Colonial Coal CEO Presentation Enthuses Investors

Colonial Coal (TSX.V: CAD)

CEO David Austin gave an upbeat online presentation yesterday, where he highlighted the potential for the Colonial Coal Peace River assets at the prevailing world coal prices.

Quite simply, with FOB costs of around C$150, and coal fetching over C$500 per tonne, the numbers make a compelling investment case. […]

.

| Colonial Coal | TSX.v : CAD |

| Stage | Exploration |

| Metals | Metallurgical coal |

| Market cap | C$332 m @ C$1.90 |

| Location | British Columbia, Canada |

.

.

Colonial Coal (TSX.V: CAD)

CEO David Austin gave an upbeat online presentation yesterday, where he highlighted the potential for the Colonial Coal Peace River assets at the prevailing world coal prices.

Quite simply, with FOB costs of around C$150, and coal fetching over C$500 per tonne, the numbers make a compelling investment case.

Colonial have been in M & A mode for some time now, and the share price has halved recently as some investors became impatient, but in the words of the great Charlie Munger, “the market is a mechanism for transferring wealth from the impatient to the patient”

David Austin ran through the presentation in his own style, succinct and honest, no slick stock promotion here, that works for me every time, and always will do.

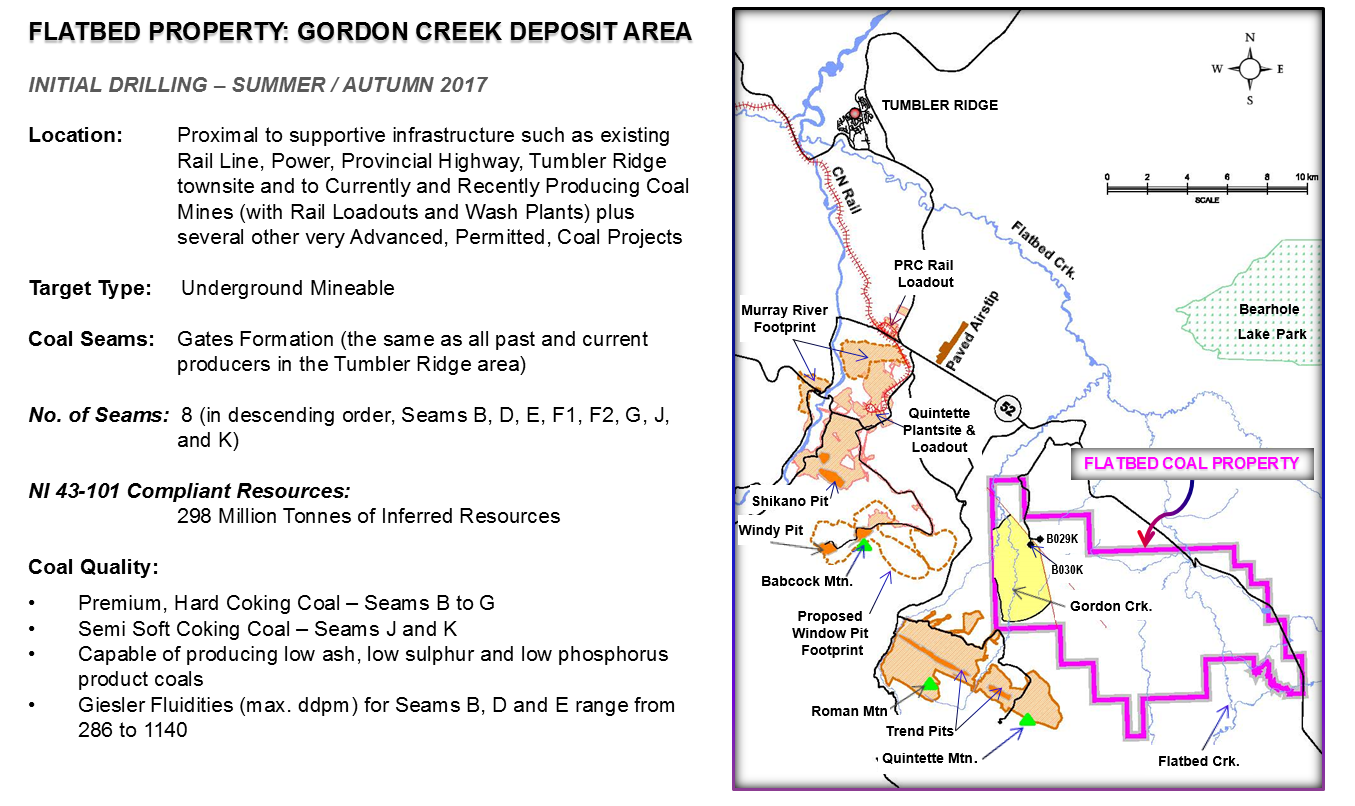

The early parts of the presentation are already known but there’s no harm in a refresher, and a reminder of the potential of the Peace River coal region.

