Calidus Resources (ASX: CAI)

Announced improved results for the June Quarter, meeting production and cost guidance.

FY24 guidance is 65,000 – 75,000 Oz gold at an AIS|C of A$1,900 to A$2,100.

.

.

| Calidus Resources | ASX: CAI |

| Stage | Production, exploration |

| Metals | Gold, lithium |

| Market Cap | A$121 m @ A$ 20c |

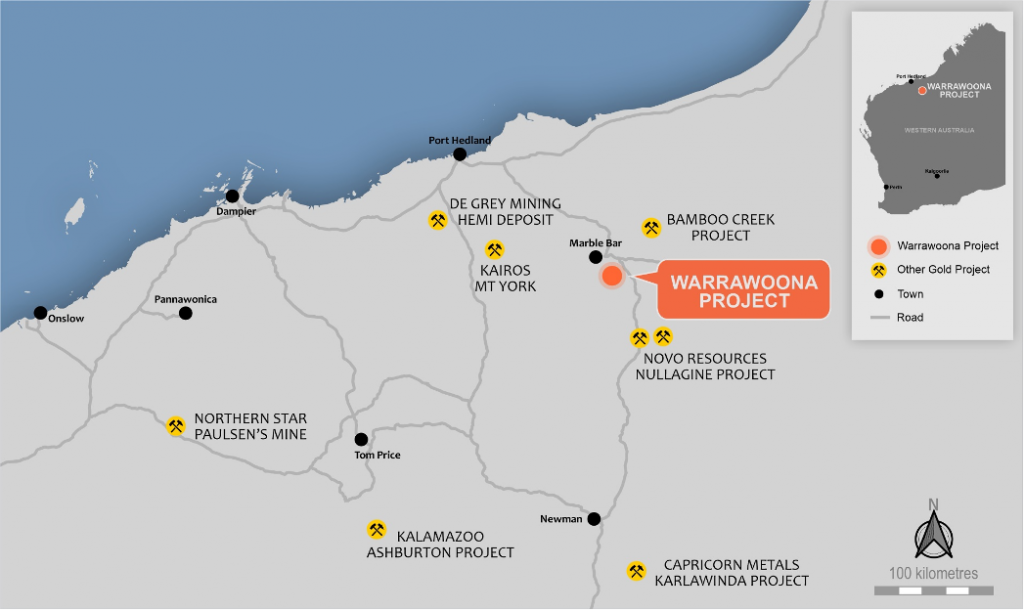

| Location | Pilbara, Western Australia |

.

.

Calidus Meets Half-Year Production and Cost Guidance for the June Quarter

FY24 guidance is 65,000 – 75,000oz at an AISC of A$1,900 – A$2,100/oz

.

OPERATIONS

• Zero Lost Time Injuries and Zero Recordable Injuries in the quarter

• Warrawoona Gold Project (WGP) met guidance for the half year with 31,364oz

produced at an AISC of $2,172/oz

• Record quarterly gold production for the June 2023 quarter; 7% increase in

quarterly gold production to 16,177oz at an AISC of $2,245/oz; 15% increase in mill

throughput to 675,170t

• Gold sales for the quarter of 15,487oz for revenue of $40.1M at an average realised

price of $2,590/oz

• Operating cashflow of $10.2M offset by a realised loss of $5.7M on hedge contracts

CORPORATE AND FINANCIAL

• At the end of the June Quarter, Calidus held cash and cash equivalents of $26.0M

including $21.6M of cash and $4.4M of bullion after $6.0M debt repayment and

$1.4M spent on development and growth activities

• Project Loan Facility reduced to $81.0M at quarter end; Hedge reduced by

9,250ozs to 106,250ozs

• Calidus raised $24.8M (before costs) via a $23.0M Placement and $1.8M Share

Purchase Plan plus the conversion of $10.5M of Macmahon’s creditor position to

equity at the same price as the placement

.

GUIDANCE FOR 2023-24

• FY24 guidance is 65,000 – 75,000oz at an AISC of A$1,900 – A$2,100/oz

• Production expected to be weighted to second half due to mill shut in Q1 and

higher-grade ore being accessed in H2.

• AISC forecast to be lower in H2 due to reduced strip ratio and increased production

• Forecast life-of-mine costs for the open pit estimated at an AISC of $1,750 –

$1,850/oz. The lower costs for LOM reflect strip ratios reducing 20% as the pit is

deepened and associated reduction in mining costs.

To read the full news release, please click HERE

——-

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Calidus Resources

..