Karora Resources (TSX: KRR)

Announced unaudited financial and operating results for the Q4 2022 and full-year 2022.

Highlights are a record revenue of $96.8 million, (45% increase from Q4 2021); net earnings growth of 56% to $9.6 million ($0.06 per share); Operating cash flow increased 30% over Q3 to $36.5 million.

.

.

.

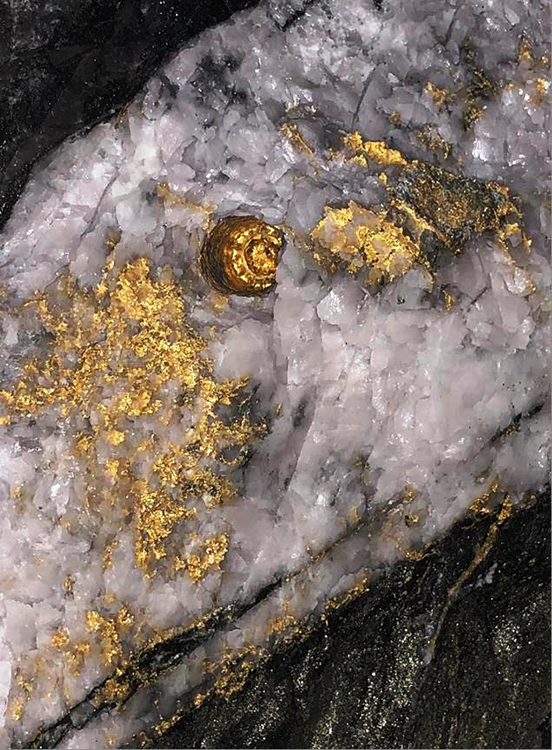

Gold in drill core from Beta Hunt mine, Western Australia.

.

.

.

| Karora Resources | TSX: KRR |

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$841 million @ C$4.86 |

| Location | Kalgoorlie, Western Australia |

.

.

.

KARORA RESOURCES REPORTS RECORD REVENUE, STRONG EARNINGS GROWTH IN FOURTH QUARTER 2022

TORONTO, March 23, 2023 /CNW/ – Karora Resources Inc. (TSX: KRR) (“Karora” or the “Company”) today announced unaudited financial and operating results for the fourth quarter (“Q4 2022”) and full-year (“2022”) 2022. All dollar amounts are in Canadian dollars, unless otherwise noted.

.

- SOLID FINANCIAL PERFORMANCE IN Q4 2022

Record revenue of $96.8 million, 45% increase from Q4 2021; net earnings growth of 56% to $9.6 million ($0.06 per share); Operating cash flow increased 30% over Q3 to $36.5 million - RECORD GOLD PRODUCTION AND SALES IN 2022

133,887 ounces of gold produced in 2022, 19% increase from 2021 and in line with top end of 2022 guidance (120,000 – 135,000 ounces); Gold sales increased 16% to 132,098 ounces - STRONG GROWTH IN ORE MINED AT BETA HUNT

Record mine production at Beta Hunt in 2022, with 1.1 million tonnes mined, a 23% increase from 2021

.

.

.

Paul Andre Huet, Karora Chairman and CEO, commented:

“I am very pleased with Karora’s performance in 2022, including our solid results during the fourth quarter.

“For the year, we achieved record production driven by strong growth in mined tonnes at Beta Hunt and increased processing capacity. During the fourth quarter, we generated record revenue and gold sales as well as our best net earnings performance of the year.

“I am also proud of the way our team managed external factors in 2022 such as disruptions caused by record COVID-19 cases in Western Australia early in the year, sector-wide inflationary pressures and volatile commodity markets.

“Our unit costs showed marked improvement in the second half of 2022, which positioned us to achieve our guidance for AISC of US$1,100 – US$1,200 per ounce sold.

.

“We have refreshed our 2023 and 2024 production, cost and capex guidance to tighten up ranges and reflect the reality of inflationary cost pressures since we originally provided the guidance in mid-2021 alongside our original growth plan announcement.

“Since then, we have materially de-risked our growth plan with the addition of the 1.0 Mtpa Lakewood Mill in 3Q22 as well as the completion of the second decline at Beta Hunt ahead of schedule earlier this year.

“With these two critical components of our plan delivered, we remain on the path to ramp up production over 2023 and 2024 to deliver gold production growth into a range of 170,000 to 195,000 ounces at AISC of US$1,050 – US$1,200 per ounce sold by 2024.

“During 2022, we significantly advanced plans to grow our nickel business, with the release of our Nickel PEA outlining the potential to grow low-cost nickel production that delivers attractive returns, increased price leverage and higher nickel by-product credits to further improve our gold unit costs.

“We expect to ramp up nickel production meaningfully during 2H24 and 2025 once our development of the 50C/Gamma Zone is in place – enabled by the increased ventilation capacity to be installed during 2023.

“Exploration was another key area of success, with drilling at Beta Hunt resulting in new discoveries, major extensions of mineralization and, as recently announced, significant growth in gold Mineral Reserves and both gold and nickel Mineral Resources.”

.

.

Karora will host a call/webcast on March 23, 2023 at 10:00 a.m. (Eastern Time) to discuss the unaudited fourth quarter and full year 2022 results. North American callers please dial: 1-888-204-4368, international callers please dial: (+1) 647-794-4605. For the webcast of this event click [here] (replay access information below).

.

The Company’s audited financial statements and management’s discussion and analysis will be will be filed on SEDAR at www.sedar.com and posted to the Company’s website at www.karoraresources.com on Tuesday, March 28, 2023

.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

/

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Karora Resources.

.

.