Scorpio Gold Corp. {TSX.V: SGN} made their second significant announcement in ten days, as they continue to improve an already impressive production story, in a first class jurisdiction.

Following on from their extended LOM news release on the 21st July, SGN have reported further drilling results from their Brodie Satellite Deposit at Mineral Ridge, Nevada. Some significant intercepts were returned.

Full release can be found here;

http://www.scorpiogold.com/s/news.asp?ReportID=667192

July 31, 2014

Scorpio Gold Reports Results from 2014 Expansion Drilling at the Brodie Satellite Deposit, Mineral Ridge Project, Nevada

Vancouver, July 31, 2014 – Scorpio Gold Corporation (“Scorpio Gold” or the “Company”) (TSX-V: SGN) reports additional results from its 2014 satellite deposit drilling program at the 70% owned Mineral Ridge project, located in Nevada. The Brodie deposit lies southwest of the currently producing Drinkwater and Mary/LC pits and is immediately adjacent to the leach pad.

On July 21, 2014, the Company reported an updated Life of Mine Plan (“LOM”) for the Mineral Ridge Operation, which includes the currently producing Drinkwater and Mary/LC pits and five adjacent satellite deposits, including the Brodie deposit. The cut-off date for the LOM was March 31, 2014. Continued drilling since the March 31, 2014 cut-off date is designed to potentially upgrade and increase the reported mineral reserve and resource estimate and potentially extend life of mine. Drilling on the Brodie deposit continues to meet with success, returning significant intercepts both within and extending outside of the pit shell outlines modelled in the updated LOM.

Highlights from this latest phase of RC drilling on the Brodie deposit include:

- MR14838: 10.34 grams per tonne (“g/t”) gold over 6.10 meters

- MR14839: 4.49 g/t gold over 3.05 meters

- MR14847: 2.52 g/t gold over 7.62 meters

- MR14942: 2.75 g/t gold over 21.34 meters

- MR14943: 2.02 g/t gold over 6.10 meters

All holes presented in Table 1 were completed by reverse circulation (“RC”) drilling. True width is estimated at 80-100% of downhole width. Analytical results were performed by American Assay

Laboratory Inc. in Sparks, Nevada, an ISO/IEC 17025:2005 accredited facility. External check assays to verify lab accuracy are routinely completed by ALS Chemex, an ISO 9001:2000 certified and ISO/IEC 17025:2005 accredited facility. Further details are presented in the Company’s quality assurance and quality control program for the Mineral Ridge project.

Full release can be found here;

http://www.scorpiogold.com/s/news.asp?ReportID=665141

Jul 21, 2014

Scorpio Gold Reports on Updated Life of Mine Plan for the Mineral Ridge Gold Operation, Nevada

Vancouver, July 21, 2014 – Scorpio Gold Corporation (“Scorpio Gold” or the “Company”) (TSX-V: SGN) announces results of an updated Life of Mine Plan (“LOM”) completed for the Drinkwater, Mary/LC, Brodie, Bluelite, Solberry, Wedge and Oromonte deposits at the 70% owned Mineral Ridge Gold Operation, located in Nevada.

The updated mine plan, which includes an updated mineral reserve estimate, projects mine life for Mineral Ridge extending into the 3rd quarter of 2016, or approximately 29 months as of the end of March 2014, the date of the LOM update. Average ore production over this time frame is estimated at 73,700 tons per month (“t/m”) based on estimated Probable Mineral Reserves of 2.1 million tons (“Mt”) grading 0.061 oz/ton gold (131,190 oz contained gold) within estimated Indicated Mineral Resources of 2.7 Mt grading 0.059 ounces per ton (“oz/ton”) gold (160,300 oz contained gold). Expansion and infill drilling of the satellite deposits has continued since the March 31, 2014 cut-off date for the LOM and is expected to add to the resource base and potentially support further conversion of current mineral resources to mineral reserves.

This LOM is inclusive of the Drinkwater and Mary/LC deposits and the five satellite deposits, Brodie, Wedge, Bluelite, Solberry and Oromonte. An Inferred Mineral Resource estimate for the Brodie, Wedge, Bluelite, and Solberry deposits, dated June 1, 2013, was reported in the Company’s August 16, 2013 news release. Development drilling over the past two years has allowed for an upgrade of the previous resource estimate to include Indicated Mineral Resources containing Probable Mineral Reserves. The updated Indicated Mineral Resource estimate for the five satellite deposits is 625,100 tons grading 0.061 oz/ton gold (38,360 oz contained gold), which includes a Probable Mineral Reserve for four of the deposits of 463,880 tons grading 0.065 oz/ton gold (30,050 oz contained gold).

