Zentek Ltd. (TSX.V:ZEN)

A Canadian, IP development and commercialization company focused on next-gen healthcare solutions announces that it has entered into an agreement with Eight Capital as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters to raise up to C$32.5 million via a bought deal, and a non brokered private plaement.

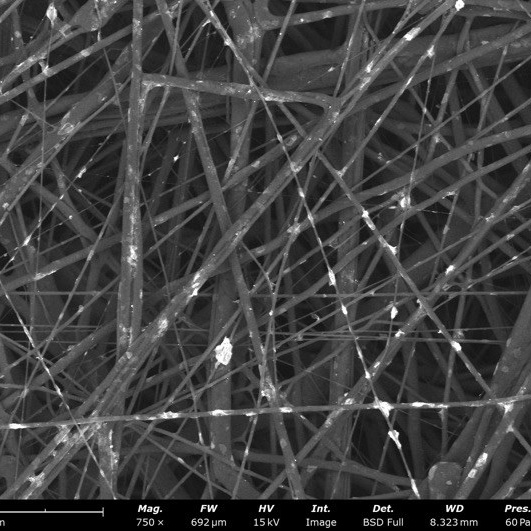

Zentek nanotechnology image

Zentek Announces C$20 Million Bought Deal Public Offering and C$12.5 Million Non-Brokered Private Placement

Guelph, ON

Zentek Ltd. (“ZEN” or the “Company”) (TSX-V:ZEN and OTC:ZENYF)a Canadian, IP development and commercialization company focused on next-gen healthcare solutions announces that it has entered into an agreement with Eight Capital as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters have agreed to purchase on a bought deal basis 3,419,000 common shares of the Company (the “Common Shares”), at a price of C$5.85 per Common Share (the “Offering Price”) for gross proceeds of approximately C$20.0 million (the “Brokered Offering”). The Company has granted the Underwriters an option (the “Over-Allotment Option”) to purchase up to an additional 15% of the Common Shares of the Offering on the same terms exercisable at any time up to 30 days following the closing of the Brokered Offering, for market stabilization purposes and to cover over-allotments, if any.

In addition, the Company intends to complete a concurrent non-brokered private placement of 2,137,000 Common Shares at the Offering Price to certain shareholders for aggregate gross proceeds of approximately $12.5 million (the “Concurrent Private Placement”, and collectively with the Brokered Offering, the “Offerings”).

The Common Shares issuable pursuant to the Concurrent Private Placement will be on the same terms as those issuable pursuant to the Offering.

The net proceeds from the Offerings will be used for capital expenses, research and development, acceleration of business growth opportunities and working capital.

Closing of the Offerings is expected to occur on or about December 8, 2021 and is subject to regulatory approval, including that of the TSX Venture Exchange.

To read the full news release, please click HERE

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.