Wesdome Gold Mines Ltd. (TSX: WDO)

Announced Q4 and full year 2021 production results and 2022 guidance.

Production from the Eagle River Complex in Q4 2021 produced 24,630 ounces of gold, putting full year 2021 production at 265,267 tonnes at an average grade of 12.2 gpt to produce 101,403 ounces, near the high end of 2021 production guidance of 92,000 – 105,000 ounces. […]

.

| Wesdome Gold | TSX : WDO |

| Stage | Production, Development |

| Metals | Gold |

| Market cap | C$1.67 B @ C$11.87 |

| Location | Ontario and Quebec, Canada |

.

.

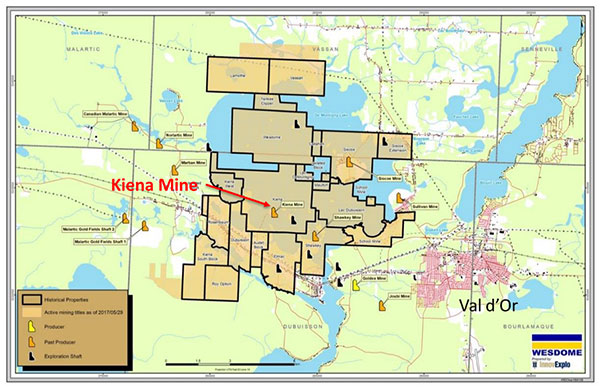

Wesdome Gold – Kiena complex map

.

.

Wesdome Announces 2021 Fourth Quarter and Full Year Production Results (123,843 Ounces); Provides 2022 Guidance

TORONTO, Jan. 13, 2022 (GLOBE NEWSWIRE) — Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces fourth quarter (“Q4”) and full year 2021 production results and 2022 guidance. All figures are in Canadian dollars unless otherwise stated.

Production from the Eagle River Complex in Q4 2021 totaled 62,374 tonnes at an average grade of 12.6 grams per tonne (“gpt”) and a recovery rate of 98% to produce 24,630 ounces of gold, putting full year 2021 production at 265,267 tonnes at an average grade of 12.2 gpt to produce 101,403 ounces, near the high end of our 2021 production guidance of 92,000 – 105,000 ounces.

At Kiena, Q4 production was 38,000 tonnes at an average grade of 14.1 gpt and a recovery rate of 98% to produce 16,929 ounces. Total production for the year at Kiena was 68,470 tonnes at an average grade of 10.4 gpt at a recovery rate of 98% to produce 22,440 ounces, also near the high end of our guidance range of 15,000 – 25,000 ounces.

.

2021 Highlights:

- Eagle River underground gold production of 228,759 tonnes at an average grade of 13.8 gpt at a recovery rate of 98% to produce 99,120 ounces.

- Total Eagle River Complex production of 101,403 ounces, the first time in the mine’s history production exceeded 100,000 ounces.

- Mishi gold production of 36,508 tonnes at an average grade of 2.4 gpt to produce 2,283 ounces.

- Kiena Mine embarked on a construction and mining ramp up as per the May 2021 Pre-Feasibility study – fully funded from cash flow.

- Combined revenue from gold sales of $262.6 million (which excludes an additional $3.9 million from a bulk sample at the Kiena Mine).

- Published Kiena Pre-Feasibility Study (“PFS”); IRR 98%.

- Discovered new high grade Footwall Zone at Kiena Complex.

- Initial sill development and production on the Falcon 7 Zone and discovery of North Contact Zone at Eagle River.

- Monetized Moss Lake via vend-in transaction with Goldshore Resources for aggregate consideration of $57M including $12.5M upfront in cash and 30% of issued and outstanding shares at closing

- Included in TMX 30 recognition program for the third consecutive year. This flagship program showcases the TSX’s 30 top-performing stocks based on dividend adjusted share price appreciation.

- Placed 56thoverall out of 220 TSX-listed companies in the annual Globe and Mail Board Games report on corporate governance, and in a multi-way tie for 10thin the materials category

- In June 2021, the Company released its annual Environmental, Social, and Governance (“ESG”) Report, prepared using the Sustainability Accounting Standards Board (“SASB”) Metals & Mining Standard and providing an overview of the company’s ESG strategies, policies, commitments, and 2020 performance.

.

Wesdome Gold management comments

“2021 was an excellent year for Wesdome. We achieved two significant operational milestones, record production at the Eagle River Complex of 101,403 ounces, and the commencement of pre-production and construction activities at the Kiena mine in preparation for commercial production in Q2 2022.

“These achievements have resulted in further de-risking of the Company with the addition of a second producing Canadian asset which ultimately increases scale and diversifies cash flow sources, both key steps towards becoming a mid-tier Canadian producer.

“Looking ahead to 2022, we are guiding total production of 160,000 – 180,000 ounces, a 30% – 45% increase over 2021.

“We expect costs to be slightly lower than 2021, and are guiding consolidated cash costs per ounce sold to range between $875 – $970 per ounce (US $700 – $775), and all-in sustaining costs (“AISC”) to range between $1,270 and $1,400 per ounce (US$ 1,015 – $1,125).

“Full operating and financial details for 2021 will be provided in the Company’s year end financial statements and management discussion and analysis on March 10, 2022.

“I would like to thank all of our employees and stakeholders who have made this transformational year possible, despite the obvious challenges of the global pandemic and associated supply chain disruptions. Tough times make tough teams.”

Duncan Middlemiss, President and CEO of Wesdome Gold

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.