Orla Mining Continues Explortion Success

Orla Mining (TSX: OLA)

Provided an update on its 2022 exploration activities at Camino Rojo and provided an overview of its 2023 exploration plans in Mexico.

Updates on Orla’s exploration activities in Nevada, US and Panama will be provided in the first quarter.

.

.

.

Orla Mining project panoramic view and location map – Zacatecas State, Mexico

4.66 g/t Au over 64.0 m (Sulphide Zone), 4.02 g/t Au & 1.5% Zn over 22.9 m (Deep Potential), Regional Program Ramping Up with Encouraging Results.

.

.

Vancouver, BC – January 31, 2022 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an update on its 2022 exploration activities at Camino Rojo and provide an overview of its 2023 exploration plans in Mexico. Updates on Orla’s exploration activities in Nevada, US and Panama will be provided in the first quarter.

.

2022 Exploration Highlights: Camino Rojo (Mexico)

Camino Rojo Sulphides: The Sulphide drill program continued to return higher-grade gold intercepts (>2 g/t) over wide widths (>30 m). Notable results include:

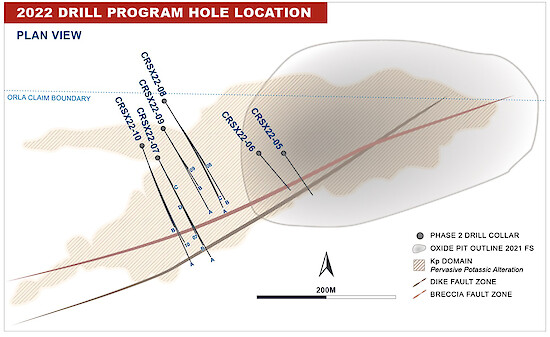

- Hole CRSX22-09B: 4.66 g/t Au over 64.0 m

- Hole CRSX22-09A 2.76 g/t Au over 79.0 m, incl. 3.22 g/t Au over 55.0m

- Hole CRSX22-08C: 2.81 g/t Au over 70.0 m

- Hole CRSX22-10A: 1.92 g/t Au over 87.0 m, incl. 3.14 g/t Au over 25.5 m

and 1.74 g/t Au over 73.5m, incl. 2.61 g/t Au over 24.0 m

.

.

Camino Rojo Deep Potential: Drill results have shown that gold mineralization extends deeper than the limit of the current mineral resource. These deeper intercepts suggest gold mineralization remains open at depth along and adjacent to interpreted feeder-like structures for the currently defined Camino Rojo deposit. Notable result include:1

- Hole CRSX22-07: 4.02 g/t Au & 1.5% Zn over 22.9 m, incl. 56.7 g/t Au & 17.2% Zn over 0.6 m

.

.

