![]() Cartier Resources Inc. (TSX.V:ECR)

Cartier Resources Inc. (TSX.V:ECR)

Announced a “best efforts” private placement of up to 11,628,000 common shares of the Company that will qualify as “flow-through shares” to be issued at C$0.43 per FT Share for aggregate gross proceeds of up to C$5,000,040.

.

.

.

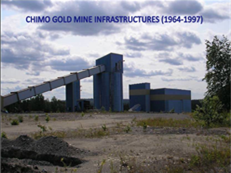

Chimo Gold Mine – Cartier Resources, Quebec

.

.

Cartier Resources announces a $5 million flow through placing

.

VAL D’OR, Québec, July 21, 2020 – Cartier Resources Inc. (the “Company” or “Cartier“) (TSX.V:ECR) announces that it has entered into an agreement with Paradigm Capital Inc. (the “Agent”) in connection with a “best efforts” private placement of up to 11,628,000 common shares of the Company that will qualify as “flow-through shares” (within the meaning of subsection 66 (15) of the Income Tax Act (Canada) and section 359.1 of the Taxation Act (Québec)) (“FT Shares“) to be issued at C$0.43 per FT Share (the “Issue Price”) for aggregate gross proceeds of up to C$5,000,040 (the “Offering”).

.

In addition, the Agent have been granted an option to sell up to that number of additional FT Shares for additional gross proceeds of up to C$750,006.

.

Pursuant to the Investor Rights Agreement between Cartier and Agnico Eagle Mines Limited (“Agnico Eagle”), Agnico Eagle has the right to participate in the Offering to maintain its pro-rata 16.6% interest in Cartier.

.

The gross proceeds from the Offering will be used by the Company to incur eligible “Canadian exploration expenses” that will qualify as “flow-through mining expenditures” as such terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures“) related to the Company’s project in Quebec. All Qualifying Expenditures will be renounced in favour of the subscribers of the FT Shares effective December 31, 2020.

.

The Offering is expected to close on or about August 11, 2020 (the “Closing Date”) and is subject to certain closing conditions including, but not limited to, the receipt of all necessary approvals including the conditional listing approval of the TSX Venture Exchange and the applicable securities regulatory authorities. The Offering is being made by way of private placement in Canada. The securities issued under the Offering will be subject to a hold period in Canada expiring four months and one day from the closing date of the Offering. The Offering is subject to final acceptance of the TSX Venture Exchange.

.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

.

.

.