Peter J. Hawley, CEO comments, “We are very pleased with the results of this updated LOM study, which places the Mineral Ridge operation in a very similar position to where it was as of April 30, 2012, the date of the previous LOM study. Over the two year span, approximately 1.7 Mt of ore have been mined at Mineral Ridge, which has been more than replaced by ongoing exploration, resulting in the 2.1 Mt of ore outlined as of March 31, 2014. Results from additional development drilling completed since the March 31, 2014 cut-off date of the study have been very positive and are fully expected to further increase mine life. This latest economic study reinforces that Mineral Ridge has the potential to continue as a producing mine for years to come.”

Principal Outcomes – Life of Mine Study

- Estimated Probable Mineral Reserves: 2.1 Mt grading 0.061 oz/ton gold (131,190 oz contained gold).

- 2.5 year mine life at 73,700 t/m ore throughput as of March 31, 2014.

- Total gold production over projected life of mine is approximately 97,700 ounces gold which includes 85,300 recoverable ounces mined and 12,400 recoverable ounces gold in inventory as of March 31, 2014.

- Average total cash cost per ounce of gold sold of $1,074.

- After tax net present value until mine closure of $7.4 million (8% discount rate) using an average gold price of $1,300/oz.

- Key risks include:

- Current estimated reserves may not be realized causing a shortfall in gold production.

- Current water requirements for the heap leach solution would be in jeopardy if the main water well were to fail. The Company is currently rehabilitating a second water well to reduce this risk.

- Key opportunities include:

- Current estimated reserves may be exceeded, thus increasing gold production.

- There is potential to identify additional mineralization from drill-defined extensions to the known deposits, which may support Mineral Resource estimation updates and potentially be converted into Mineral Reserves.

- Exploration potential of other identified prospects on the Mineral Ridge property.

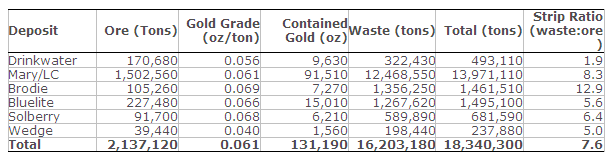

Mineral Reserves presented in Table 1 have demonstrated economic viability. All Mineral Reserves are classified as Probable Mineral Reserves with no Proven Mineral Reserves.

Table 1. Probable Mineral Reserves Estimate – March 31, 2014

Notes to Table 1:

- The effective date of the Mineral Reserve estimate is March 31, 2014.

- The Mineral Reserve estimate was prepared by Jim Ashton, P.E., of Scorpio Gold and audited by independent qualified person, Randy Martin, SME-RM, of Welsh Hagen Associates.

- Mineral Reserves are reported at a 0.020 oz/ton gold cut-off grade.

- Mineral Reserves are contained within a designed pit with access ramps based on the Lerchs-Grossmann (LG) algorithm utilizing a $1,300 oz gold price. The optimization mining cost was $4.15/t of ore mined at Drinkwater, $3.79/t of ore mined at Mary/LC, $2.96/t of ore mined from the satellite deposits, $2.92/t for waste mined from the Drinkwater, $2.57/t for waste mined from the Mary/LC and satellite deposits, and $1.56/t of fill mined. An average processing cost of $11.29 was applied per ton processed. G&A costs were applied at $4.70 per ton processed. Shipping and refining costs of $28.82/oz gold produced were applied. A 65% metallurgical recovery was applied. Overall pit slope angles ranged from 45 degrees to 49 degrees.

- No economic pit was developed for the Oromonte deposit.

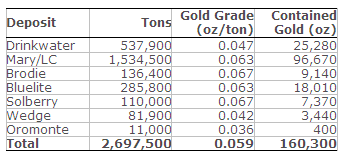

Table 2. Indicated Mineral Resources Estimate – March 31, 2014

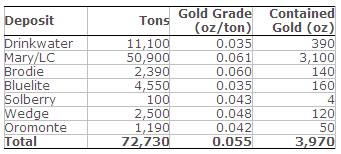

Table 3. Inferred Mineral Resources Estimate – March 31, 2014

Notes to Tables 2 & 3:

- Mineral Resources in Table 2 are reported inclusive of Mineral Reserves.

- The effective date of the Mineral Resource estimate is March 31, 2014.

- The Mineral Resource estimate was prepared by Jim Ashton, P.E., of Scorpio Gold and audited by independent qualified person, Randy Martin, SME-RM, of Welsh Hagen Associates.

- Mineral Resources are reported at or above a 0.020 oz/ton gold cut-off grade.

- Mineral Resources are reported using a long-term gold price of US$1,500/oz.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The Mineral Resource estimate is based on a total of 2,514 drill holes and 108,969 assay results collected between 1939 and 2014 from the Drinkwater, Mary, Brodie, Bluelite, Solberry, Wedge, and Oromonte deposits. The cut-off date for information used in the geologic model and Mineral Resource model was March 31, 2014.