![]() Colonial Coal {TSX.V: CAD}

Colonial Coal {TSX.V: CAD}

Colonial Participated in the 121 Mining Forum held last week, and the price has soared, up by 75% in five trading days. No news has been released by the company.

This looks like institutions and investors buying in after becoming aware of the undervaluation of the company, give their near 800 million tons of premium quality coking coal resource, in B.C., Canada.

.

.

.

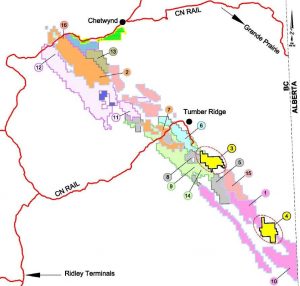

Map of the Peace River Coalfield, Flatbed is licence 3, and Huegenot licence 4

.

.

.

Colonial Coal {TSX.V: CAD}

.

Colonial Participated in the 121 Mining Forum held last week, and the price has soared, up by 75% in five trading days. No news has been released by the company.

.

This looks like institutions and investors buying in after becoming aware of the undervaluation of the company, give their near 800 million tons of premium quality coking coal resource, in B.C., Canada.

.

Colonial have been a bit under the investment radar for a while, but it would seem they chose an opportune moment to introduce their story to a receptive audience, at the 121 Mining Forum.

.

121 is a quality event with institutional professionals, high net worth individuals, and private investors, from London and EMEA.

.

Given the current modest market cap for Colonial, and the low value that attributes to high quality resources in a world class jurisdiction, it’s no surprise to me that their engagements with investors new to the story has resulted in strong buying and a subsequent steep rise in price.

.

The conference gave Colonial CEO David Austin the opportunity to engage with investors new to the story, and the result of that is plainly obvious. Investors look for quality management, and David, having completed two deals in the same coalfields, (one for $3.2 billion for Western Canadian Coal), has a track record second to none in the region.

.

Colonial has a top quality board, steeped in experience, and with the current world markets turmoil, look well capable of concluding a deal for their metallurgical coal, in a safe jurisdiction, with one of the world’s steelmakers looking to secure essential supply.

.

I still think Colonial are cheap, even if they sold for the equivalent of $1 a ton, that would be multiples of the current shareprice.

Declaration.

The writer is a long term holder of Colonial Coal shares, bought over time in the market, at market prices prevailing at the time.