Karora Resources (TSX: KRR)

Announced financial and operating results for the fourth quarter (“Q4 2023”) and full-year of 2023.

Production was a record 160,492 ounces, increased 20% from 133,887 ounces for 2023, driven by a 37% increase gold produced from the Beta Hunt Mine. The Company exceeded 2023 production guidance.

.

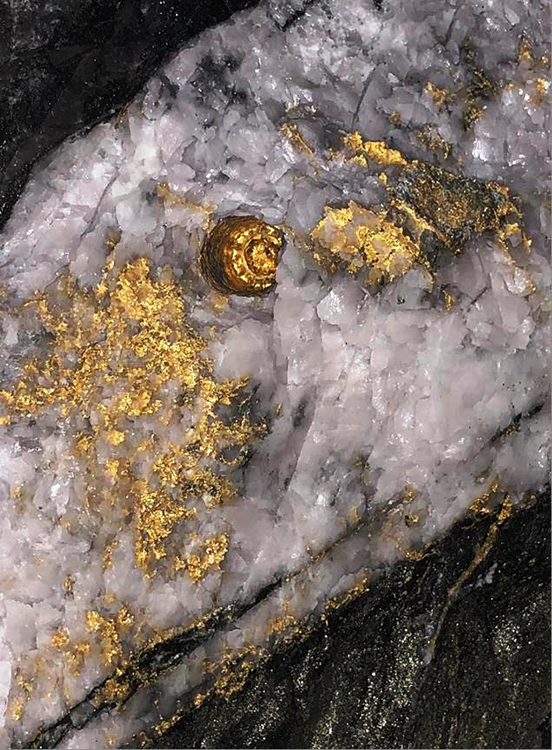

Gold in drill core from Beta Hunt mine, Western Australia

,

| Karora Resources | TSX: KRR |

| Stage | Production + Development + Exploration |

| Metals | Gold + Nickel |

| Market cap | C$791 million @ C$4.45 |

| Location | Kalgoorlie, Western Australia |

KARORA RESOURCES REPORTS RECORD PRODUCTION, REVENUE AND CASH FLOW FOR 2023

TORONTO, March 22, 2024 /CNW/ – Karora Resources Inc. (TSX: KRR) (“Karora”or the “Company”) today announced financial and operating results for the fourth quarter (“Q4 2023”) and full-year (“2023”) of 2023.

The Company’s audited condensed interim financial statements and management discussion & analysis (“MD&A) are available on SEDAR at www.sedarplus.ca and on the Company’s website at www.karoraresources.com. All dollar amounts are in Canadian dollars, unless otherwise noted.

.

RECORD 2023 GOLD PRODUCTION

- 2023 production was a record 160,492 ounces, increased 20% from 133,887 ounces for 2023, driven by a 37% increase gold produced from the Beta Hunt Mine. The Company exceeded 2023 production guidance of 145,000 – 160,000 ounces.

- Q4 2023 production of 40,295 increased 8% from 37,309 ounces in the fourth quarter of 2022, was up 2% compared to production of 39,547 ounces in the third quarter of 2023 (“the previous quarter”) due to a 57% improvement in production from Beta Hunt partially offset by lower production at HGO.

.

AISC INLINE WITH 2023 GUIDANCE

- Cash operating costs1 and all-in sustaining costs (“AISC”)1 per ounce sold averaged US$1,128 and US$1,248, respectively, in 2023 compared to US$1,099 and US$1,174, respectively, in 2022. Operating costs1 in the second half of 2023 were impacted, primarily, by a higher royalty expense due to higher gold realized prices and a crusher bridge failure at HGO, resulting in the temporary use of higher cost contract crushing services. Repair of the crusher bridge was completed in the first quarter of 2024. Specifically, the contract crushing required during the crusher bridge remediation contributed US$21 to AISC per ounce in 2023. Additionally, the 2023 nickel by-product credit was US$24 per ounce sold compared to US$40 per ounce sold in 2022, reflecting reduced nickel sales during the second half of 2023. Full-year 2023 AISC1 per ounce sold in line with full-year 2023 guidance of US$1,100 – US$1,250.

- Cash operating costs1 and AISC1 per ounce sold for Q4 2023 averaged US$1,272 and US$1,435, respectively, versus US$1,034 and US$1,110, respectively, for Q4 2022. Higher AISC1 in Q4 2023 were driven primarily by temporary higher processing costs and lower grades at Higginsville offsetting strong performance at Beta Hunt. Operating costs1 were primarily impacted by the above noted higher royalty expense and temporary factors, now resolved, including crusher bridge failure resulting in the use of higher cost contract crushing for the entire quarter. Specifically, the contract crushing required during the crusher bridge remediation contributed US$51 to AISC per ounce. Repairs to the crusher bridge were completed during the first quarter of 2024. Additionally, the Q4 2023 nickel by-product credit was US$6 per ounce sold compared to US$56 per ounce sold for Q4 2022, reflecting reduced nickel sales during the quarter.

