Cartier Resources (TSX.V: ECR)

Announced drill hole results from the program that is in progress at the Chimo Mine Project, where a recent PEA demonstrated its economic viability.

The new results show the discovery potential of the ‘West Chimo Mine’ sector which has seen very little drilling to date.

.

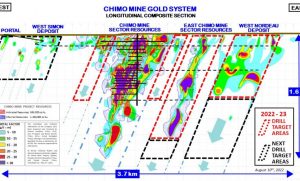

Cartier Resources – Longitudinal section drill plan for 2022 – 2023 campaign

.

| Cartier Resources | TSX.v : ECR |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$26.5 m @ 9.5 cents |

| Location | Quebec, Canada |

.

Val-d’Or, May 4 2023 – Cartier Resources Inc. (TSX-V: ECR) (“Cartier”) announce drill hole results from the program that is in progress at the Chimo Mine Project, where a recent (‘’PEA’’) demonstrated its economic viability. The Chimo Mine property, which is 100% owned by Cartier, is located 45 km east of the Val-d’Or mining camp.

.

Philippe Cloutier, President and CEO commented;

“The new results show the discovery potential of the ‘’West Chimo Mine’’ sector which has seen very little drilling to date; as well as the remainder of the property where gold-bearing zones remain to be further drilled in order to increase their dimensions with a view to fully optimize the resource growth potential of the project”

.

Highlights of press release(FIGURE 1):

New 5BW Gold Zone (‘’West Chimo Mine’’ Sector):

16.8 g/t Au / 1.0 m, 6.0 g/t Au / 1.0 m and 1.2 g/t Au / 16.0 m

New 6N1W Mineralized Zone (‘’West Chimo Mine’’ Sector):

13.2 g/t Au / 0.5 m and 6.0 g/t Au / 1.0 m within 42.0 m grading 0.9 g/t Au

New intersections increasing the dimension of gold zones of ‘’East Chimo Mine’’ Sector:

13.0 g/t Au / 1.0 m, 9.7 g/t Au / 1.0 m included in 6.5 g/t Au / 2.0 m

Two drills are currently operating on the property

Reminder of the highlights of project:

- Recentpositive Preliminary Economic Assessment*(FIGURE 2):

- Post-Tax NPV5%of CAD$388M and 20.8% IRR

Longterm gold price of US$1,750/oz, Exchange rate of CAD $1.00 = US $0.77

Paybackperiod of 2.9 years and mine life of 9.7 years

Capex of CAD$341M, average all-in sustaining cost of US$755/oz

Averageannual production of 116,900 oz at a milled average of 4.6 g/t Au

- Recent Mineral Resource Estimate**(FIGURE 3):

- 720,000ounces of gold in the indicated resource category

- 1,633,000 ounces of gold in the inferred resource category

‘’West Chimo Mine’’ Sector(FIGURE 1):

- The New 5BW Gold Zone, that is comprised of values such as 16.8g/tAu/1.0m, 6.0g/tAu/1.0 m and 1.2 g/t Au / 16.0 m (PHOTO 1), is situated at 100 m west of Chimo mine drifts between depths of 75 m and 350 m (Table 1). Two holes were drilled between depths of 150 m and 350 m, which assays are pending, in order to explore the vertical extension.

- The New 6N1W Mineralized Zone, is comprised of values such as 13.2g/tAu/ 0.5m and 6.0g/tAu/1.0 m included in 3.3 g/t Au / 5.0 m; all of which are included in a wider interval of 42.0m grading 0.9 g/t Au (PHOTO 2). This new zone is situated only 50 m west of Chimo mine drifts between depths of 450 m and 600 m. These drill hole results add to the historical results presented in table 2 below. One drill hole is currently in progress in order to explore the vertical extension of the zone between depths of 600 m and 835m.

The geometry of the Chimo Mine Gold System should show a certain symmetry either side of the main mineralized sector of the project currently known as the ‘’Chimo Mine’’ Sector. These first drill results, already suggest the development of a good discovery potential in the ‘’West Chimo Mine’’ Sector, which is situated proximal to the Chimo mine infrastructures and which have been little explored to date.

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Cartier Resources.

..