Calidus Resources (ASX: CAI)

Reported on the significant progress that has been made at the Warrawoona Gold Project during the September quarter.

The ramp-up towards steady state production at WGP continued during the period, with the 2.4M tpa processing plant achieving nameplate capacity and the LNG power station commissioned and fully integrated into operations.

.

.

Calidus Resources new solar and battery farm at the Warrawoona Gold Mine, WA.

.

.

| Calidus Resources |

ASX: CAI |

| Stage |

Production, exploration |

| Metals |

Gold, lithium |

| Market Cap |

A$208 m @ A$0.475 |

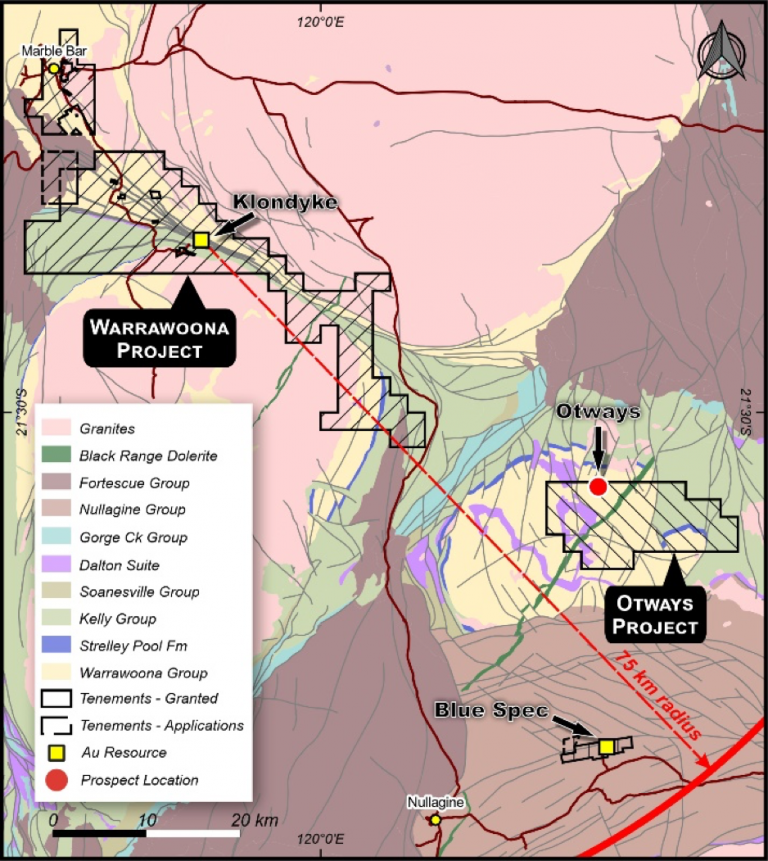

| Location |

Pilbara, Western Australia |

.

Comment

Well “there’s often a slip between cup and lip” as the saying goes, particularly in mining, and Calidus have just validated that with disappointing September Quarter Results.

The share price pulled back 17% yesterday as a result, which may create a buying opportunity provided they produce better results, in line with or exceeding guidance, in the December Quarter.

For me the key positive is that they have identified various points of weakness and taken immediate steps to strengthen these key areas by engaging industry experts, with a focus on staff training.

With covid isolation laws now scrapped for Western Australia, and experts now employed on resolving the production issues, the company have an opportunity to allay market doubts in the next three months, in which case the current lower share price will have been an opportunity.

Calidus Resources September Quarter Operations Update

.

.

Calidus Resources (ASX:CAI) is pleased to report on the significant progress that has been made at the Warrawoona Gold Project (WGP) during the September quarter.

The ramp-up towards steady state production at WGP continued during the period, with the 2.4Mtpa processing plant achieving nameplate capacity and the LNG power station commissioned and fully integrated into operations.

These key milestones were achieved despite challenges stemming from a labour shortage, including the impact of two major COVID outbreaks that occurred during the quarter.

Consequentially, material movement and ore production were restricted due to a large number of critical operational workers required to isolate under the WA Government mandatory isolation requirements.

With the processing plant’s high throughput and recovery rates, mining movement normalising and removal of regulatory COVID isolation requirements, WGP is on track for a strong December Quarter.

.

.

Calidus Managing Director Dave Reeves said:

“We have made substantial progress at Warrawoona during the September quarter despite a number of COVID-19 related disruptions affecting overall production figures due to the reduction in our workforce, however WA has now transitioned away from isolation periods which should minimise impacts moving forward.”

“Positively, the underlying ramp-up performance is highly encouraging including the process plant that has operated at above nameplate capacity with exceptional recoveries.

“The grade control-modelled grade also continues to reconcile well with the resource model and additional initiatives are being implemented to ensure this grade is reflected in the mill, paving the way for a strong December quarter”.

.

.

Mining and Processing Plant

The processing plant is now operating at or above nameplate capacity with a recent

peak of 330tph (equivalent to 2.64Mtpa) achieved against nameplate of 300tph (2.4Mtpa).

Gold recovery remains exceptionally high, averaging 98% for the quarter, 3% above Feasibility Study expectations.

Total mill throughput throughout the quarter was 525,705t at 0.78g/t.

The mill feed during the quarter was adversely impacted as result of COVID-19 related

workforce disruptions that restricted ore tonnages to the processing plant and

subsequently resulted in:

• Lowering of the head grade material feed to the mill

• Increased stockpile depletion

• The ROM cut-off grade lowered to 0.4g/t

A total of 12,657oz of gold was poured during the quarter with 1,380oz of additional gold in circuit.

Mining has since normalised with 36,289t of stockpiles currently on the ROM pad.

A further 14,493m of RC grade control drilling was completed during the quarter, with an additional 20,000m planned for the remainder of 2022.

In the 4 months to date, the grade control model reconciliation to the resource model grade is 100% with a 13% reduction in ore tonnes. The reduction in tonnage is attributable to the exclusion of lower confidence ore blocks away from the main ore zone and it is expected that slightly increased mining rates will make up for any lower ore tonnes predicted by the grade control to date.

Mill head grade and reconciled gold output was lower than the diluted grade control model predicted (0.78g/t v 1.01g/t). This is under review and is believed to be attributable to a combination of blasting and mining practices that are subject to a continuous improvement programme.

These practices resulted in unexpected ore loss and dilution to that modelled in the Feasibility Study.

.

To improve mine to mill reconciliation, Calidus has implemented the following initiatives:

• An external grade control specialist has been mobilised to site to review grade control and mining practices, and has suggested changes to the current system that are being implemented;

• An external blasting specialist has been mobilised to site to review blasting practices and assist with training staff;

• A 3D blast monitoring system has been implemented to better predict ore block positions and grade post blast;

• Additional geologists and pit technicians will be employed to ensure these extra initiatives can be fully covered; and

• A Calidus Mining Superintendent responsible for ensuring quality mining practices has commenced..

.

For brevity, this summary has been abridged. To read the full Calidus Resources news release, including charts, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Calidus Resources, bought in the market at the prevailing price on the days of purchase.

.

.