.

RECORD 2023 REVENUE

- 2023 revenue was a record $416.3 million, 31% higher than $317.0 million in 2022 mainly reflecting a 19% increase in gold sales and a realized gold price that was US$133 per ounce higher than in 2022.

- Revenue in Q3 2023 of $101.8 million increased 5% from Q4 2022 and was slightly lower than the previous quarter due to timing of sales.

.

SOLID OPERATING CASH FLOW GENERATION

- Record 2023 cash flow provided by operating activities of $132.7 million was a 50% increase compared to $88.2 million in 2022.

- Q4 2023 cash flow provided by operating activities was $32.1 million compared to $36.5 million in Q4 2023.

- Cash at December 31, 2023 of $82.5 million increased $13.7 million or 20% from $68.8 million at December 31, 2022.

.

EARNINGS PERFORMANCE

- Net earnings for 2023 of $8.9 million ($0.05 per share) compared to net earnings of $9.9 million ($0.06 per share) for 2022 reflecting the impact of a non-cash impairment charge and foreign exchange loss.

- Adjusted earnings1 for 2023 totalled $36.1 million ($0.21 per share), a 71% increase from $21.1 million ($0.13 per share) for 2022. The main differences between net earnings and adjusted net earnings in 2023 was the exclusion from adjusted earnings1 of non-cash share-based payments, $9.2 million impairment charges (on the carrying value of a small HGO mine), non-cash losses on derivatives, unrealized losses on the revaluation of marketable securities and the impact of foreign exchange losses.

- Adjusted EBITDA1,2 for 2023 was $129.3 million, 41% higher than $91.5 million in 2022 reflecting the 19% increase in gold sold and 7% increase in the USD realized gold price.

- Net loss for Q4 2023 of $1.7 million ($0.01 per share) compared to net earnings of $9.6 million ($0.06 per share) in Q4 2022 and net earnings of $6.9 million (0.04 per share) in Q3 2023. Q4 2023 was impacted by a non-cash $9.2 million impairment charge and a $3.1 million NRV adjustment to historic stockpiles.

- Adjusted earnings for Q4 2023 of $3.3 million ($0.02 per share) compared to $8.7 million ($0.05 per share) in Q4 2022 and $14.0 million ($0.08 per share) the previous quarter.

- Adjusted EBITDA1,2 for Q4 2023 was $24.9 million, 15% lower than $29.2 million in Q4 2022.

GROWTH PLAN HIGHLIGHTS

BETA HUNT EXPANSION TO 2.0 MTPA

- The expansion project at Beta Hunt continued to advance during the final quarter of 2023 with significant improvements to the mine’s primary ventilation circuit to accommodate the increasing mining fleet. Orders were placed for the supply, installation and commissioning of new permanent primary ventilation fans late in the third quarter of 2024. The current temporary primary fan arrangement successfully incorporated the three completed ventilation raises during Q4 2023. The expansion of the new mining fleet continued with the delivery of five underground trucks and three underground loaders in 2023, with further fleet expansion planned in 2024. Once completed, the Beta Hunt expansion project is expected to increase the mine’s annualized production run-rate to 2.0 Mtpa by the end of 2024.

Paul Andre Huet, Chairman and CEO, commented:

“I am pleased with our 2023 performance, during which we produced over 160,000 gold ounces, achieving a new record and exceeding our full-year guidance range of 145,000 to 160,000 ounces for gold production.

“The strong production drove strong financial results including adjusted earnings1of$36.1 million($0.21/sh) and cash flow from operations of$132.7 million, beating our performance in 2022. 2023 AISC costs were US$1,248 per ounce sold, within our guidance range of US$1,100 to US$1,250 per ounce for 2023 despite a crusher bridge failure during the second half of the year which has now been repaired and is back online.

“Our flagship Beta Hunt Mine continues to be the engine room powering our growth in both production and Mineral Resources. Outstanding production results during the fourth quarter, totaling almost 35,000 ounces, drove continued strong cost performance at our flagship operation.

“At Higginsville, where the third quarter delivered strong production results at Aquarius, the fourth quarter production result of just under 6,000 ounces was in line with our mine plan as we set up the next phase of the Pioneer pit to deliver in Q2 2024.

“I am proud to say we ended the year in a very robust financial position with a cash balance of$82.5 million, placing us well to deliver on our aggressive growth objectives in 2024.

“We expect to reach our goal of a 2.0 Mtpa production rate at Beta Hunt before the end of 2024, with significant opportunities and levers for continued production growth emerging ahead of us. 2024 will certainly be another exciting year for Karora Resources.”

,

To read the full news release, please click HERE

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Karora Resources

.