Wesdome Gold Mines Ltd. (TSX: WDO)

Wesdome Gold Mines Ltd. (TSX: WDO)

Published its gold production results for the Q3 2020.

CEO Duncan Middlemiss commented, “Production in the third quarter of 20,008 ounces was lower than the previous quarter due to annual planned mill maintenance from May deferred to August, year to date production of 70,272 ounces leaves us well positioned to achieve our full year guidance range of 90,000 – 100,000 ounces.”

.

.

.

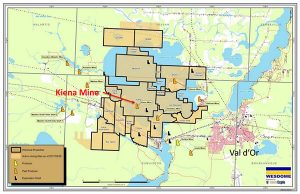

Wesdome Kiena Mine location at Val d’Or

.

.

.

Wesdome Gold Mines – Published its gold production results for Q3 2020.

.

.

TORONTO, Oct. 15, 2020 – Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”) today announces its gold production results for the third quarter of 2020 (“Q3”). All figures are in Canadian dollars unless otherwise stated.

.

Mr. Duncan Middlemiss, President and CEO commented, “Production in the third quarter of 20,008 ounces was lower than the previous quarter due to annual planned mill maintenance from May deferred to August, and the upgrade of the hoist control system affecting the productivity of the Eagle River mine. Year to date production of 70,272 ounces leaves us well positioned to achieve our full year guidance range of 90,000 – 100,000 ounces.”

.

Operations at the Eagle River Complex have continued in the third quarter with several measures in place to facilitate enhanced physical distancing to limit the potential spread of the COVID-19 virus. We are now operating a total of five diamond drills, four underground and one on surface. Mishi open pit operations resumed during the quarter as planned.

.

.

| Amounts are denominated in Canadian dollars | Third Quarter | Year-to-Date | ||||||||||||||||

| 2020 | 2019 | Variance |

% +/(-) | 2020 | 2019 | Variance |

% +/(-) | |||||||||||

| Ore milled (tonnes) | ||||||||||||||||||

| Eagle River | 44,667 | 39,453 | 5,214 | 13 | % | 142,890 | 99,148 | 43,742 | 44 | % | ||||||||

| Mishi | 11,533 | 204 | 11,329 | 5553 | % | 36,301 | 37,297 | -996 | (3 | %) | ||||||||

| 56,200 | 39,657 | 16,543 | 42 | % | 179,191 | 136,445 | 42,746 | 31 | % | |||||||||

| Head grade (grams per tonne, “g/t”) | ||||||||||||||||||

| Eagle River | 13.8 | 23.4 | (9.6 | ) | (41 | %) | 15.1 | 21.9 | (6.7 | ) | (31 | %) | ||||||

| Mishi | 2.5 | 2.8 | (0.3 | ) | (9 | %) | 2.7 | 2.6 | 0.0 | 0 | % | |||||||

| Gold production (ounces) | ||||||||||||||||||

| Eagle River | 19,319 | 28,894 | -9,575 | (33 | %) | 67,893 | 67,723 | 170 | 0 | % | ||||||||

| Mishi | 689 | 15 | 674 | 4493 | % | 2,379 | 2,633 | -254 | (10 | %) | ||||||||

| Total Gold Production | 20,008 | 28,910 | -8,902 | (31 | %) | 70,272 | 70,356 | -84 | (0 | %) | ||||||||

| Production sold (ounces) | 21,700 | 23,450 | -1,750 | (7 | %) | 71,340 | 66,323 | 5,017 | 8 | % | ||||||||

| Revenue from gold sales ($ millions) | $55.0 | $45.9 | $9.1 | 20 | % | $167.0 | $120.6 | $46.4 | 38 | % | ||||||||

| Average realized price per ounce 2 | $2,532 | $1,957 | 575 | 29 | % | $2,341 | $1,819 | 522 | 29 | % | ||||||||

.

Notes:

- Operating numbers may not add due to rounding.

- Average realised price per ounce is a non-IFRS performance measure and is calculated by dividing the revenue from gold sales by the number of ounces sold for a given period.

At Kiena, the Prefeasibility Study (“PFS”) is ongoing and on track to be completed by H1 2021.

.

Technical Disclosure

The technical content of this release has been compiled, reviewed and approved by Marc-Andre Pelletier, P. Eng, Chief Operating Officer, a “Qualified Person” as defined in National Instrument 43-101 –Standards of Disclosure for Mineral Projects.

.

ABOUT WESDOME

Wesdome Gold Mines has had over 30 years of continuous gold mining operations in Canada.

The Company is 100% Canadian focused with a pipeline of projects in various stages of development. The Eagle River Complex in Wawa, Ontario is currently producing gold from two mines, the Eagle River Underground Mine and the Mishi Open pit, from a central mill.

Wesdome is actively exploring its brownfields asset, the Kiena Complex in Val d’Or, Quebec. The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill.

The Company has further upside at its Moss Lake gold deposit, located 100 kilometres west of Thunder Bay, Ontario. The Company has approximately 139.4 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol “WDO”.

/

For further information, please contact:

| Duncan Middlemiss President and CEO 416-360-3743 ext. 2029 duncan.middlemiss@wesdome.com |

or | Lindsay Carpenter Dunlop VP Investor Relations 416-360-3743 ext. 2025 lindsay.dunlop@wesdome.com |

||

| 220 Bay St. East, Suite 1200 Toronto, ON, M5J 2W4 Toll Free: 1-866-4-WDO-TSX Phone: 416-360-3743, Fax: 416-360-7620 Website: www.wesdome.com |

||||

.

City Investors Circle is based in the financial district in the City of London.

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter..

If you wish to present to our select group of active mining investors, please email: andrew@city-investors-circle.com for information.

——-

.

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

These are not recommendations in any form, Always consult an investment professional.