![]() Scorpio Gold Corporation {TSX-V: SGN}

Scorpio Gold Corporation {TSX-V: SGN}

Announced its financial results for the first fiscal quarter (“Q1”) ended March 31, 2019.

.

.

.

.

.

.

Vancouver, May 22, 2018 – Scorpio Gold Corporation (“Scorpio Gold” or the “Company”) (TSX-V: SGN) announces its financial results for the first fiscal quarter (“Q1”) ended March 31, 2019.

.

This press release should be read in conjunction with the Company’s condensed interim consolidated financial statements for the three-months ended March 31, 2019 and Management’s Discussion & Analysis (“MD&A”) for the same period, available on the Company’s website at www.scorpiogold.com and under the Company’s SEDAR profile at www.sedar.com. All monetary amounts are expressed in US dollars unless otherwise specified.

.

On April 15, 2019, the Company completed a 2 for 1 consolidation of its outstanding common shares. All share and per share amounts are shown on a post-consolidated basis retroactively throughout this news release.

.

PERFORMANCE HIGHLIGHTS:

|

Q1 2019 |

Q1 2018 |

|

|

$ |

$ |

|

| Revenue (000’s) |

1,486 |

3,026 |

| Mine operating earnings (000’s) |

111 |

1,111 |

| Net earnings (000’s) |

3,425 |

144 |

| Basic and diluted earnings (loss) per share |

0.05 |

(0.00) |

| Adjusted net earnings(1) (000’s) |

100 |

435 |

| Adjusted basic and diluted net (loss) earnings per share(1) |

(0.00) |

0.00 |

| Adjusted EBIDTA(1)(000’s) |

259 |

690 |

| Adjusted basic and diluted EBIDTA per share(1) |

0.00 |

0.01 |

| Cash flow (used for) from operating activities (000’s) |

(205) |

828 |

| Total cash cost per ounce of gold sold(1) |

1,129 |

832 |

| Gold ounces produced |

1,216 |

2,833 |

| Gold ounces sold |

1,211 |

2,300 |

HIGHLIGHTS FOR THE FIRST QUARTER (“Q1”) ENDED MARCH 31, 2019 AND SUBSEQUENT EVENTS

- 1,216 ounces of gold were produced at the Mineral Ridge mine, compared to 2,833 ounces produced during Q1 of 2018.

- Revenue of $1.5 million, compared to $3.0 million during Q1 of 2018.

- Total cash cost per ounce of gold sold(1) of $1,129, compared to $832 during Q1 of 2018.

- Mine operating earnings of $0.1 million, compared to $1.1 million during Q1 of 2018.

- Net earnings of $3.4 million ($0.05 basic and diluted per share), compared to a net loss of $0.1 million ($0.00 basic and diluted per share) during Q1 of 2018.

- Adjusted net earnings(1) of $0.1 million ($0.00 basic and diluted per share), compared to $0.4 million ($0.00 basic and diluted per share) during Q1 of 2018.

- Adjusted EBITDA(1) of $0.3 million ($0.00 basic and diluted per share), compared to $0.7 million ($0.01 basic and diluted per share) million during Q1 of 2018.

- Subsequent to March 31, 2019, the Company completed a $7 Million convertible debenture private placement financing, and the Company used part of the proceeds therefrom to extinguish certain debts and buy back the remaining 30% interest in Mineral Ridge (Refer to “Debenture Financing and Waterton Buyout” in the Company’s Management discussion & Analysis for the period ended March 31, 2019).

.

(1)This is a non-IFRS measure; refer to Non-IFRS Measures section of this press release and the Company’s Management Discussion & Analysis for Q1 of 2019 for a complete definition and reconciliation to the Company’s financial statements for Q1 of 2019.

.

Outlook

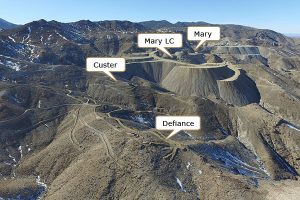

The Company’s main focus is to raise sufficient funds through financings to improve its financial position in order to proceed with the construction of a new processing facility at Mineral Ridge with a view to process heap leach materials and additional open-pit mineral reserves.

.

.

.