Mining Review Sunday Update 20th March 2022

Nickel prices are back to normal, whatever that is, after a strange week where trading on the LME was interrupted several times, after deals were reversed earlier, ostensibly to bail out a horrendously underwater Chinese trader.

Gold remains above $1900 per ounce, despite interest rate rises this week being less than anticipated.

.

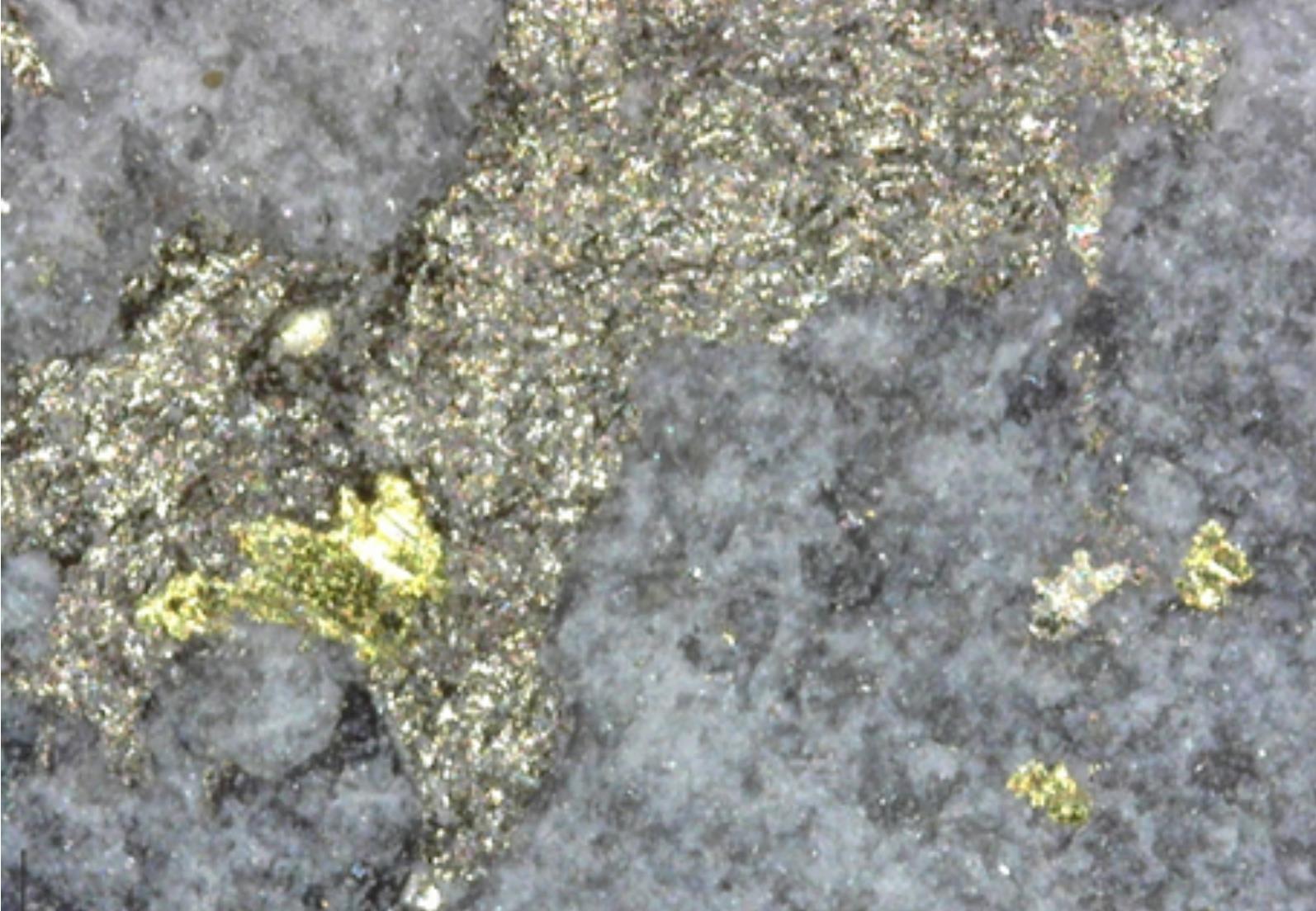

Banyan Gold drill intercept, Yukon, Canada.

.

City Investors Circle Mining Review Sunday Update 20th March 2022

Nickel prices are back to normal, whatever that is, after a strange week where trading on the LME was interrupted several times, after deals were reversed earlier, ostensibly to bail out a horrendously underwater Chinese trader.

Gold remains above $1900 per ounce, despite interest rate rises this week being less than anticipated.

What is becoming rapidly apparent is that commodity supply chains are seizing up, worse then they were before the Ukraine confrontation. Russia is a large supplier of refined copper, platinum, palladium, thermal coal, coking coal, and uranium.

Ukraine and Russia also supply a lot of the world’s wheat, around 40% of exportable wheat, and I sincerely doubt that supply can be replaced. In the short term it is difficult to see commodity prices falling much, one suspects they will rise strongly.

One way to play the commodity markets is via the Rogers Index funds for agriculture, energy, and metals. Another is to invest in the COPX ETF invested in our friend copper.

.

General mining news

Las Bambas copper mine in Peru was blockaded by local residents, but that has now ceased and copper production has resumed.

City Investors Circle watchlist companies making news this week

Maple Gold Increased their Douay Mineral Resources

Cornish Metals Sold their Sleitat NSR to Electric Royalty

GoldMining Inc. Acquired the NSR For Yarumalito

Market Data (In US$)

.

Precious metals

| Gold | 1922 | -3% |

| Silver | 24.88 | -4% |

| Palladium | 2501 | -11% |

| Platinum | 1029 | -5% |

| Rhodium | 20250 | 7% |

.

Base metals

| Copper | 4.61 | 0% |

| Nickel | 19.12 | -13% |

| Zinc | 1.73 | -4% |

| Tin | 18.98 | -2% |

.

Energy metals

| Cobalt | 37.03 | -1% |

| Manganese | 3.95 | 11% |

| Lithium | 74247 | 0% |

| Uranium | 56.35 | -7% |

.

Bulk commodities

| Iron Ore | 148.7 | -9% |

| Coking Coal | 620 | 31% |

| Magnesium | 6523 | -8% |

.

Metals ETF’s

| GDX | 37.22 | -3% |

| GDXJ | 47.06 | -1% |

| Sil | 36.33 | -2% |

| SILJ | 14.26 | -1% |

| GOEX | 32.69 | -1% |

| GLD | 178.3 | -4% |

| COPX | 43.91 | 2% |

The City Investors Mining Review is complete

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.