West Red Lake Gold Mines (TSX.V: WRLG)

Announced that as a result of strong investor demand, the Company has amended its agreement with Canaccord Genuity Corp. and Eight Capital, to increase the size of the previously announced “best efforts” private placement of units to raise gross proceeds of up to C$13,000,000, consisting of up to 25,000,000 units of the Company at a price of C$0.52 per Unit.

.

.

| West Red Lake Gold Mines | TSX.V : WRLG |

| Stage | Exploration / Development |

| Metals | Gold |

| Market cap | C$105 m @ 57 cents |

| Location | Ontario, Canada |

.

WEST RED LAKE GOLD ANNOUNCES UPSIZE OF MARKETED PRIVATE

PLACEMENT OF UNITS TO C$13 MILLION

/

.

West Red Lake Gold Mines Ltd. (TSX.V: WRLG) (OTCQB: WRLGF) (“West Red Lake Gold” or “WRLG” or the “Company”) is pleased to announce that as a result of strong investor demand, the Company has amended its agreement with Canaccord Genuity Corp. and Eight Capital (collectively, the “Agents”), to increase the size of the previously announced “best efforts” private placement of units to raise gross proceeds of up to C$13,000,000 (the “Offering”), consisting of up to 25,000,000 units of the Company (the “Units”) at a price of C$0.52 per Unit (the “Offering Price”).

Each Unit will consist of one common share of the Company (each, a “Unit Share”) and one common share purchase warrant of the Company (each a “Warrant”). Each Warrant will entitle the holder to acquire one common share of the Company for 36 months from the closing of the Offering at a price of C$0.68.

The Agents will have an option (the “Agents’ Option”) to increase the size of the Offering by up to C$2,080,000 through the sale of an additional 4,000,000 Units at the Offering Price, which Agents’ Option is exercisable, in whole or in part, at any time up to 48 hours prior to the Closing Date (defined herein).

The net proceeds received from the Offering will be used to advance the Company’s mineral properties in Ontario, as well as for working capital and general corporate purposes.

It is anticipated that closing of the Offering will occur on or about November 28, 2023 (the “Closing Date”), or such other date or dates as the Company and the Underwriters may agree. The Offering is subject to the satisfaction of certain conditions, including receipt of all applicable regulatory approvals including the approval of the TSX Venture Exchange. The securities sold under the Offering will have a hold period in Canada of four months and one day from the closing date in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America.

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

.

To read the full news release, please click HERE

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in West Red Lake Gold Mines

.

.

.

ABOUT WEST RED LAKE GOLD MINES

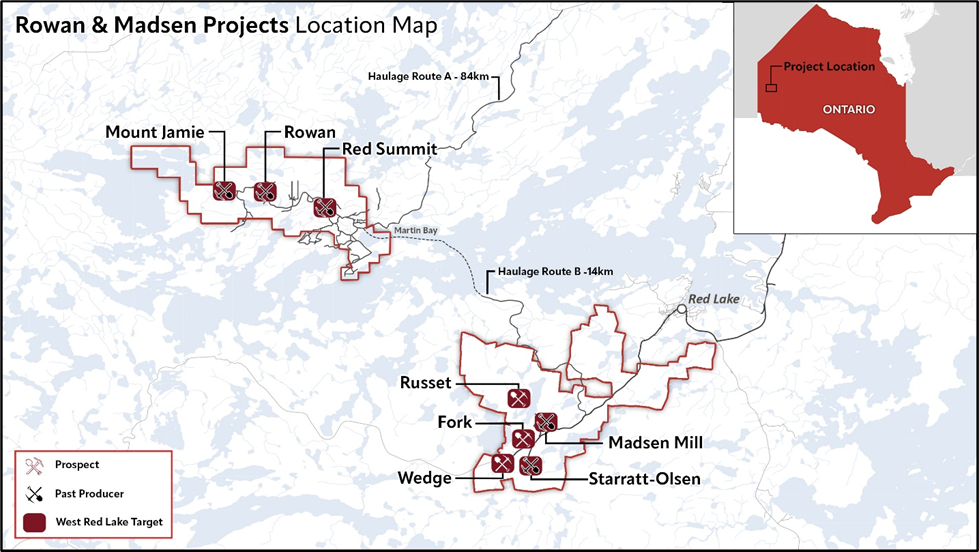

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario.

The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits.

WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.