Mining Review 19th February 2023

The early euphoria of the first trading days of 2023 has clearly subsided now, as has the gold price, and share prices of mining companies are sliding .

Calidus Resources, Eloro Resources, Japan Gold, Karora Resources, and Orla Mining made news this week.

I reference “greed creep” in mining conferences.

.

.

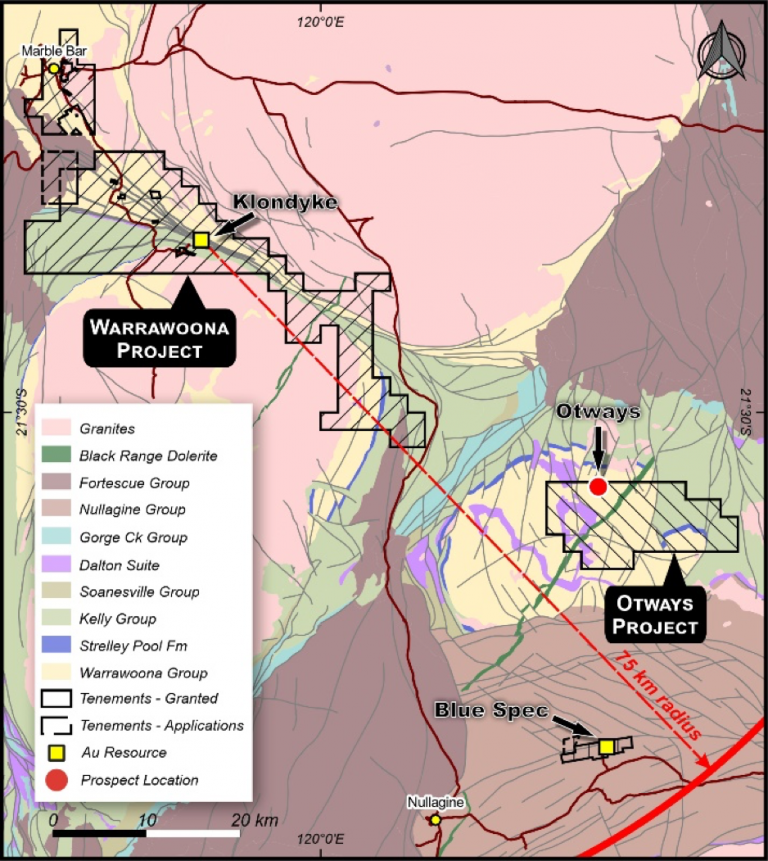

Calidus Resources – Blue Spec Project 20 km from their Warrawoona Gold Mine.

City Investors Circle Mining Review 19th February 2023

..The early euphoria of the first trading days of 2023 has clearly subsided now, as has the gold price, and share prices of mining many companies are sliding once again. I had hoped the start of year rally associated with the TSX would last longer than a month, but that now looks to be a vain hope.

Quite disappointing, we are only a couple of months away from the “sell in May” summer doldrums, so once again I’m holding dry powder waiting for further opportunities. The ASX sells off towards the end of the Australian tax year at the end of June, so that normally produces some bargains.

Calidus Resources, Eloro Resources, Japan Gold, Karora Resources, and Orla Mining made news this week, with an unresponsive market soaking up the good news like a sponge and adding nothing to the share prices.

“Greed creep” in mining conferences.

Mining conferences are funded by the presenting companies paying a fee to present, with probably the cheapest being PDAC at around C$2,600 per booth, to Swiss and London conferences where fees are much higher at around £12,000 or more per company.

To be a success and justify the investment made by the presenting companies, conferences need genuine investors to attend and meet relevant companies. It used to be so simple, register, and in you went.

Sadly greed is now creeping in, as conferences have seen the opportunity to make more money by charging investors to attend to meet the companies that have paid large sums of money to be there!

The Australian based Diggers and Dealers is very expensive to attend, around £1,200, and I have only attended once, as it also requires a premium priced air ticket, as it’s in the UK summer, and accommodation is hard to find.

PDAC then followed a couple of years ago, charging C$25 per day, which isn’t expensive per person, but with over 25,000 delegates, quite a tidy sum. And with the Wednesday half day where nobody arrives on their booths first thing in the morning due to the festivities the night before, they have a cheek to charge to go in at all, in my opinion.

Now, Denver Gold Group are charging delegates to the European Gold Forum US$175 to attend their event! They have over 100 companies attending normally, and it’s expensive, so why oh why do they feel the need to charge the investors too?

I’m fed up of paying eye watering hotel or Airbnb prices just because the conference is on, and now the organisers are joining in with fees of their own.

As a result I have decided to be selective from this year, and for the first time in 15 years I’m giving PDAC a miss. I checked out the presenting companies and there were only a handful I really wanted to meet, and some will come over here at some point, so I’m giving the frozen waste land that is Toronto in March a wide berth this year.

I have also decided to give the European Gold Forum a miss too, in protest at the introduction of the charge. I can easily afford to go, but that’s not the point. Without investors those conferences are failures, they need our participation.

I am receiving multiple invitations for all the conferences at the moment, suggesting after a very painful couple of years, investors are not registering, even for the free to attend ones such as 121 and Mines and Money.

If Tesco’s introduced an admission charge, would you pay it?

Cartier Resources Gave East Chimo Drill Results

Orla Mining Plans Cerro Quema 2023 Exploration

Japan Gold Announced their 2023 Exploration Plan

Eloro Outlined an Extensive IP Conductivity Anomaly

Calidus Resources Delivered Strong Gold Production in January

Karora Resources Increased Beta Hunt Gold Reserves and Resources

Read more: http://www.city-investors-circle.com/archives/#ixzz7tfrhAWoE

.

Market Data

Week on week price movements

(US$ unless stated)

.

Metal Prices

| Gold price in UK £ | 1531 | -0.97% |

| Gold | 1843 | -1.07% |

| Silver | 21.74 | -1.23% |

| Palladium | 1502 | -3.35% |

| Platinum | 930 | -1.80% |

| Rhodium | 11500 | -4.96% |

| Copper | 4.03 | -0.74% |

| Nickel | 11.73 | -4.40% |

| Zinc | 1.38 | -4.17% |

| Tin | 12.11 | -3.51% |

| Cobalt | 15.88 | -8.47% |

| Manganese | 3.91 | 0.00% |

| Lithium | 57770 | -5.42% |

| Uranium | 51.8 | +2.57% |

| Iron Ore | 125.4 | +1.13% |

| Coking Coal | 349 | +7.38% |

| Thermal coal | 186 | -3.13% |

| Magnesium | 3254 | -3.70% |

.

Metal ETF’s

| GDX | 28.39 | -4.15% |

| GDXJ | 34.59 | -2.95% |

| Sil | 27.51 | -1.71% |

| SILJ | 10.06 | -1.76% |

| GOEX (PCX) | 24.63 | -2.96% |

| GLD | 171.26 | -1.21% |

| COPX | 39.19 | +1.92% |

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Calidus Resources, Eloro Resources, Karora Resources, and Orla Mining.

.

.