Mining Review Sunday Update 12th June 2022

City Investors Circle Mining Review 12th June 2022

This week’s news was dominated by news from down under, with Gold Road and Calidus Resources putting out significant announcements. News from our Canadian watchlist was thin on the ground, with only Westhaven Gold putting out a drilling news release. […]

.

Global Mining Finance Conference Summer 2022 – Amid the splendour of the Armourers’ Hall Chris Sangster of Ariana Resources presents to a packed house

.

.

.

City Investors Circle Mining Review 12th June 2022

This week’s news was dominated by news from down under, with Gold Road and Calidus Resources putting out significant announcements. News from our Canadian watchlist was thin on the ground, with only Westhaven Gold putting out a drilling news release.

A shorter review this week due to travelling, so no stats, we’ll start again next week.

Gold traded pretty much sideways again, and the markets in general were dragged down by poor economic news and the news of yet more lockdowns in China for just a few new cases of covid.

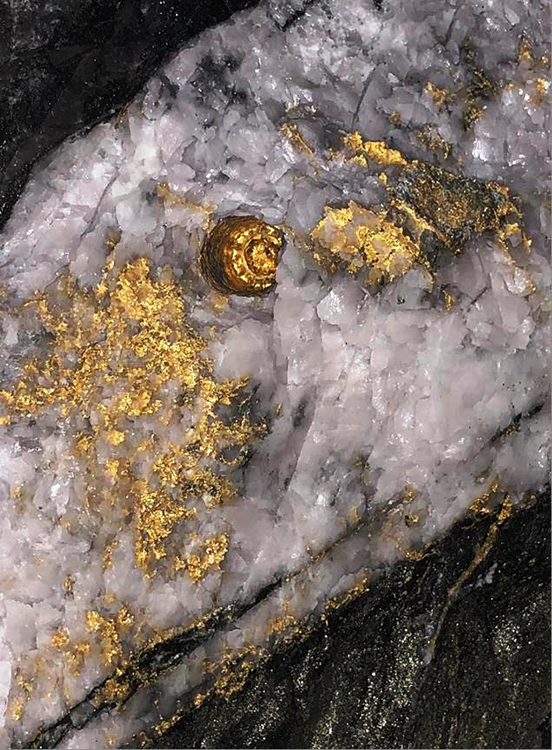

Amiongst the stocks we follow, Calidus Resources generated two items of news, and their antipodean neighbour Gold Road Resources chipped in with encouraging news regarding their proposed friendly takeover of DGO.

Westahaven Gold were the only Canadian company with news, producing some really encuraging drill results from their Shovelnose Mountaoin property.

.

The week also saw the final London mininfg conference before the summer break, the Global Mining Finance Conference, held at the beautiful and historic Armourers’ Hall, in Moorgate, City of London.

With recent London mining conferences being on the quiet side, and with a tube strike ending on the morning of the conference, audience number expectations were low, but the opening keynote speaker, Alasdair MAcleod of Goldmoney.com addressed a packed audience, with some delegates standing at the back.

The Global Mining Finance Conferences are traditional mining conferences with speakers addressing the audience, and the high delegate numbers suggest there is still an appetite for this traditional conference format. The networking sessions were particularly vibrant and engaged.

News from companies on our watchlist this week

Calidus Resources Publish an Updated Presentation

Gold Road Resources closing in on DGO Takeover Target

Can we Have a ‘Curse of the PDAC’ in June?

Global Mining Finance Conference Full and Standing

Westhaven Gold drills 14.96 meters of 5.69 g/t gold

Calidus Resources Spear Hill “significant lithium find”

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the authorholds shares in Calidus Resources and Gold Road Resources, bought in the market at the prevailing price on the days of purchase.

.

.