Cyprium Metals (ASX: CYM)

Provided the following update in relation to its funding requirements and the commencement of a strategic review.

Cyprium has entered into a Secured Loan Deed for $6 million, and is undertaking a full strategic review of all assets.

.

.

.

.

| Cyprium Metals | ASX: CYM |

| Stage | Development, Exploration |

| Metals | Copper, Cobalt |

| Market cap | A$70m @ 9.6 c – CURRENTLY SUSPENDED |

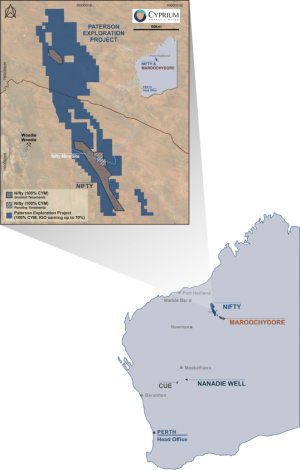

| Location | Pilbara, Western Australia |

.

.

Comment

This is not looking good at all, borrowing A$6 million to pay interest on a prior A$36 million loan looks poor.

Then the words every investor should dread, “strategic review”, which normally means they’ve failed, and are looking for another plan!

This is generally bad for investors, and you have to ask how on earth they were so close to a financing to construct the mine, and now this?

I will be removing Cyprium from the watchlist, and placing on the possible recovery watchlist for now, I fear shareholders are not going to have a happy outcome here.

.

.

Cyprium Metals Has Entered into a Secured Loan and is Conducting a “Strategic Review”

.

Cyprium Metals Limited (ASX: CYM) (“CYM”, “Cyprium” or “the Company”) provides the following update in relation to its funding requirements and the commencement of a strategic review.

.

.

Highlights

• Cyprium has entered into a Secured Loan Deed for $6 million

• Cyprium is undertaking a full strategic review of all assets

• Cyprium has a suite of high-quality copper projects with +1.6Mt of contained Copper in Mineral Resources

..

Secured Loan Deed

As outlined in the Company’s 23 February 2023 ASX Announcement, the Company was unable to secure senior debt financing for the Nifty Copper Project Restart on commercially attractive terms and as a result, the previously announced $35 million1 equity raise was not completed.

As a result, Cyprium has entered into a Secured Loan Deed (“Loan Deed”) with Avior Asset Management Pty Ltd (“the Investor”).

The proceeds from the Loan Deed will be used for the upcoming interest payment on the Company’s existing unsecured $36 million Convertible Notes and for working capital purposes whilst the Company undertakes a strategic review on all assets in the company.

.

Key terms of the Loan Deed facility:

• Facility amount: $6 million

• Facility term: 6 months from first drawdown

• Interest rate: Commercial rates of financing charges, capitalised over the Facility term

• Loan conversion: A minimum of $0.8 million will be converted into CYM shares

• Share issue price: 20% discount to the Issue price of the next capital raising (“NCR”)

• Loan repayment: Balance after Loan conversion is repayable following issue of shares under NCR

• Director: Investor has the right to appoint a nominee Director to the CYM Board

Management Comment

.

.

.

Cyprium Managing Director, Barry Cahill, commented:

“Copper market fundamentals combined with Cyprium’s quality portfolio of more than 1.6Mt of contained copper at Nifty, Maroochydore and the Murchison, including significant infrastructure, as well as the extensive Paterson Exploration JV with IGO in the highly prospective Paterson Province presents a highly attractive portfolio in an environment where battery metals are in strong demand.

The board is committed to preserving the value of the Company’s assets as a priority whilst the strategic review is undertaken.”

.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Cyprium Metals.

.

.