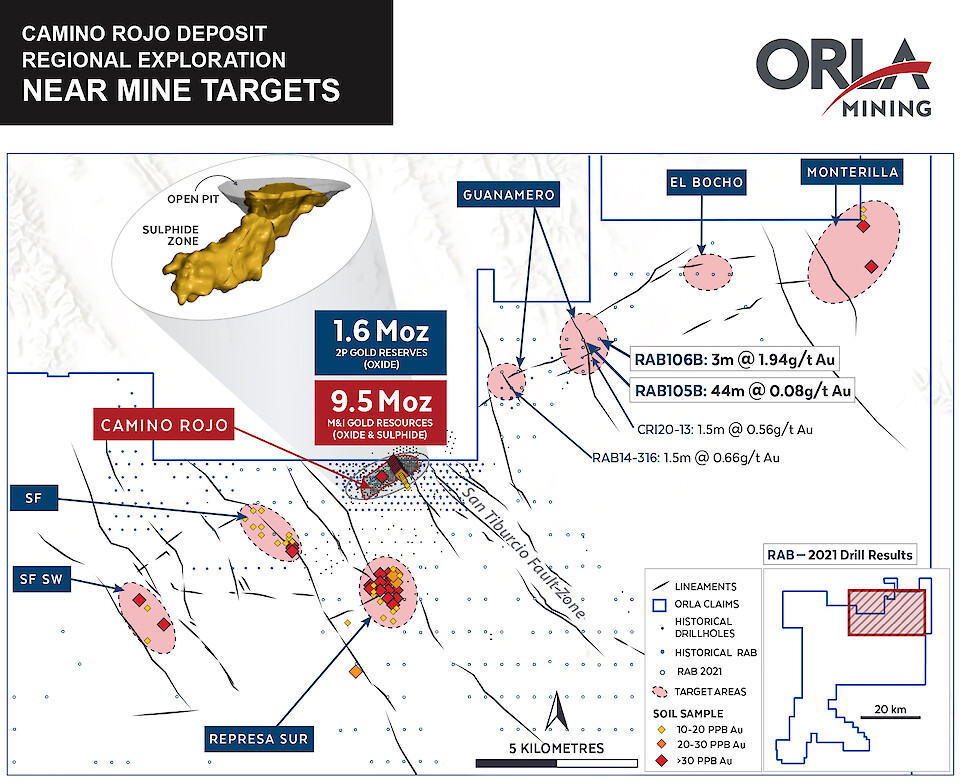

Regional Exploration: Encouraging drill result on the first diamond drill core hole completed outside the footprint of the Camino Rojo mine. The Guanamero target area is located approximately 7 km northeast of the Camino Rojo mine along the mine structural trend. Notable results include:1

- Hole CRED22-01: 0.54 g/t over 7.10 m, incl. 4.12 g/t over 0.7 m (from 51.4 m)

and 1.35 g/t over 2.35 m, incl. 5.59 g/t over 0.5 m (from 104.95 m)

.

.

.

Sylvain Guerard, Orla’s Senior Vice President, Exploration stated;

“The 2022 infill drilling of the sulphide extension of the Camino Rojo deposit has consistently generated exceptional gold intersections enhancing future development opportunity scenarios and potential to grow the resource at depth.

“We are excited to advance a full exploration pipeline in 2023 in an effort to upgrade and expand reserves and resources and make new discoveries on our large and under explored land package”.

.

.

2022 Exploration: Camino Rojo (Mexico)

Exploration at Camino Rojo in 2022 focused on advancing the understanding of the sulphide deposit (the “Sulphide Project” or “Camino Rojo Sulphides”) and testing priority regional targets to make new satellite discoveries.

.

.

Near Mine Exploration Results

Drill results at Camino Rojo Sulphides continue to support potential for underground development

Drilling continues to intercept wide zones of higher-grade gold mineralization, and in conjunction with metallurgical results from the 2021 drilling (see news release dated May 9, 2022), supports the potential for underground development and a standalone processing option for the Camino Rojo Sulphides.

A large part of the 2022 program included infilling the sulphide deposit and improving the geological model to support potential underground mine development scenario. A total of 9,174 metres was completed in 15 holes, with 5 holes previously reported (see news release dated September 12, 2022 – Orla Mining Advances Exploration & Growth Pipeline).

The 15 holes completed in 2022 returned 32 significant mineralized drill intercepts with grade-by-thickness factor greater than 50 g/t by metre Au (g/t * m), including 16 intercepts with grade-by-thickness factor greater than 100 g/t by metre Au. Full drill results are available in the Appendix to this news release and are available at www.orlamining.com.

The current mineral resource estimate for the Sulphide Project at Camino Rojo consists of 74 koz of measured resource (3.358 million tonnes at 0.69 g/t gold) and 7,221 koz of indicated resources (255.445 million tonnes at 0.88 g/t gold) and has an effective date of June 7, 2019.2

Figure 1: Camino Rojo Sulphides 2022 Drill Program Hole Location (Plan View)

.

.

This news release has been abridged for brevity. To read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.

.