Mining Review Sunday Update 13th February

The media is talking up the potential for a war in the Ukraine and an imminent Russian invasion, and that is driving gold and oil prices upwards.

Gold was up 3% week on week, and silver an impressive 5%. Naturally many gold and silver juniors had a good week as a result. […]

.

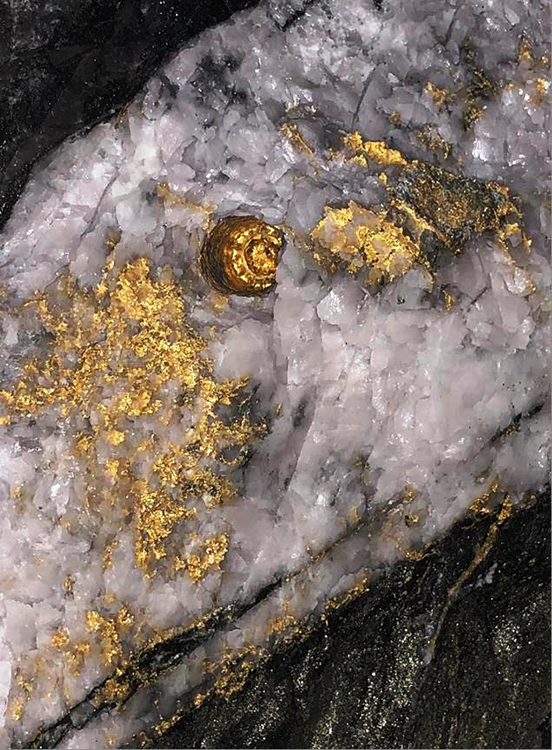

Gold in drill core from Beta Hunt mine, Karora Resources, Western Australia

.

City Investors Circle Mining Review Sunday Update 13th February

The media is talking up the potential for a war in the Ukraine and an imminent Russian invasion, and that is driving gold and oil prices upwards.

Gold was up 3% week on week, and silver an impressive 5%. Naturally many gold and silver juniors had a good week as a result. Gold was helped by rising US inflation as much as Ukraine tensions

The dollar also rose on increased interest rate speculation, perm any one of many different speculations as to the number of rises rumoured throughout the media. I still insist there is a limit as to how high rates can go as their level effects government borrowing costs.

Barrick Gold reported depletion after mining of +150% in 2021, after a few years of falling reserves, a positive sign.

Chaarat Gold are experiencing hard times trying to raise the capex for their mine in the Kyrgyz Republic, due to the fact that the state have taken the Kumtor Gold Mine from Centerra Gold, who have no choice but to negotiate a settlement.

Obviously that action has caused potential financiers to lose faith in the Kyrgyz Republic, and who can blame them? They have acted in bad faith in my opinion, and deserve the negative publicity they have received. Sadly none of this is the fault of Chaarat’s shareholders (nor Centerra’s either for that matter), yes as always it is the shareholders who will suffer.

For this reason I am very choosy about the jurisdictions I invest in.

Stocks on our watchlist in the news this week;

Cabral Gold Drills 23.8m @ 5.5 g/t gold at Cuiú Cuiú, Tapajos, Brazil

Calidus Resources commits to a renewable micro grid at the Warrawoona Gold Project

O3 Mining Reported 96% Gold Recoveries at Marban

American Creek JV Partner CEO Ken Konkin interview

Karora Resources Beta Hunt Shear Zone extended

Argosy Minerals Is on Schedule For Production in H2 2022

.

Market data

In US$

Precious metals

| Gold | 1859 | 3% |

| Silver | 23.62 | 5% |

| Palladium | 2316 | 1% |

| Platinum | 1031 | 0% |

| Rhodium | 18350 | 9% |

Gold and silver were boosted by rising US inflation figures, and ongoing Ukrainian war tension.

.

Base Metals

| Copper | 4.64 | 5% |

| Nickel | 10.91 | 4% |

| Zinc | 1.7 | 4% |

| Tin | 20.16 | 2% |

Tin was boosted by threats of an Indonesian export ban.

Copper stocks are alarmingly low, although Shanghai received a new stock on Friday, possibly Chinese government reserve being released.

.

Energy Metals

| Cobalt | 31.96 | 0% |

| Manganese | 3.38 | -1% |

| Lithium | 60911 | 7% |

| Uranium | 43.6 | -1% |

Lithium continues to rise exponentially as prices in China rise due to increased EV battery demand.

.

Bulk commodities

| Iron Ore | 153 | 6% |

| Coking Coal | 398 | -3% |

| Magnesium | 7003 | 1% |

Iron ore demand from China is increasing at the same time as supply from Australia is struggling to keep pace.

The Chinese government are taking action to curb the price of coking coal after the recent rise to all time highs.

.

ETF’s

| GDX | 32.43 | 7% |

| GDXJ | 41.42 | 8% |

| Sil | 35.19 | 8% |

| SILJ | 12.4 | 11% |

| GOEX | 28.9 | 7% |

| GLD | 173.81 | 3% |

| COPX | 40.78 | 7% |

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.