Neometals (ASX: NMT)

Have announced the demerger of their Mt. Edwards Nickel project into a newco, Widgie Nickel Limited, to be subsequently listed on the ASX.

NMT shareholders will benefit by the receipt of free shares in the newco, as well as having the option to subscribe through a rights issue. The timeline is scheduled for Q4 2021.

.

| Neometals | ASX : NMT |

| Stage | Production + development |

| Metals | Titanium + Vanadium + lithium + nickel |

| Market cap | A$281 m @ 51.5 c |

| Location | Western Australia |

.

.

Neometals intend to demerge their Mt. Edwards Nickel Project into a Newco

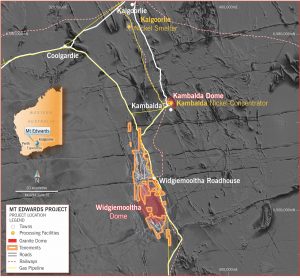

Neometals Ltd (ASX: NMT) (“Neometals” or “the Company”) is pleased to announce its intention to demerge its Mt Edwards Nickel Project (“Mt Edwards Project”) into a dedicated nickel exploration and development company to be called Widgie Nickel

Limited (“Widgie Nickel”).

The Mt Edwards Project contains a material estimated Mineral Resource inventory of 162,000 tonnes of contained nickel across 11 deposits and, after careful consideration of the various strategic options available to realise value for Neometals shareholders, the Neometals board, subject to certain conditions, has approved the proposed demerger (“Demerger”).

HIGHLIGHTS

• Mt Edwards Nickel Project to be demerged into a new company, “Widgie Nickel Limited”. Post demerger, Widgie Nickel will seek to list on ASX;

• Eligible Neometals shareholders to receive new Widgie Nickel shares (at no cost) on a pro rata basis in proportion to their existing Neometals shareholding via a capital reduction and in-specie distribution, subject to Neometals shareholder approval among other things;

• Post demerger, Widgie Nickel shareholders will be entitled to participate in an entitlement offer to subscribe for additional Widgie Nickel shares;

• Post demerger and entitlement offer, Widgie Nickel will have dedicated resources and capital to realise Mt Edwards’ long-term latent value allowing Neometals to focus on its core ‘battery materials’ projects; and

• ASX listing of Widgie Nickel is expected to occur by Q4 in 2021, with further information to be released in the coming weeks.

Neometals management comments

“The demerger and return of our Mt Edwards asset offers existing Neometals shareholders the opportunity to realise the inherent long-term value of this exciting development story in a discrete, nickel focussed corporate vehicle.

“Widgie Nickel has a number of very exciting deposits located on the Widgiemooltha Dome, a world class nickel sulphide camp that has hosted more than seven historical nickel mines and hosts Australia’s newest high-grade nickel mine being developed less than a kilometre from our southern tenure.

“These assets are highly deserving of their own time and attention, and the recent metallurgical results from just one of the deposits that revealed high grade palladium reporting to concentrate demonstrates just some of what can be achieved with a dedicated focus.

“Widgie Nickel is strongly leveraged to both the world economic recovery

and the electrification of transport which will drive increasing product demand from both the traditional steel and lithium battery sectors.

“The Neometals Board considers it is the best outcome for shareholders that a new, independent entity is established to devote the technical, human and financial resources that the Mt Edwards Project deserves.

“We are excited by what Widgie Nickel can achieve with the assets. A capital reduction and in-specie distribution to Neometals shareholders will provide a direct level of participation in a new nickel-focussed business, while Neometals remains focused on the Lithium-ion Battery Recycling JV (Primobius GmbH), the Scandinavian Vanadium Recovery Project and the Barrambie Titanium Project.”

Neometals’ Managing Director, Chris Reed

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

To read our full terms and conditions, please click HERE