![]() Colonial Coal International Corp. {TSX.V: CAD}

Colonial Coal International Corp. {TSX.V: CAD}

Released the results of a recently completed PEA for the Gordon Creek area that forms part of the company’s 100-per-cent owned Flatbed metallurgical coking coal property.in British Columbia.

The Gordon Creek Project has an indicative after-tax (and royalty) net present value (“NPV”) of US$690.5 million or CAD$897.7 million.

.

.

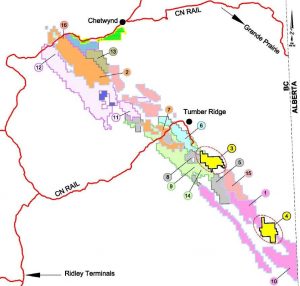

Map of the Peace River Coalfield, Flatbed is licence 3, and Huegenot licence 4

.

.

Colonial Coal pegs Gordon Creek NPV at $690.5M (U.S.)

2018-11-12 13:29 ET – News Release

Mr. David Austin reports

.

COLONIAL COAL ANNOUNCES RESULTS OF A PRELIMINARY ECONOMIC ASSESSMENT FOR ITS FLATBED PROPERTY

.

.

Colonial Coal International Corp. {TSX.V: CAD} has released the results of a recently completed preliminary economic assessment for the Gordon Creek area that forms part of the company’s 100-per-cent owned Flatbed metallurgical coking coal property located approximately 27 kilometres south-southeast of Tumbler Ridge in northeast British Columbia.

.

The PEA report, prepared by Stantec Consulting Services Inc. (“Stantec”; formally Norwest Corporation), in accordance with CSA National Instrument 43-101 (“NI 43-101”) standards, will be completed and filed on SEDAR (the System for Electronic Document Analysis and Retrieval) within 45 days of the date of this news release. The results of the PEA show that the Gordon Creek Project demonstrates positive economics, and that it is worthy of continued exploration and development.

.

In summary, Stantec used previously reported (November 27, 2017 and January 16, 2018 and by way of corresponding NI 43-101 technical report filings) in situ and potentially mineable resources, developed a conceptual mine plan to exploit the coal resources using underground mining methods and prepared scoping-level cost estimates and economic analyses.

.

Highlights of the PEA report respecting the Gordon Creek Project are summarized below. All costs are in US dollars, however, where Canadian dollar equivalents are provided they have been converted using an exchange rate of US$1.00 equals CAD$1.30.

.

- The Gordon Creek Project has an indicative after-tax (and royalty) net present value (“NPV”) of US$690.5 million (CAD$897.7 million), using a 7.5% discount rate and an IRR of 24.4%, based on a weighted average coking coal price of US$164.8 per tonne and a premium pulverized coal injection (“PCI”) coal price of US$140.5 per tonne.

- The financial analysis suggests that the “break-even” coal price is less than US$91.1, US$96.5 and US$103.3 per tonne for discount rates of 5%, 7.5% and 10%, respectively. It also indicates that for a 15% internal rate of return (“IRR”), a minimum coal price of US$119.9 per tonne would be required.

- The PEA is based on a conceptual underground mine plan that targets 111.6 million run-of-mine tonnes of resource, with a yield of 51%, producing 57.4 million tonnes of clean coal over a mine life of 30 years.

- Geological modeling and resource estimation have identified an inferred, potentially underground mineable, coal resource at Gordon Creek of 298 million tonnes.

- The Project’s potential coal production is identified as coking coal from Seams B to G and premium PCI coal for Seams J and K. Seams J and K, which would be mined last, are the two deepest seams and represent approximately 28.6% of the reported resources and approximately 31.5% of the reported saleable tonnes.

- Selling prices were determined for each product coking coal from Seams B, D, F (combined F1 and F2) and G. These prices ranged from US$156.0 to US$176.5 per tonne; the weighted average coking coal price of US$164.8 per tonne represents a discount of US$20.2 per tonne from a projected long-term benchmark price of US$185.0 per tonne for premium low volatile hard coking coal. Seams J and K were priced as premium PCI coals with no discount to the projected long-term PCI benchmark price of US$140.5 per tonne. The overall weighted average price for all coal types is US$160.5 per tonne.

- In full mine operation, projected clean coal production ranges from 1.6 million tonnes per annum (“Mt/a”) to 2.6 Mt/a, and averaging approximately 1.9 Mt/a.

- The pre-production capital cost for the underground mine is estimated at US$300 million (CAD$391 million), with additional sustaining capital of US$406 million (CAD$528 million) over the life-of-mine.

- The Project’s proposed payback of initial capital is estimated to be within three years from the start of coal production.

- Total costs FOB port, including direct mine site costs, offsite costs and indirect costs, are estimated at US$80.91 (CAD$105.19) per tonne. This includes mine site costs of US$41.16 per tonne, offsite costs of US$25.42 per tonne for trucking, rail car loading, rail and port charges, and indirect costs of US$14.33 per tonne for mineral taxes, royalties and corporate overhead.

.

The PEA assumed that the Gordon Creek Project would be connected by road to the existing rail line south of Tumbler Ridge. The rail line would be accessed via a loadout located in the area of an existing coal loadout operated by Peace River Coal. Costs for trucking product coal to the proposed loadout are included in the Project’s operating cost projections.

.

A summary of the financial analyses is shown in the following table:

Coal Price NPV (millions) at

Varying Discount Rates with IRR

5% 7.5% 10% IRR (%)

US$160.5/t $1,081 $691 $446 24.4%

CAD$208.7/t $1,405 $898 $579 24.4%

.

This PEA is preliminary in nature and includes Inferred mineral resources that are considered to be too geologically speculative to be subject to economic considerations that would enable them to be categorised as mineral reserves. There is no certainty that the forecast results stated in the PEA will be realised.

.

This news release has been reviewed by Derek Loveday of Stantec, a Professional Geologist and a Qualified Person, as defined in NI 43-101. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

.

.

About Colonial Coal International Corp.

Colonial Coal is a publicly traded coal corporation in British Columbia that focuses primarily on coking coal projects. The northeast Coal Block of British Columbia, within which our Corporation’s projects are located, hosts a number of proven deposits and has been the subject of M&A activities by Anglo-American and others.

.

Additional information can be found on the Company’s website www.ccoal.ca

or by viewing the Company’s filings at www.sedar.com

We seek Safe Harbor.