Cartier Resources (TSX.V: ECR)

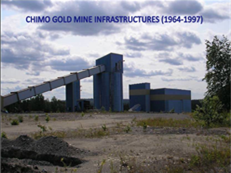

Released positive results of the PEA prepared in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects, on the Chimo mine project located 45 kilometres east of the Val d’Or mining camp.

.

.

.

Cartier Resources pegs Chimo posttax NPV at $388M

2023-04-13 09:40 ET – News Release

Mr. Philippe Cloutier reports

CARTIER DELIVERS POSITIVE PEA FOR CHIMO MINE PROJECT POST-TAX NPV5% OF CAD$388M AND 20.8% IRR

.

Cartier Resources Inc. has released the positive results of the preliminary economic assessment (PEA), prepared in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects, on the Chimo mine project located 45 kilometres east of the Val d’Or mining camp.

Philippe Cloutier, president and chief executive officer stated

“The results of the study demonstrate the economic viability of the project as well as several optimization opportunities related to the characteristics of the project.

“Two drills are in operation on the property and the results continue to increase the size of the gold zones with a view to continuing to increase the project’s resources

“Strategic solutions are being studied to further push the development of the project.”

.

The study presents an underground mining operation with 280 employees that uses conventional longitudinal and transverse longhole stoping at a mining rate of 4,500 tpd (tonnes per day).

Mined mineralized material will be sorted using automated sensor-based sorting technology with an expected concentration ratio of 1.85 and a recovery rate of 91.9 per cent.

The sorted mineralized material would then be processed in a concentrator using a gravity separator followed by a carbon-in-leach process with a capacity of 3,000 tpd for an estimated recovery rate of 93.1 per cent.

The current plan of operations assumes an average annual production of 116,900 ounces for a mine life of 9.7 years.

.

.

Financial analysis

The project requires $341-million of initial capital and $160-million of sustaining capital. Average cash costs of $647 (U.S.)/oz and all-in sustaining cost of $755 (U.S.)/oz are expected over the mine life.

The financial analysis was performed using a 5-per-cent discount rate, a long-term gold price of $1,750 (U.S.)/oz and an exchange rate of $1:77 U.S. cents.

On a posttax basis, the project demonstrates a net present value (5 per cent) of $388-million, an internal rate of return of 20.8 per cent and a payback period of 2.9 years. On a pretax basis, the project demonstrates an NPV of $672-million, an IRR of 27.4 per cent and a payback period of 2.5 years.

.

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author is not a shareholder of Cartier Resources, bought in the market at the prevailing price on the day of purchase.

.

.

.