![]() Tinka Resources Ltd. {TSX.V: TK}

Tinka Resources Ltd. {TSX.V: TK}

Provided an update of exploration results at the Ayawilca project in central Peru, including results for 10 recent drill holes.

“The discovery of epithermal silver-bearing veins at the Vetas area is a further encouraging development” stated CEO Graham Carmen.

.

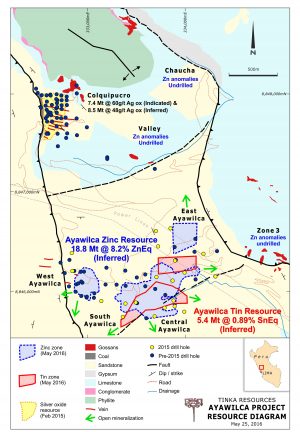

Map of the project showing the old resource numbers

.

2018-10-15 04:11 ET – News Release

Dr. Graham Carman reports

.

TINKA CONTINUES TO EXPAND ZINC MINERALIZATION AND DISCOVERS HIGH-GRADE SILVER VEINS AT AYAWILCA PERU

.

Tinka Resources Ltd. has provided an update of exploration results at the Ayawilca project in central Peru, including results for 10 recent drill holes.

.

Key highlights

- Four resource stepout holes were drilled at South, Central and West Ayawilca. Hole A18-152 is a 60-metre stepout from known mineralization at South Ayawilca. Hole A18-158 is a 100-metre stepout from known mineralization at Central Ayawilca. A18-125 is a new intersection at zone 3. Highlights include:

- A18-152

- 1.2 metres at 13.8 per cent zinc, 0.8 per cent lead, 817 grams per tonne silver and 64 g/t indium from 156.3-metres depth.

- A18-158

- 1.5 metres at 9.6 per cent zinc, 1.2 per cent lead and 32 g/t indium from 458.4-metre depth.

- A18-125

- 1.4 metres at 22.7 per cent zinc and 99 g/t indium from 531.4-metre depth. Note: Intercepts above are down-hole intercepts of mantos hosted by limestone or sandstone. True thicknesses of the mantos are estimated to be at least 90 per cent of the down-hole intercepts.

- A18-152

- Three holes were drilled to test outcropping silver-lead-zinc carbonate veins at the Vetas area, a target drilled for the first time in 2018. High-grade silver intercepts occur with visible ruby silver minerals and associated base metal sulphides in multiple vein structures. The grade-thickness of intercepts improve with depth due to a more favourable host rock (sandstone). The epithermal silver-lead-zinc carbonate vein system remains open and untested along strike and at depth. Highlights include:

- Hole A18-131

- 2.5 metres (true width) at 665 g/t silver, 1.4 per cent zinc and 1.9 per cent lead from 264.0 m depth, including 1.5 metres (true width) at 925 g/t silver, 1.5 per cent zinc and 2.8 per cent lead from 266.0 m depth.

- Hole A18-131

- Tinka has drilled 20,200 metres at Ayawilca in 56 holes during the 2018 drill campaign, mostly as resource stepout holes. New zinc discoveries at West Ayawilca and the Camp areas, in particular, have significantly extended the mineralization beyond the existing resources (current estimated inferred mineral resources contain 5.6 billion pounds of zinc, 3,300 tonnes of indium and 23 million ounces of silver with an additional 66,000 tonnes of tin; November, 2017 news release). The 2018 drill campaign has now ended, as planned, allowing the company’s technical team to compile all geological data and finalize interpretations.

- Roscoe Postle Associates Inc. (RPA) of Toronto has been appointed as independent consultant to undertake a mineral resource update, which is expected to be finalized by November, 2018.

- A preliminary economic assessment (PEA) is scheduled for the first half of 2019.

.

