Karora Resources (TSX: KRR)

Announced updated 2024 gold production guidance of 170,000 – 185,000 ounces and all-in sustaining cost cost guidance of US$1,250–US$1,375 per ounce sold.

Karora’s updated guidance incorporates optimized 2024 mine and development plans across its operations.

.

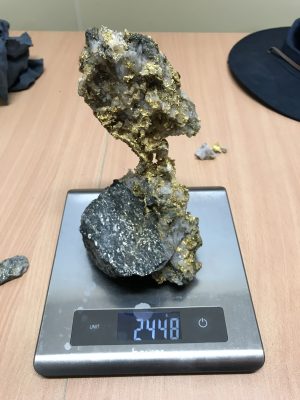

Karora Resources – Beta Hunt Mine Specimen Stone

.

| Karora Resources | TSX: KRR |

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$791 million @ C$4.45 |

| Location | Kalgoorlie, Western Australia |

/

Karora Announces Consolidated 2024 Gold Production Guidance Of 170,000 – 185,000 Ounces At AISC Of US$1,250 – US$1,375 Per Ounce Sold

TORONTO,March 11, 2024/CNW/ – Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce updated 2024 gold production guidance of 170,000 – 185,000 ounces and all-in sustaining cost (AISC)1 cost guidance of US$1,250–US$1,375 per ounce sold.

Karora’s updated guidance incorporates optimized 2024 mine and development plans across its operations.

At Beta Hunt, this includes planned mine development required to bring the mine to 2.0Mtpa as well as accessing the new Fletcher zone by the end of the year.

The guidance also includes further equipment additions, processing plant upgrades at both Higginsville and Lakewood, tailings storage expansions and other growth-related expenditures.

By the end of 2024, Karora’s three-year growth plan will have been executed to deliver a 2.0Mtpa operation at Beta Hunt feeding two upgraded mills alongside contributions from Higginsville Gold Operations.

.

Paul Andre Huet, Chairman & CEO, commented:

“Following our record full year gold production of 160,492 ounces in 2023, gold production in 2024 is projected to be another significant increase to between 170,000 – 185,000 ounces.

“Our updated guidance incorporates our ramp up to an annualized 2.0M tpa production rate at Beta Hunt by end of year as well as contributions from Pioneer, Two Boys and stockpiles.

“The minor (5%) trim to the top end of our gold production guidance reflects a focus on prioritizing higher margin Beta Hunt ounces over slightly lower margin smaller open pit options at Higginsville.

“Given increased cost pressures experienced across the industry since our last update inMarch 2023, we have adjusted our AISC guidance for 2024 to reflect the current operating environment and lower planned nickel by-product credits.

“At Beta Hunt we are in a position of unique operational flexibility with respect to mining nickel. The mine leverages shared infrastructure for both gold and nickel mining, driving a very competitive cost structure per nickel tonne.

“However, with the global pressure on spot nickel prices, we have made the decision to reduce higher cost hand-held nickel mining to focus on mechanized mining in our currently developed areas, trimming forecast payable nickel production in 2024 to a range of 200-300 nickel tonnes.

“With significant dual-purpose infrastructure in place, an enviable feature of our operations is the ability to significantly ramp up the new 50C/Gamma nickel blocks as market conditions warrant.

“Capital guidance for our final year of the Beta Hunt 2.0M tpa growth plan, involves mine development, equipment additions and growing the workforce to accommodate the higher production rates.

“The 10% increase in midpoint capital guidance reflects, among other things, the decision to move more aggressively in advancing the compelling Fletcher Zone, an impressive new area proximal to our Western Flanks and Larkin mining areas.

“We look forward to continuing to deliver on our plan and extend the Beta Hunt mine life via the drill bit. With the current mining areas of Western Flanks and A Zone still growing, the Fletcher Zone is poised to be the next exciting new gold production target area joining Larkin, Mason and Cowcill.

“As we have stated before, the exploration and resource expansion potential at Beta Hunt remains wide open, which we look forward to drilling aggressively via another A$18–$A23 M exploration and resource development budget this year.

“Overall, we are proud of the progress made to date on our growth plan which has delivered an aggressive organic expansion schedule through a challenging cost environment for the entire sector, taking Karora from a production level of just 99koz in 2020 to the targeted 170,000 – 185,000 oz in 2024.”

.

To read the full news release, please click HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Karora Resources.

.

.