Colonial Coal {TSX.V: CAD} recently announced a significant maiden discovery on their Flatbed property of some 300 million tons of metallurgical (coking) coal resource.

In terms of value this increase is significant, yet the market only now seems to be waking up to the fact, with the share price up strongly on higher volume of shares traded.

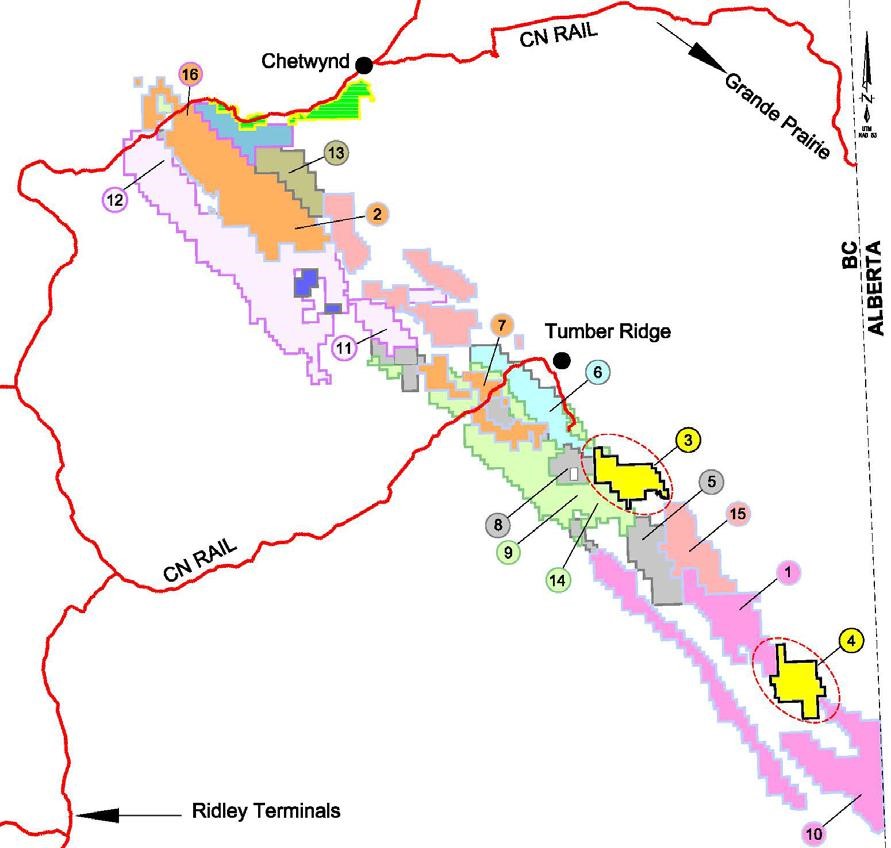

Map of the Peace River Coalfield, Flatbed is licence 3, and Huegenot licence 4

.

Colonial Coal {TSX.V: CAD} recently announced a significant maiden discovery on their Flatbed property of some 300 million tons of metallurgical (coking) coal resource.

.

In terms of value this increase is significant, yet the market only now seems to be waking up to the fact, with the share price up strongly on higher volume of shares traded.

.

Two months ago CAD had a 400 million ton resource at Huegenot, and the price of metallurgical (coking) coal was CAD$ 240. Two months later the situation is that CAD now have 700 million tons at Huegenot and Flatbed, and the price of coking coal is now CAD $ 360.

.

So we have a resource increase of 75% and a 50% increase in the price of coking coal, yet the stock price is only now starting to respond.

.

The FOB cost of producing and transporting the coal to the ship on board is currently now around $CAD 130. The current margin is far higher than the norm, coal is a high volume low margin product normally.

.

Under any normal metrics Colonial Coal looks very undervalued.