![]() Minera Alamos {TSX.V: MAI}

Minera Alamos {TSX.V: MAI}

Announced it has finalised Definitive Agreements with arms length parties to acquire 100% of the Cerro de Oro gold project comprising the Zacatecas I and Zacatecas II concessions near Concepcion del Oro, Zacatecas, Mexico.

The acquisition of the two core claims in the district that contain a significant gold project with 76 holes and 8200 m of historic drilling.

.

.

.

.

.

Minera Alamos Completes Definitive Agreements To Acquire The Cerro De Oro Gold Project, Zacatecas, Mexico

Toronto, Ontario and Vancouver, British Columbia – August 4th, 2020

.

.

Minera Alamos Inc. (TSX.V:MAI) (the “Company” or “Minera Alamos”)is pleased to announce it has finalised Definitive Agreements with arms length parties (collectively the “Vendor”) to acquire 100% of the Cerro de Oro gold project comprising the Zacatecas I and Zacatecas II concessions near Concepcion del Oro, Zacatecas, Mexico (see figure 1), subject to approval of the TSX Venture Exchange.

,

The acquisition of the two core claims in the district that contain a significant gold project with 76 holes and 8200 m of historic drilling bolsters the Company’s total claim holdings in the Concepcion del Oro district to approximately 6,500 ha in size. The two concessions are bounded by existing Minera Alamos concessions and the overall package is surrounded by a larger claim owned by the Company providing all the necessary land that would be required to facilitate the development of the deposit (see figure 2).

.

“The Cerro de Oro gold project has many characteristics that mimic the El Castillo gold mine our team developed under the Castle Gold Corporation banner from 2007 until its eventual sale in 2010.” stated Darren Koningen, CEO of Minera Alamos. “Cerro de Oro contains a large disseminated gold system with a significant oxidation profile and a low implied strip ratio with the majority of mineralised areas outcropping at surface. Northern Zacatecas has a rich mining history and hosts some of the largest gold deposits in north-central Mexico. We look forward to working with the local community and Mexican mining authorities to rapidly advance permitting and establish a new mine in the district.”

.

Highlights of the Acquisition

- Historical exploration data consisting of 8200m of drilling and 6000m of trench sampling.

- Gold mineralisation delineated over an area of approximately 500m x 1000m (to oxidized depths in excess of 70-80m) which appears to remain open in multiple directions.

- Majority of the mineralisation is exposed at surface and readily accessible for potential open pit mining operations.

- Location/infrastructure – excellent established mining region – good road access and accessible grid power.

- Augments the Company’s local existing claim holdings to now include the core mineralised area.

- Historical metallurgical work that indicates amenability to conventional heap-leaching methods.

- Existing databases of historical information which are currently being reviewed and should support the preparation of a maiden NI43-101 compliant resource report that is in progress.

- The agreement conveys 100% ownership to Minera with no underlying royalties subject to meeting the schedule of payments outlined below (see Transaction Terms).

.

The project is located less than 3km from the town of Melchor Ocampo and approximately 30 km from the district’s mining hub at Concepcion del Oro. This area of north-central Mexico is famous for its mineral production, most notably related to gold and silver rich-intrusive-related deposits. Of particular note are a number of nearby large-scale mining operations including Peñasquito (Newmont) just 30 km away, Tayahua (Frisco), Noche Buena (Fresnillo) and Camino Rojo (Orla).

.

Figure 1 – Regional Location Map

.

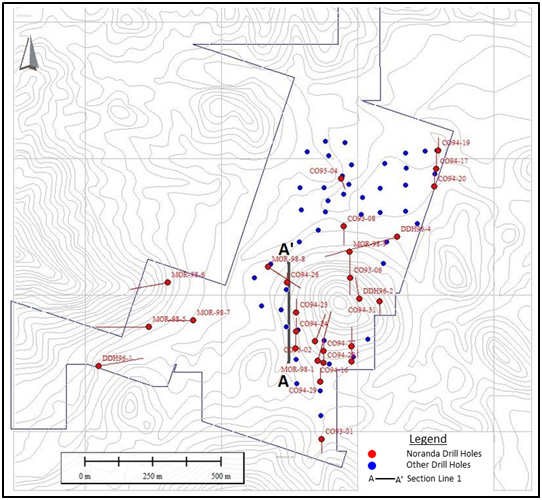

The disseminated gold and skarn related mineralisation at Cerro de Oro is represented by a gold porphyry system characterized by A, B, and magnetite veins with associated potassic alteration that is overprinted by phyllic alteration, with the gold mostly hosted by a porphyritic intrusive centre. The deposit is divided into two zones (North and South) by an east-west fault. Initial drilling was conducted in the 1990’s by Noranda and was comprised of 20 widely spaced holes on approximately 100m to 200m spacings.

..

The drill holes in this initial program were limited to an average depth of approximately 75m with most holes ending within oxide gold mineralisation that would indicate potential for additional gold mineralisation beyond the limit of the drilling. Subsequent groups have completed approximately 4,000m of additional drilling that served to infill the Noranda program and extend the known mineralisation to depths up to 100-150m. All drill data for the project is currently being evaluated by the Company and its consultants as they work towards the completion of a NI 43-101 compliant resource estimate for the project.

,

The property contains numerous historical pits, trenches and various underground workings. Although some of the site activity appears to be from a period of more than 75 years ago, the most significant period of recorded activity occurred in the 1950’s and included the completion of a series of exploration pits, shafts, declines and adits around the side of the Cerro de Oro hill in the center of the concession area. Two areas of high-grade underground structures were mined via adits and declines from surface using a series of internal raises and cross-cuts completed to a vertical depth of approximately 150 metres.

,

Historical information from the Noranda drilling and trenching programs in the mid 1990’s are presented below in Figures 3 through 5 for reference purposes (Note: As the Noranda drill results and trenching data are historic in nature, Minera Alamos has not yet been able to fully verify the data disclosed, including sampling, analytical, and test data underlying the information included in the following tables.)

,

Figure 2 – Minera Alamos Cerro de Oro Project Claim Holdings

.

.

Figure 3 – Drill Hole Location Map

.

.

Figure 4 – Section Line 1

.

,

.

To read the full news release, please click HERE

.

.

Minera Alamos (TSX.V: MAI) is a gold development company poised to join the ranks of gold producers in 2020.

The Company has a portfolio of high-quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach development project in Sonora currently under construction, which is expected to have its first gold production in Q1 2021.

The La Fortuna open pit gold project in Durango (100%-owned) has an extremely robust and positive preliminary economic assessment (PEA) completed and is nearing the end of the permitting process. A construction decision on La Fortuna could be made in late 2020 or early 2021

Minera Alamos is built around its operating team that together brought 3 mines in to production over the last 12 years.

Proven Mine Building team

The Minera Alamos team has successfully built three mines in the last 12 years, including founding Castle Gold and developing the El Castillo mine for $8 million, which was later sold to Argonaut Gold for $130M.