Reed Resources, an ASX listed lithium and titanium development and exploration company have been renamed Neometals {ASX: NMT}, with immediate effect.

Author Archives: admin

Zenyatta Ventures share price hit after latest news release fails to excite investors

Zenyatta Ventures {TSX.V: ZEN} share price hit after latest news release fails to excite investors.

The share price has since regained half of the loss

Nymox secure 1.7m funding and announce NASDAQ market deficiency

Nymox Pharma {NASDAQ: BYMX} announced the closing of a $1.7 million financing, boosting the treasury and allowing for continue developing their prostate cancer programs.

Nymox also announced the current share price means they are deficient ..

Scorpio Gold drill results provided some early festive cheer for their investors

Scorpio Gold Corp. {TSX.V: SGN} gave their investors some early festive cheer by reporting further drill results from their Mary LC Deposit at Mineral Ridge, Nevada.

CEO Peter Hawley reported some excellent grades with one hole delivering 7.79 g/t Gold over 9.14 metres, from a shallow depth.

Terrace Energy CEO Gibbs issues revised market guidance

Terrace Energy {TSX.V: TZR} CEO Dave Gibbs announces that “the company have reacted to lower oil prices and taken steps to adjust its capital budget and development plans in response to the drop in commodity prices”.

Gibbs added “we believe that current oil prices are not the result of a sudden and precipitous change in long term fundamentals but rather the result of geopolitics. As a consequence, it is highly probable oil prices will”

London Mines and Money ignore the mining sector slump by declining some buy side investors and the trading of entry badges was brisk

London Mines and Money 2014 review – The mining sector is on its knees, yet incredibly, some buy side investors were declined for the recent show!

Numerous people registered under false names, and many others traded entry badges ..

Inovio Pharmaceuticals added to the prestigious NASDAQ Biotechnology Index

Dr. J. Joseph Kim. President and CEO proclaimed “another milestone achieved” as Inovio Pharmaceuticals {NASDAQ: INO} celebrated being added to the influential and prestigious NASDAQ Biotechnology Index, effective December 22nd 2014.

A class action lawsuit has been commenced against Nymox Corp. and its board

A class action lawsuit has been commenced against Nymox Corp. and its board of directors on behalf of shareholders that purchased their shares between January 2011 and November 2014.

The allegation is that Nymox failed to disclose material information affecting the Phase 3 clinical trials for its proprietary drug NX-1207 for the treatment of benign prostatic hyperplastic (BPH).

Scorpio confirms additional resources from drilling at Bluelite

Scorpio Gold {TSX.V SGN} continue to report good drilling results from their Mineral Ridge Property (70%) in Nevada, this time from the Bluelite Satellite Deposit.

The Bluelite is one of five satellite deposits outside of the producing pit area at Mineral Ridge, the focus of the current drilling to increase the LOM..

Continue reading

Cartier Resources confirm continuity at depth on their MacCormack property

Cartier Resources {TSX.V ECR} confirm recent drilling intersected massive sulphides on their MacCormack property on Quebec.

The drill results show continuity at depth..

Continue reading

Colonial Coal update institutions and investors in London

Colonial Coal Intl. {TSX.V: CAD} President and CEO David Austin updated institutions and investors in London recently, as he passed through on his return from a hectic schedule of meetings in Asia and the Far East.

David was keen to update investors and discuss the opportunities that may arise from the current low price of coking coal, and he opined that the bottom may well be ..

Continue reading

Scorpio intersects good mineralisation at the NW Brodie Trend

Scorpio Gold {TSX.V SGN} Intersects 1.12 g/t Gold over 36.58 meters on the NW Brodie Trend, Mineral Ridge Project, Nevada, USA.

The Brodie Trend is outside the area of the current resource, and CEO Peter Hawley commented “we have an opportunity to potentially outline a significant resource in an area that until this year was held under a privately held patented mineral claim. The claim”

Inovio Roche to continue partnership on INo-1800

Inovio Pharma {NASDAQ: INO} ends collaboration with Roche re ONO-5150, but confirms ongoing partnership re INO01800 Hepatitis B virus.

President and CEO Joseph Kim confirmed the ongoing partnership for INO-1800 “continues to thrive” on the ..