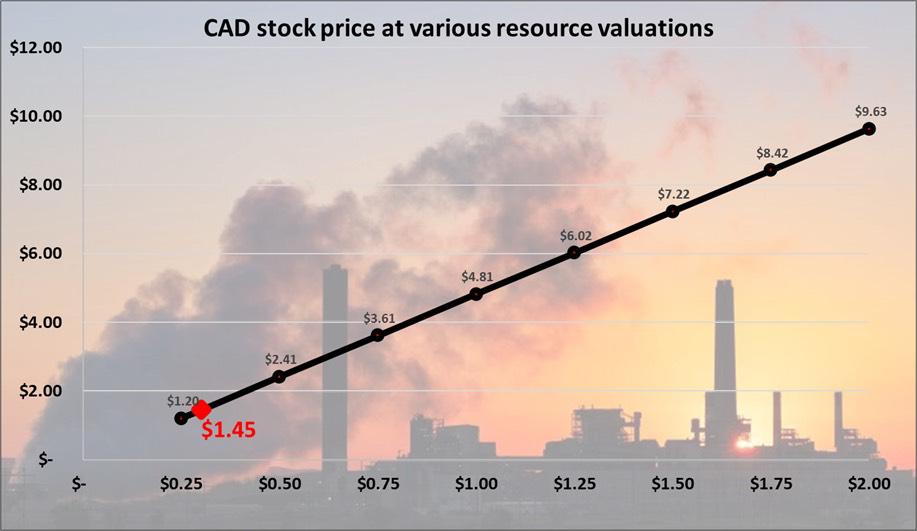

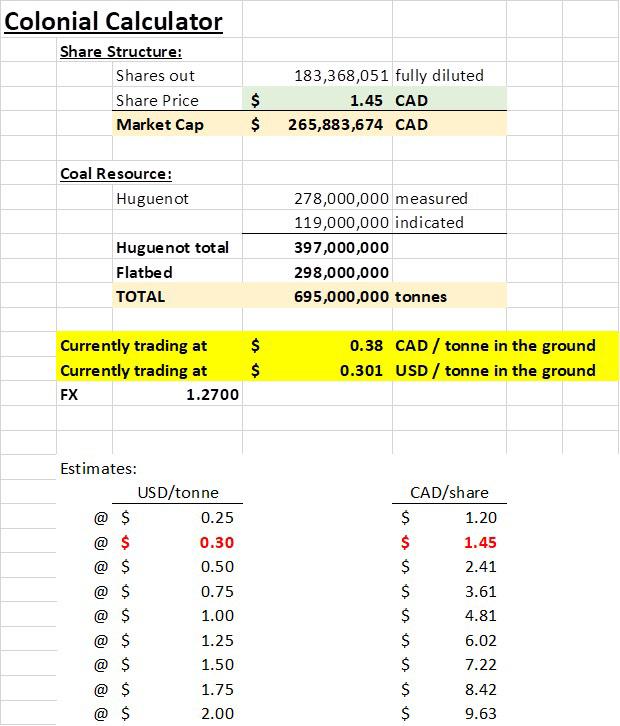

The presentation progressed to look at recent takeover deals, with over C$3 per tonne being paid, compared to CAD’s 20c per tonne current valuation. The upside potential is clear and it’s useful to see what the figures look like with current coal prices.

With CAD’s friendly large holders holding over 50%, there won’t be any hostile takeovers here

Dave concluded by informing listeners that CAD currently have 12 NDA’s and a couple of standstill agreements, and he expects another couple of NDA’s soon.

That last fact seems to have perked up investors as the stock has risen around 20c since the interview.

I have held this stock for a long time, but have the feeling the end game may finally be coming.

.

=======

.

If you need clarification of any information contained in this note, or have any questions about Colonial Coal, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure,

The author holds shares in Colonial Coal, bought in the market at the prevailing price on the days of purchase.

.

.