Mining Review Sunday Update 19th September

The story of the week again, sadly, was the falling gold price, into the mid 1700’s, due to better than expected US retail figures, and a strengthening US dollar.

Iron ore is another casualty, but for a different reason. Coking coal is roofing it as supply is tight, bring companies like Colonial Coal into investor focus.

.

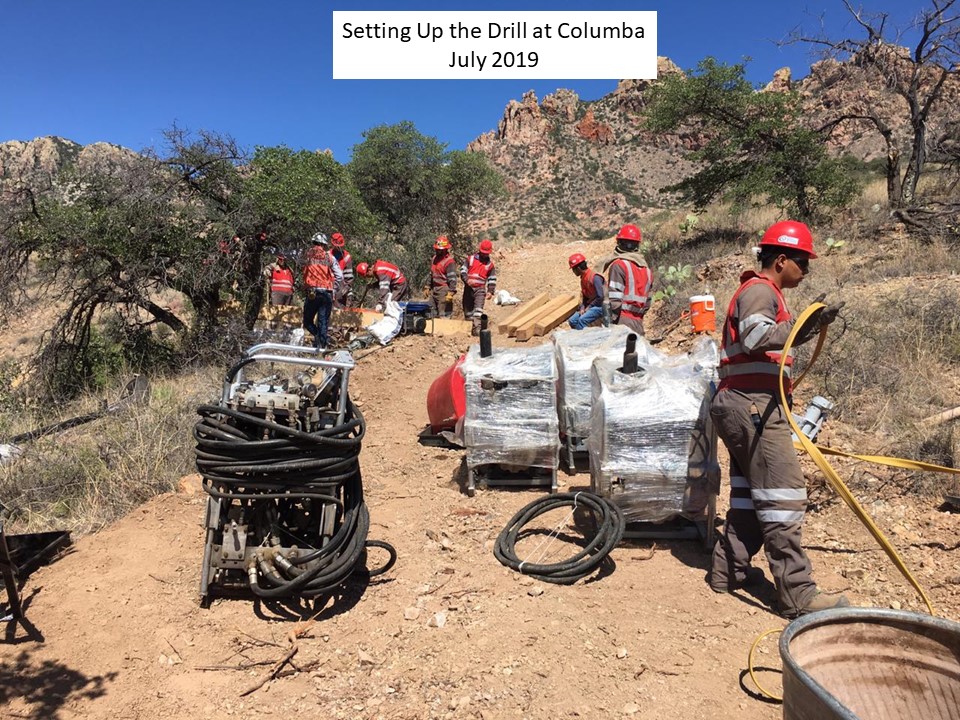

Kootenay Silver Columba drill camp, Mexico

.

Mining Review Sunday Update 19th September

The story of the week again, sadly, was the falling gold price, into the mid 1700’s, due to better than expected US retail figures, and a strengthening US dollar.

Iron ore is another casualty, but for a different reason, the Chinese government is limiting steel production for the remainder of 2021, causing a sharp drop in demand for iron ore.

Coking coal is roofing it as supply is tight, bring companies like Colonial Coal into investor focus. The price has more than doubled in a few short months.

Stocks on our watchlist making news this week

Orla Mining – Placed 8th in the TSX30 for stock price performance over three years.

Wesdome Gold – Placed 10th in the TSX30 for stock price performance over three years.

Apollo Consolidated – Defined some robust gold zones at Lake Rebecca

Fiore Gold – Amended their Pan Mine Technical Report

Neometals – The Primobius JV have started phase 2 of their battery recycling project

Gold Road – Reported a net profit and a dividend

Bardoc Gold – Highlighted the potential to grow the Zorastrian deposit

Market Data

Precious metals

| Gold | 1755 | -2% |

| Silver | 22.4 | -6% |

| Palladium | 2015 | -8% |

| Platinum | 943 | -1% |

| Rhodium | 14500 | -6% |

Gold got thumped by some unexpectedly good US retail numbers, and fell sharply back through to around $1,760. Silver took an ever harder beating, losing 6% in 5 trading days.

Palladium was knocked back on lower car production due to a shortage of micro chips, and reports that some manufacturers are switching to platinum due to the lower cost.

Base metals

| Copper | 4.22 | 0% |

| Nickel | 9 | -2% |

| Zinc | 1.39 | 0% |

| Tin | 15.85 | 3% |

Energy Metals

| Cobalt | 22.19 | -1% |

| Manganese | 2.87 | -1% |

| Lithium | 22941 | +16% |

| Uranium | 44 | +9% |

Lithium is roaring away as supply concerns are forcing battery companies to try and secure supply at ever higher prices.

Uranium is rising rapidly due to the actions of the Sprott Physical Uranium Trust buying a significant quantity on the spot market to warehouse, thus driving up prices. Sprott has just announced it is raising another $1 billion for uranium purchases. I wonder if Sprott is related to the Hunt brothers?

Bulk commodities

| Iron Ore | 102 | -25% |

| Coking Coal | 359 | +22% |

Quite an extraordinary divergence here, with iron ore slumping due to Chinese steel production limitations at the same time as a real coking coal supply crunch.

Miscellaneous

| GDX | 30.58 | -3% |

| GDXJ | 40.48 | -1% |

| Sil | 37.46 | -4% |

| SILJ | 12.46 | -3% |

| GLD | 163.77 | -2% |

| Au / Ag Ratio | 75.94 | +1% |

| 10 yr Tbond | 1.371 | 2% |

| US index (DXY) | 93.26 | 1% |

| HUI | 237.63 | -2% |

The precious metal ETF’s had predicable falls, given the losses on the other precious metals, as the US dollar strengthened.

The gold / silver ratio is widening again just as it seemed to be returning to a more normal level.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Bardoc Gold, Colonial Coal, Gold Road Resources, and Orla Mining.