Continue reading

Terrace reports on production development activities

Terrace Energy {TSX.V: TZR} report that three well test results will be available in early December.

The company has expectations that these three wells will perform in a consistent manner to the earlier seven wells drilled at the site, and produce around 1,000 BOEPD

The Munich International Precious metals and Commodities show is my favourite mining show

The Munich based International Precious Metals and Commodities show is my favourite mining show, and is once again upon us.

We are a week away from my favourite mining show of the year, the Munich based International Precious metals and Commodities show, often affectionately known as the ‘Munich Gold show’ by some of us anglophiles!

I attend this excellent show every year

El Nino confirms final court victory and the return of all their DRC assets

El Nino Ventures Receives DRC Supreme Court Approval for All Arbitration Awards to be applied in the DRC Against GCP Group.

Mining veteran Harry Barr today confirmed the final court victory for El Niño in the DRC to recoup property, assets, and equipment fraudulently removed from the custody of El Niño.

Continue reading

WesternZagros tests their Sarqala-1 well at up to 11,500 bbl day

Western Zagros {TSX.V WZR} WesternZagros tests Sarqala-1 well at up to 11,500 bbl / d

Western Zagros delighted shareholders by producing flowrates of up to 11,4500 bbl day, 40 degree API oil, exceeding expectations of around 8 – 10,000 bbl/d.p.for their Sarqala1 well in Iraq.

The market took this excellent news in its stride, and has yet to respond positively, with other factors outside WZR’s control being the cause.

Range Energy {CSE: RGO} declares commercial oil find at Khalakan, Kurdistan, Iraq

Range Energy {CSE: RGO} announce a commercial light oil discovery for their Khalakan JV project located in Iraqi Kurdistan.

Sadly Range are prevented from releasing full details of the discovery due to their Gas Plus Khalakan partners not sharing this information with them!

Reed Resources commences drilling of high priority nickel targets in the Yilgarn Craton

Reed Resources {ASX: RDR} commences drilling of high priority nickel targets in the Yilgarn Craton.

ASX listed Reed Resources confirms that drilling has commenced at its Green Dam and Mt. Gordon nickel sulphide targets, located in Western Australia at Yilgarn.

Reed, with strong existing projects in Lithium and titanium, sees these targets as highly prospective for nickel.

Continue reading

Colonial Coal Profile

Colonial Coal International {TSX.V: CAD} is the third company founded by Canadian coal veteran David Austin, all located in the prolific Peace River coal region of British Colombia, Canada.

David’s previous ventures both ended in success, Western Canadian Coal were bought out for Walter Energy for $3.2 billion, and NEMI, his follow up company, listed on the TSX.

Other members of an experienced and accomplished management team include John Perry, who has 35 years exploration experience in the Peace River area, and Perry Braun, a capital markets expert.

The Peace River region is famous for high quality metallurgical (coking) coal, principally used in steelmaking, and in large demand from the Asian powerhouses of China, Japan, and India.

The key to any successful company is, of course, the knowledge and experience of the management team, and here Colonial scores very highly, with an accomplished team that have created significant shareholder value before, as detailed below.

Directors and Management

David Austin – President, Chairman of the Board, and CEO.

David Austin has founded Western Canadian Coal, NEMI, and Colonial Coal, and combines an extensive knowledge of the coal industry, with an intimate knowledge of the Peace River region, and also has prior experience managing transport and logistics.

John Perry – Chief Operating Officer and director.

John has over thirty years’ experience working in the Peace River coalfields, and has an encyclopaedic knowledge of the geography, geology, and the companies working there.

Previous experience includes Director of Exploration for Belcourt Saxon, and NEMI.

Perry Braun – VP Corporate Development

Perry has extensive corporate and capital markets experience gained working for both Goldman Sachs and BMO Nesbitt Burns in London, New York, Toronto, and Vancouver.

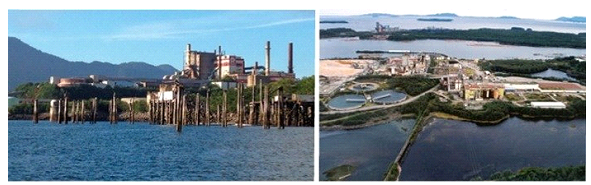

Perry is the CEO of WatCo, a group looking to create and establish port facilities on the B.C. coast at Watson Island, Prince Rupert.