Dr. Graham Carman, Tinka’s president and chief executive officer, stated: “Tinka has been drilling continuously at Ayawilca for 20 months since February, 2017, having drilled more than 40,000 metres during that time. The company is now focusing on compiling and analysing the large quantity of drill hole information, completing a mineral resource update, expanding metallurgical test work and advancing the project to a PEA in 2019. Tinka is well positioned financially with $13-million in cash reserves at the end of September, 2018, and no debt..

“The Ayawilca zinc mineral resource is expected to increase meaningfully as a result of this year’s drill program. Ayawilca is already one of only a handful of independently owned, large zinc resources, located in a mining-friendly jurisdiction with good infrastructure. The property has already attracted interest from a number of large mining companies, and the company has signed multiple confidentiality agreements and conducted several site visits. We are encouraged by the level of potential strategic interest and look forward to completing the resource update and a PEA. (Note that there can be no assurance the company will pursue a transaction or that a transaction, if pursued, will be completed.).

“The discovery of epithermal silver-bearing veins at the Vetas area is a further encouraging development. Although we do not yet have sufficient holes to add to our resource base, the vein system offers additional exploration upside given the high silver grades, while grades and vein thicknesses appear to increase at depth when hosted in the lower sandstone (a quartz-rich unit). We believe further exploration of the veins is warranted. Further drill testing of the veins, along with other targets, is planned for 2019.”

.

Summary of Ayawilca inferred zinc zone mineral resources (November, 2017)

- South Ayawilca: 13.3 million tonnes at 9.5 per cent zinc equivalent (ZnEq) (7.6 per cent zinc, 0.2 per cent lead, 25 g/t silver and 118 g/t indium);

- West Ayawilca: 9.0 million tonnes at 7.2 per cent ZnEq (6.1 per cent zinc, 0.2 per cent lead, 14 g/t silver and 64 g/t indium);

- Central Ayawilca: 13.0 million tonnes at 5.7 per cent ZnEq (4.7 per cent zinc, 0.3 per cent lead, 13 g/t silver and 54 g/t indium);

- East Ayawilca: 7.5 million tonnes at 6.2 per cent ZnEq (5.1 per cent zinc, 0.2 per cent lead, 13 g/t silver and 69 g/t indium);

- Total: 42.7 million tonnes at 7.3 per cent ZnEq (6.0 per cent zinc, 0.2 per cent lead, 17 g/t silver and 79 g/t indium).

.

Notes

(1) $55 (U.S.)/t net smelter return cut-off was used. Metal price assumptions were $1.15 (U.S.) per pound zinc, $300 (U.S.)/kg In, $18 (U.S.)/oz Ag and $1.10 (U.S.)/lb Pb. Metal recovery assumptions were 90 per cent Zn, 75 per cent In, 60 per cent Ag and 75 per cent Pb for the ZnEq calculation.

(2) The NSR value was calculated using the formula: NSR is equal to Zn (per cent) multiplied by $15.34 (U.S.) per Pb (per cent) multiplied by $6.15 (U.S.) plus In (g/t) multiplied by 18 U.S. cents plus Ag (g/t) multiplied by 27 U.S. cents.

(3) The ZnEq value was calculated using the formula: ZnEq is equal to NSR divided by $15.34 (U.S.).

(4) Numbers may not add due to rounding.

Significant new drill intercepts are summarised in the attached table with the strongest intercepts in bold text.

.

RECENT DRILL INTERCEPTS AT AYAWILCA

Drill hole From m To m Downhole int m True width m Zn % Pb % Ag g/t Indium g/t Area Comment

