![]() Wesdome Gold {TSX: WDO}

Wesdome Gold {TSX: WDO}

The Globe and Mail reports in its Friday, March 13, edition that Canaccord Genuity analyst Tom Gallo says Wesdome Gold Mines is “well positioned for growth.”

The Globe’s David Leeder writes that following the release of “strong” 2019 operational and financial results, Mr. Gallo raised his rating for the Toronto-based company to “buy” from “hold” ahead of it embarking on “unprecedented” exploration.

.

.

.

Globe says Gallo raises Wesdome to “buy” from “hold”

2020-03-13 08:49 ET – In the News

The Globe and Mail reports in its Friday, March 13, edition that Canaccord Genuity analyst Tom Gallo says Wesdome Gold Mines ($7.84) is “well positioned for growth.”

.

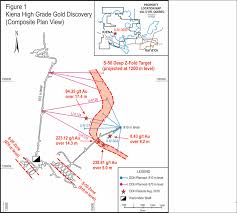

The Globe’s David Leeder writes that following the release of “strong” 2019 operational and financial results, Mr. Gallo raised his rating for the Toronto-based company to “buy” from “hold” ahead of it embarking on “unprecedented” exploration. Mr. Gallo says in a note: “Across both properties, Wesdome plans to drill nearly a quarter of a million meters (240 kilometres to be exact), the most drilling ever undertaken by the company.

.

They are fully funded out of the current treasury and projected cash flows.” Mr. Gallo boosted his share target to $11.50 from $10. Analysts on average target the shares at $10.97. The Globe reported on Dec. 12, 2019, that Industrial Alliance Securities analyst George Topping had reiterated his “buy” call on Wesdome.

.

The shares could then be had for $9.29. The Globe reported on Jan. 16, 2020, that Laurentian Bank analyst Barry Allan cut Wesdome to “hold” from “buy.” The shares could then be had for $9. The Globe reported on March 12, 2020, that Mr. Allan returned his rating to “buy.” The shares were then worth $8.77.