Key highlights

- 397 million tons of Indicated + inferred high quality coming coal

- Experienced management team

- Both projects owned 100%

- Projects in a prolific region for coking coal

- Neighbouring properties owned by major mining companies

- Safe jurisdiction

- Potential for regional consolidation

- Interest in Watson Island port development

Projects – Peace River Valley, B.C.

Huguenot

A mature project that has a 43-101 resource of 397 tons of high grade metallurgical (coking) coal already defined. It is amenable to open pit mining, and the resources are split between surface and underground.

The project consists of one contiguous block of 13 coal licences and two licence applications that encompass previously explore deposits. The property is located 140km from the Quintette load out

Colonial, quite rightly, do not see the value in spending millions more dollars expanding the existing resource here, which is clearly correct and prudent in the current market. The resource speaks for itself, and is open in both directions and at depth.

Huguenot looks an ideal candidate to be sold to one of the neighbouring larger players, such as Canadian Dehau, Belcourt Saxon, or Teck.

Flatbed

Flatbed is located some 40kn south of Huguenot, and is a green field exploration project, albeit with some historical drilling from the 1980’s when a previous owner drilled for oil and gas.

The project is conveniently located some 9 kilometres from the Quintette and PRC Loadout facilities.

Neighbouring properties include Anglo American’s Trend and Teck’s Window (proposed mine), and touches Canadian Dehau’s property where they recently announced a discovery of 7 billion tons of coking coal, considered to be the world’s largest to date.

Colonial have recently received their exploration licences for Flatbed, and now the Ministry for energy and Mines (MEM) have approved a phase 1 Work permit which allows for 48 drill holes, and is valid until October 2018.

The MEM is currently processing the phase 2 Work Permit, which includes three targets considered to be worthy of exploration by an independent consultant to the company.

Due to the receipt of the work permit being so close to the Canadian winter, it looks likely the phase 1 drilling will take place in mid-2015 currently. This could well be opportune, as it would allow CAD to evaluate any JV opportunities that may arise, and allow for a larger drill next year if the phase 2 work permit is received in the meantime.

Watson Island (Watco)

Colonial Are in discussions with the City of Prince Rupert re the acquisition and refurbishment of the Watson Island port facility.

This is currently in legal dispute, and discussions are currently taking place between both parties.

Current tends

The global coal market is currently suffering from an oversupply situation.

This situation is being resolved by some supply being taken out of the market, as some mines become uneconomic at the lower prices, and cease production.

The problem is particularly acute for thermal coal, where many Australian producers are currently losing money, and the recent Chinese import duty can only exacerbate the problem.

Colonial’s assets, are, fortunately, metallurgical, or coking coal, and this is more in demand for the iron and steel industry, where there is an anticipated shortfall in supply due in 2016.

It is hoped the recent market price of around US $110 constitutes the bottom, and in recent weeks the price has strengthened somewhat, though not spectacularly so.

It has to be remembered that coking coal prices are quoted in US $, and Colonial’s costs are all in Canadian $, so a $120 price equates to $132 For Colonial, at the current US$1.10 exchange rate.

Future Prospects

David Austin has founded two coal exploration companies that were successfully sold to larger producers, creating shareholder value, and is looking to achieve his hat trick here.

Given the current state of the commodities markets, and coal in particular, shrewd money is looking to buy in at these low prices.

This is clearly demonstrated by the London based X2 Resources fund, run by Mick Davis, who, after raising $3.5 billion on March 2014, was able to raise another $1 billion from investors in October 2014, to continue to buy assets at these low levels.

Clearly Colonial have some options to consider;

- A potential partial sale of Huguenot

- A complete sale of Huguenot

- A JV on Flatbed

- A deal on the Watco port.

It has to be remembered that Colonial have a tight share structure, and are not looking to raise money at these low prices, whereas many companies are having to do so, due to lack of funds, and shareholders are suffering acute dilution where this is occurring.

Colonial’s management are prudent and shrewd, which are key skills in the current market environment.

The next twelve months are looking to be very interesting for Colonial Coal.