A18-125 518.90 520.00 1.10 10.7 0.0 3 11 Zone 3 Manto

and 531.40 532.80 1.40 22.7 0.0 7 99 Zone 3 Manto

and 545.90 547.70 *1.8 5.1 2.3 82 19 Zone 3 Vein

A18-131 243.60 246.80 *3.2 1.3 1.1 338 0 Vetas Vein

and 264.00 274.00 10.00 2.5 1.4 1.9 665 0 Vetas Vein

including 266.00 272.00 6.00 1.5 1.5 2.8 925 0 Vetas Vein

A18-144 68.20 69.10 *0.9 4.9 2.2 222 0 West Vein

196.00 198.00 *2 0.2 0.5 166 0 West Vein

214.40 217.00 *2.6 4.7 1.9 97 0 West Vein

254.20 255.90 *1.7 1.8 0.3 547 0 West Vein

A18-144 lost at 365.1-metre depth in limestone

A18-147 111.50 112.40 *0.9 0.3 0.4 115 0 Vetas Vein

A18-149 12.30 14.50 *2.2 0.1 0.5 129 0 Vetas Vein

and 211.60 214.70 3.10 1.5 0.8 1.4 221 0 Vetas Vein

A18-152 156.30 157.50 1.20 13.8 0.8 817 64 South Manto

and 224.00 224.70 0.70 10.9 1.2 255 1 South Manto

A18-153 No significant results to 93 m depth South

A18-155 No significant results West

A18-156 70.90 71.90 *1.0 12.2 0.1 36 2 Camp Vein

and 79.80 83.30 *3.5 4.8 0.0 1 1 Camp Vein

A18-158 458.40 459.90 1.50 9.6 1.2 20 32 Central Manto

.

Note: All intercepts shown above are down-hole intercepts. True thicknesses of the manto zinc intersections are

estimated to be at least 90 per cent of the downhole thicknesses. Estimated true thicknesses of vein

intercepts are marked (in brackets, where known). For vein intercepts marked * true thicknesses are

undetermined.

.

Qualified person — mineral resources: The mineral resources disclosed in this press release have been estimated by David Ross, PGeo, an employee of Roscoe Postle Associates Inc. and is independent of Tinka. By virtue of his education and relevant experience, Mr. Ross is a qualified person for the purpose of National Instrument 43-101. The mineral resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). An independent National Instrument 43-101 technical report on the mineral resource estimate for the Ayawilca property, Department of Pasco, Peru, has been filed under the company’s profile on SEDAR and is available on the company’s website.

.

The qualified person, Dr. Graham Carman, Tinka’s president and chief executive officer, and a fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

.

Notes on sampling and assaying

Drill holes are diamond HQ or NQ size core holes with recoveries generally above 80 per cent and often close to 100 per cent. The drill core is marked up, logged and photographed on site. The cores are cut in half at the company’s core storage facility, with half cores stored as a future reference. Half core is bagged on average over one- to two-metre composite intervals and sent to SGS laboratories in Lima for assay in batches. Standards and blanks are inserted into each batch prior to departure from Tinka’s core storage facilities. At the laboratory samples are dried, crushed to 100 per cent passing two millimetres, then 500 grams pulverized for multi-element analysis by ICP using multi-acid digestion. Samples assaying over 1 per cent zinc, lead, or copper and over 100 g/t silver are re-assayed using precise ore-grade AAS techniques.

.

Drill core is orientated and marked as core is removed from the core barrel. In this way geological features in the core such as stratigraphic layering, fault structures, fractures and veins can typically be measured and interpreted in 3-D space.

.

About Tinka Resources Ltd.

Tinka is an exploration and development company with its flagship property being the 100-per-cent-owned Ayawilca carbonate replacement deposit (CRD) in the zinc-lead-silver belt of central Peru, 200 kilometres northeast of Lima. The Ayawilca zinc zone inferred mineral resource estimate now consists of 42.7 million tonnes at 6.0 per cent zinc, 0.2 per cent lead, 17 g/t silver and 79 g/t indium, and a tin zone inferred mineral resource of 10.5 million tonnes at 0.63 per cent tin, 0.23 per cent copper and 12 g/t silver (see Nov. 8, 2017, release). Drilling for resource extensions and the testing of new targets is continuing.

We seek Safe Harbor.