| Ascot Resources | TSX : AOT |

| Stage | Development + Exploration |

| Metals | Gold |

| Market cap | C$477 m @ $1.28 |

| Location | Golden Triangle, British Columbia |

.

Ascot Announces 25,000 Metre Exploration Drill Program And C$3.8 Million Non-Brokered Flow Through Share Private Placement

Vancouver, B.C. May 17, 2021 — Ascot Resources Ltd (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce the 2021 exploration drill program at the Company’s Premier Gold Project (“PGP”) near Stewart in northwestern British Columbia.

The access road to the site has now been cleared after a winter of significant snowfall and Ascot is preparing to start its exploration program and the preliminary preparations (“Early Works”) for the construction of the PGP. The successful COVID-19 plan implemented in 2020 has been refined to ensure the safety of employees as well as the communities of Stewart, B.C, Hyder, Alaska and Nisga’a Nation. The Company is conducting its program utilizing local contractors and temporary employees with a minimum of travel in and out of the communities.

Although the Company is focused on the construction activities of the PGP, significant effort will go towards realizing the untested exploration potential of the property as well as expanding the resource base of the PGP. The Company is planning to complete approximately 25,000 metres of drilling both from surface and underground starting in the last week of May 2021.

.

Ascot Private Placement

The Company is also pleased to announce a non-brokered private placement to raise total gross proceeds of up to C$3.8 million (the “Offering”).

The total Offering will consist of up to 2,651,796 common shares of the Company, which qualify as “flow-through shares” within the meaning of the Income Tax Act (Canada) (the “FT Shares”), at an average price of $1.42 per FT Share.

Sprott Private Resource Streaming and Royalty (“Sprott”) recently purchased the Red Mountain gold production payment and stream arrangement from Seabridge Gold Inc. On completion of the Offering, it is expected that Sprott will acquire 2,251,796 common shares of the total Offering. These additional funds will be used to finance the Company’s exploration activities this year.

.

Ascot Management Comments

“We have several very promising exploration targets and last year ‘s drilling program demonstrated how successful exploration can be at the Premier site, especially at the Premier West and Day zone areas.

“We are very excited to continue that success in 2021 and we plan to drill several new target areas both close to and away from known resources.”

Derek White, President and CEO of Ascot Resources

.Derek White, President and CEO of Ascot commented,

Surface Exploration

Ascot is planning to start the exploration drilling in the last week of May to the west of the Premier deposit. The lower elevation of this area enables the Company to commence exploration at this time until the road to Big Missouri has been cleared and snow has melted at higher elevations.

Last year’s program successfully traced gold mineralization from the Premier deposit towards the west. There is significant volume of prospective rock to the west and northwest of last year’s drill holes that will be targeted in the early stages of the 2021 program.

Depending on the access to drill pad locations, exploration activities will move to Woodbine or the Day Zone at Big Missouri. The Woodbine prospect is located to the west of the Premier deposit and last year’s drilling intercepted high-grade gold mineralization at two different elevations.

Anomalous soil geochemistry indicates the possible presence of mineralization at a third elevation higher than the other two that were tested last year. Late in the 2020 season, the Ascot team established a drill pad location at the top of the Woodbine prospect that is designed to test mineralization of all three elevations and determine the orientation and extend of these new zones.

At the Day Zone at Big Missouri, drilling has intercepted high-grade gold mineralization in multiple drill holes from three different drill pads covering an initial strike length of 150 metres.

Gold mineralization appears to trend north-south in this area and is open in these directions. Drilling this season will attempt to expand the extent of new mineralization in both directions and establish the orientation and character of the zones.

The presence of high-grade mineralization at the Day Zone is of particular significance as this area is relatively close to planned underground development in the Big Missouri area.

The Company is also planning to drill underexplored areas north of the Premier deposit (Sebakwe zone) and showings in the very northern part of the tenement north of Big Missouri.

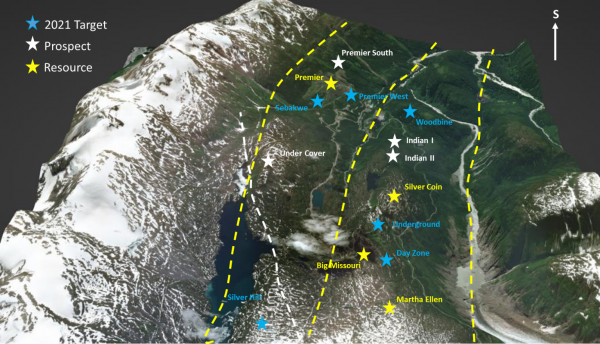

Figure 1 Overview of the Premier Gold Project depicting resource areas, prospects and 2021 exploration targets. The area is divided by north-south running faults (dashed yellow lines) and hosts many areas of mineralization. The resource areas are well defined while many of the other numerous targets require significant additional exploration in order to determine their full potential. The dashed white line signifies the location of a volcano-sedimentary contact close to the Silver Hill prospect.

.

Underground Exploration

The Company has submitted a notice of work to commence underground drilling from an exploration ramp that will be driven from the S1 pit at Big Missouri towards the Silver Coin deposit as soon as permits have been received.

The underground exploration will have two different objectives: The first objective is to explore the area between Big Missouri and Silver Coin where drilling to date has been sparse; and the second objective is to drill test various zones of inferred resources and upgrade their resource status to indicated in order to enable the inclusion of these resources into the mine plan.

Underground access also presents opportunities to drill a few deep holes to probe the underlying areas that have to date not been tested due to prohibitive cost and limitations of the available equipment.

.

The Offering

The gross proceeds from the issuance of FT Shares will be used for “Canadian exploration expenses”, and will qualify as “flow-through mining expenditures” as those terms are defined in the Income Tax Act (Canada), which will be renounced to the initial purchasers of the FT Shares with an effective date no later than December 31, 2021 in an aggregate amount not less than the gross proceeds raised from the issue of the FT Shares.

The Securities issued in the Offering will be subject to a hold period expiring four months and one day from the closing date of the Offering.

The closing of the Offering is expected to occur on or before June 7, 2021 and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory approvals, including the acceptance of the Toronto Stock Exchange.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com for information.

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

The writer currently owns shares in Ascot Resources, bought in the market at the prevailing price on the day of purchase.