4% in 2023 to 1.13 Moz;

- Nevada: Increase in Reserves net of production depletion of 12% in 2023 to 0.30 Moz;

- Company wide significant mineral endowment of over 4.1 Moz of Reserves, 8.6 Moz of Measured and Indicated Resources (inclusive of Reserves) and 3.6 Moz of Inferred Resources;

- Valentine Gold Mine’s significant mineral endowment of 2.7 Moz of Reserves and 3.96 Moz of Measured and Indicated Resources (inclusive of Reserves) and 1.10 Moz of Inferred Resources (further detailed in the tables below) (see news release dated January 26, 2024); and

- >130,000 m Resource expansion and discovery drill programs underway across all assets.

.

Darren Hall, President and Chief Executive Officer of Calibre stated:

“I am very pleased to see another year of Reserve growth net of depletion in both operating jurisdictions.

“We have crystalized a significant portion of our Resources into Reserves for a record 1.42 Moz in Nicaragua and Nevada, net of record 2023 production of 283,525 ounces.

” Nicaragua continues to deliver with Reserves at 1.13 Moz providing a robust base from which to deliver.

“With our recent acquisition of the Valentine Gold Mine, our company wide consolidated Reserves stand at 4.1 Moz, a more than 10-fold increase since Q4 2019 net of 825 koz of production.

“Importantly Reserves have grown more 36% year over year at our emerging flagship project, the VTEM gold corridor at Limon.

“In Nevada we’ve grown Reserves over 50% net of production depletion since closing the acquisition in 2021.”

,

To read the full news release please click HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Calibre Mining.

.

.